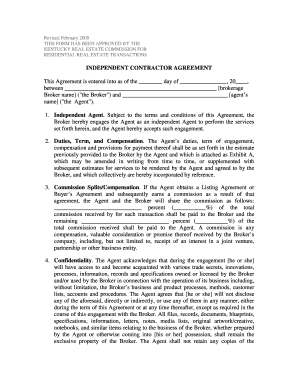

Kentucky Independent Contractor Agreement Form

What is the Kentucky Independent Contractor Agreement

The Kentucky Independent Contractor Agreement is a legal document that outlines the terms and conditions between a business and an independent contractor. This agreement defines the scope of work, payment terms, and responsibilities of both parties. It is essential for ensuring clarity and protecting the rights of both the contractor and the hiring entity. This agreement is particularly relevant for individuals working under a 1099 independent contractor status, as it helps to delineate the nature of the working relationship.

Key elements of the Kentucky Independent Contractor Agreement

Several critical components must be included in a Kentucky Independent Contractor Agreement to ensure its effectiveness and legal standing:

- Parties involved: Clearly identify the contractor and the hiring entity.

- Scope of work: Detail the specific services the contractor will provide.

- Payment terms: Outline how and when the contractor will be compensated.

- Duration of the agreement: Specify the start date and any termination conditions.

- Confidentiality clauses: Include any necessary provisions to protect sensitive information.

- Dispute resolution: Establish a method for resolving any disagreements that may arise.

Steps to complete the Kentucky Independent Contractor Agreement

Completing the Kentucky Independent Contractor Agreement involves several straightforward steps:

- Identify the parties: Clearly state the names and addresses of both the contractor and the hiring entity.

- Define the scope of work: Describe the services to be performed in detail.

- Set payment terms: Specify the payment amount, schedule, and method.

- Include additional clauses: Add any necessary confidentiality or dispute resolution clauses.

- Review the agreement: Both parties should carefully read the document to ensure all terms are understood.

- Sign the agreement: Both parties should sign the document to make it legally binding.

Legal use of the Kentucky Independent Contractor Agreement

To ensure the Kentucky Independent Contractor Agreement is legally binding, it must comply with state and federal laws. This includes adherence to the guidelines set forth by the IRS regarding independent contractor classifications. The agreement should clearly establish that the contractor is not an employee, which is crucial for tax purposes. Additionally, both parties should retain a signed copy of the agreement for their records, as this can be essential for resolving any future disputes.

How to obtain the Kentucky Independent Contractor Agreement

The Kentucky Independent Contractor Agreement can be obtained through various means. Many legal websites offer templates that can be customized to fit specific needs. Additionally, businesses may consult with legal professionals to draft a tailored agreement that addresses their unique circumstances. It is important to ensure that any template used complies with Kentucky state laws and reflects the specific terms agreed upon by both parties.

Digital vs. Paper Version

Both digital and paper versions of the Kentucky Independent Contractor Agreement are valid, but digital formats offer several advantages. Using a digital platform for signing allows for quicker execution and easier storage. Digital signatures are legally recognized in Kentucky, provided they meet the requirements of the ESIGN Act and UETA. This means that businesses can streamline their processes while maintaining compliance with legal standards.

Quick guide on how to complete kentucky independent contractor agreement

Complete Kentucky Independent Contractor Agreement smoothly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Kentucky Independent Contractor Agreement on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Kentucky Independent Contractor Agreement effortlessly

- Locate Kentucky Independent Contractor Agreement and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Kentucky Independent Contractor Agreement and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky independent contractor agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an independent contractor agreement in Kentucky?

An independent contractor agreement in Kentucky outlines the terms of work between a business and an independent contractor. This document ensures clarity regarding deliverables, deadlines, and payment terms. Understanding the specifics of this agreement is crucial for both parties to avoid legal disputes.

-

How can airSlate SignNow assist with independent contractor agreements in Kentucky?

AirSlate SignNow streamlines the process of creating and signing independent contractor agreements in Kentucky. With its user-friendly interface, businesses can easily customize templates and manage documents efficiently. This saves time and ensures that all legal requirements are met.

-

Is airSlate SignNow cost-effective for managing independent contractor agreements in Kentucky?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for businesses managing independent contractor agreements in Kentucky. The platform eliminates the need for expensive paper-based processes, allowing you to save on printing and postage costs. Invest in a solution that enhances your workflow without breaking the bank.

-

What features does airSlate SignNow offer for independent contractor agreements in Kentucky?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and automated workflows for independent contractor agreements in Kentucky. Users can track changes and manage approvals in real-time, ensuring a smooth onboarding process for contractors. These features enhance productivity and compliance.

-

Are there integrations available with other tools for managing independent contractor agreements in Kentucky?

Absolutely! AirSlate SignNow integrates seamlessly with various tools, making it easy to manage independent contractor agreements in Kentucky alongside your existing software. This allows for efficient file sharing and collaboration across teams, enhancing overall productivity.

-

What benefits does eSigning independent contractor agreements in Kentucky offer?

eSigning independent contractor agreements in Kentucky offers numerous benefits, including faster turnaround times and enhanced security. With airSlate SignNow, the signing process is simplified, reducing time spent on paperwork. Additionally, electronic signatures are legally recognized in Kentucky, ensuring your agreements are valid and enforceable.

-

Can I customize my independent contractor agreement template in Kentucky with airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your independent contractor agreement template in Kentucky. You can add specific terms and conditions that suit your business needs, ensuring that the agreement fits perfectly with your operational requirements. Customization helps better protect your interests.

Get more for Kentucky Independent Contractor Agreement

- Excavator contract for contractor alabama form

- Renovation contract for contractor alabama form

- Concrete mason contract for contractor alabama form

- Demolition contract for contractor alabama form

- Framing contract for contractor alabama form

- Security contract for contractor alabama form

- Insulation contract for contractor alabama form

- Paving contract for contractor alabama form

Find out other Kentucky Independent Contractor Agreement

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form