Affin Bank Personal Loan Form

What is the Affin Bank Personal Loan

The Affin Bank Personal Loan is a financial product designed to provide individuals with access to funds for various personal needs, such as debt consolidation, home improvements, or unexpected expenses. This loan typically features competitive interest rates and flexible repayment terms, making it an attractive option for borrowers. The Affin Bank Personal Loan is available through an online application process, allowing users to conveniently apply from the comfort of their homes.

Eligibility Criteria

To qualify for the Affin Bank Personal Loan, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a U.S. citizen or permanent resident.

- Minimum age requirement, typically eighteen years or older.

- Proof of stable income, which can include employment verification or tax returns.

- A satisfactory credit score, which may vary based on the loan amount requested.

Meeting these criteria is essential for a successful application and approval process.

Application Process & Approval Time

The application process for the Affin Bank Personal Loan is streamlined for efficiency. Applicants can start by filling out an online application form, which requires personal information, financial details, and the desired loan amount. After submission, the bank reviews the application, typically providing a decision within a few business days. Once approved, funds may be disbursed quickly, often within one week, depending on the bank's policies and the applicant's circumstances.

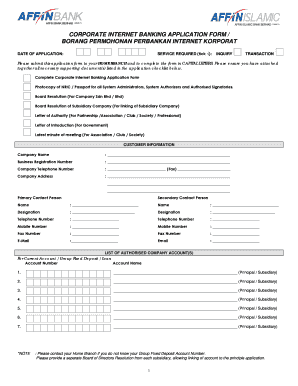

Required Documents

When applying for the Affin Bank Personal Loan, certain documents are necessary to facilitate the approval process. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, including recent pay stubs or tax returns.

- Bank statements for the past few months to verify financial stability.

- Any additional documentation that may support the loan application, such as proof of residency.

Having these documents ready can help expedite the application process.

Steps to Complete the Affin Bank Personal Loan

Completing the Affin