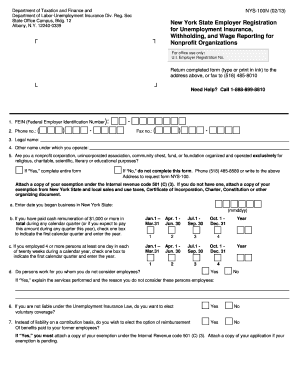

Nys100n Form

What is the Nys100n

The Nys100n, also known as the New York State Application for a Certificate of Authority, is a crucial document for businesses operating in New York. This form is essential for entities that wish to conduct business in the state and is required for both foreign and domestic corporations. By submitting the Nys100n, businesses can obtain the necessary legal authority to operate, ensuring compliance with state regulations.

How to use the Nys100n

Using the Nys100n involves several key steps. First, businesses must gather the required information, including details about the entity, its owners, and its business activities. Once the necessary information is compiled, the form can be filled out either digitally or on paper. After completing the form, it must be submitted to the appropriate state department along with any required fees. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Nys100n

Completing the Nys100n involves a systematic approach:

- Gather necessary information about your business, including name, address, and ownership structure.

- Access the Nys100n form online or obtain a physical copy.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form along with the applicable filing fee to the New York State Department.

Legal use of the Nys100n

The legal use of the Nys100n is vital for businesses to operate lawfully in New York. This form not only grants permission to conduct business but also ensures compliance with state laws. It is essential for businesses to understand that operating without a valid Nys100n can lead to penalties and legal complications. Therefore, ensuring that the form is properly completed and submitted is a critical step in establishing a legitimate business presence in the state.

Filing Deadlines / Important Dates

Filing deadlines for the Nys100n can vary depending on the type of business entity and specific circumstances. Generally, it is advisable to file the Nys100n as early as possible to avoid any delays in business operations. Businesses should be aware of any specific deadlines related to their industry or business type to ensure timely compliance. Keeping track of these important dates can help prevent potential penalties and ensure a smooth application process.

Required Documents

When preparing to submit the Nys100n, several documents may be required. These typically include:

- Proof of business registration in the home state for foreign entities.

- Identification information for business owners and officers.

- Any additional documentation specific to the business type, such as partnership agreements or corporate bylaws.

Having these documents ready can streamline the application process and facilitate quicker approval.

Quick guide on how to complete nys100n

Complete Nys100n effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Nys100n on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Nys100n with ease

- Locate Nys100n and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nys100n and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys100n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nys100n and how does it relate to airSlate SignNow?

NYS100N is a specific form used in New York for tax reporting purposes. airSlate SignNow provides an efficient solution to electronically sign and submit the nys100n form, ensuring compliance and ease of use.

-

How much does it cost to use airSlate SignNow for nys100n?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on your requirements, you can choose a plan that allows for seamless eSigning of documents like the nys100n without breaking your budget.

-

What features does airSlate SignNow offer for signing the nys100n?

airSlate SignNow includes features like customizable templates, in-app document editing, and advanced security measures to protect your sensitive information. These features make it easy for businesses to manage the signing process for the nys100n efficiently.

-

Can I integrate airSlate SignNow with other applications when managing nys100n?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and more. This allows you to directly manage your nys100n forms from the platforms you already use.

-

How does airSlate SignNow enhance the eSigning experience for nys100n?

airSlate SignNow enhances the eSigning experience by providing an intuitive interface and mobile accessibility. This ensures that users can easily complete and send their nys100n forms from any device, anywhere, at any time.

-

What security measures does airSlate SignNow use for nys100n submissions?

airSlate SignNow takes security seriously, employing SSL encryption and two-factor authentication to safeguard your nys100n submissions. These measures ensure that your data remains secure and compliant with regulations.

-

Is support available for users completing nys100n with airSlate SignNow?

Absolutely! airSlate SignNow provides customer support to assist users with questions regarding their nys100n submissions. Whether through live chat or email, help is readily available whenever you need it.

Get more for Nys100n

- Dissolution information booklet

- Notice motion document form

- Application for temporary relief minnesota 497312712 form

- Default scheduling request form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497312714 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497312715 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497312716 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497312717 form

Find out other Nys100n

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast