Limited Liability Company Return of Income California Form 568 Ftb Ca

Understanding the Limited Liability Company Return of Income California Form 568

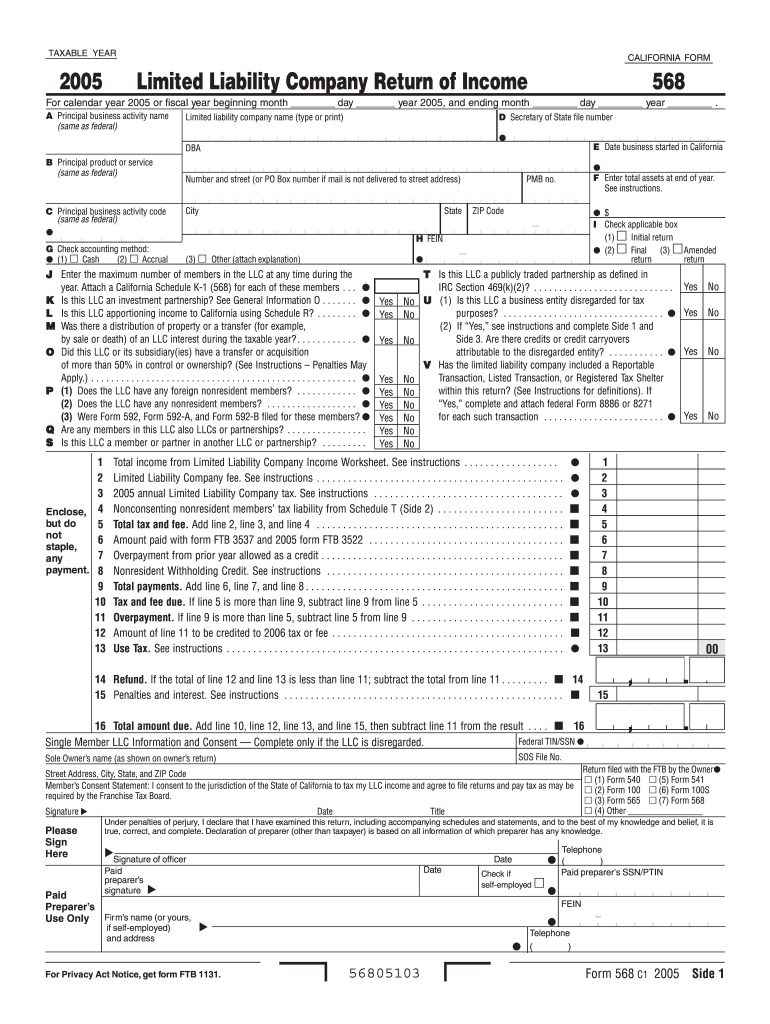

The Limited Liability Company Return of Income California Form 568 is a tax form used by Limited Liability Companies (LLCs) to report their income, deductions, and other relevant financial information to the California Franchise Tax Board. This form is essential for LLCs operating in California, as it helps ensure compliance with state tax laws. The form includes various sections that require detailed information about the LLC’s financial activities, including income earned, expenses incurred, and any applicable credits. Proper completion of this form is crucial for maintaining the legal status of the LLC and avoiding penalties.

Steps to Complete the Limited Liability Company Return of Income California Form 568

Completing the California Form 568 involves several important steps. First, gather all necessary financial documents, including income statements, expense reports, and any prior year tax returns. Next, fill out the form by entering the required information in the appropriate sections, such as income, deductions, and member information. It is important to accurately report all financial data to avoid discrepancies. After completing the form, review it thoroughly for accuracy before submitting it. Finally, ensure that you file the form by the specified deadline to avoid penalties.

Key Elements of the Limited Liability Company Return of Income California Form 568

The California Form 568 includes several key elements that LLCs must address. These elements typically consist of the following:

- Income Reporting: LLCs must report all sources of income earned during the tax year.

- Deductions: Eligible deductions can be claimed to reduce taxable income.

- Member Information: Details about LLC members, including their ownership percentages and distributions, must be provided.

- Tax Payments: Any estimated tax payments made during the year should be reported.

- Signatures: The form must be signed by an authorized member of the LLC to validate the submission.

Filing Deadlines for the Limited Liability Company Return of Income California Form 568

Filing deadlines for the California Form 568 are critical for compliance. Typically, the form is due on the 15th day of the fourth month after the end of the LLC's tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to be aware of these deadlines to avoid late fees and penalties.

Legal Use of the Limited Liability Company Return of Income California Form 568

The legal use of Form 568 is paramount for LLCs in California. This form serves as an official document that demonstrates compliance with state tax laws. Filing the form accurately and on time helps maintain the LLC's good standing with the California Franchise Tax Board. Additionally, proper filing can protect the LLC from potential audits and penalties. It is advisable for LLCs to consult with a tax professional to ensure that they are meeting all legal requirements associated with this form.

How to Obtain the Limited Liability Company Return of Income California Form 568

The California Form 568 can be obtained directly from the California Franchise Tax Board's website. The form is available for download in PDF format, allowing LLCs to print and complete it manually. Additionally, some tax preparation software may offer the option to fill out and file Form 568 electronically. It is important for LLCs to ensure they are using the most current version of the form to comply with any updates in tax regulations.

Quick guide on how to complete limited liability company return of income california form 568 ftb ca

Prepare Limited Liability Company Return Of Income California Form 568 Ftb Ca effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an excellent eco-conscious alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Limited Liability Company Return Of Income California Form 568 Ftb Ca across any platform using airSlate SignNow's Android or iOS applications and simplify any paperwork process today.

The simplest method to modify and eSign Limited Liability Company Return Of Income California Form 568 Ftb Ca without hassle

- Obtain Limited Liability Company Return Of Income California Form 568 Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Limited Liability Company Return Of Income California Form 568 Ftb Ca and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the limited liability company return of income california form 568 ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 568 and how can airSlate SignNow help?

Form 568 is a tax return document used by limited liability companies (LLCs) in California to report income and taxes. airSlate SignNow simplifies the process of document signing and management, allowing users to easily fill out, sign, and send form 568 securely and efficiently.

-

Can I use airSlate SignNow to store my completed form 568?

Yes, airSlate SignNow provides a secure cloud storage solution for all your documents, including completed form 568. This allows you to easily access, manage, and retrieve your forms whenever you need them, ensuring important documents are always at your fingertips.

-

What are the pricing options for using airSlate SignNow for form 568?

airSlate SignNow offers several pricing plans that cater to different needs, from individuals to businesses. Each plan provides access to essential features for managing form 568, ensuring that you can find a cost-effective solution that fits your requirements.

-

Does airSlate SignNow integrate with other software for managing form 568?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and more. These integrations allow users to streamline their workflow and easily manage form 568 along with other documents from one platform.

-

What features does airSlate SignNow offer for form 568?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking, all designed to enhance the experience of managing form 568. These tools help ensure compliance and speed up the completion and submission of your tax return.

-

Is airSlate SignNow suitable for both individuals and businesses filing form 568?

Absolutely! airSlate SignNow is designed for everyone, from individuals filing form 568 to larger businesses managing multiple filings. The platform’s user-friendly interface and robust features make it an ideal choice for diverse users.

-

How secure is my data when using airSlate SignNow for form 568?

Security is a top priority for airSlate SignNow. When using the platform for form 568, your data is protected with advanced encryption and compliance with industry standards to ensure that your documents remain confidential and safe.

Get more for Limited Liability Company Return Of Income California Form 568 Ftb Ca

- North carolina bankruptcy form

- Nc chapter 7 form

- Bill of sale with warranty by individual seller north carolina form

- Nc warranty 497317091 form

- Bill of sale without warranty by individual seller north carolina form

- Bill of sale without warranty by corporate seller north carolina form

- North carolina chapter 13 form

- North carolina chapter 13 497317095 form

Find out other Limited Liability Company Return Of Income California Form 568 Ftb Ca

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now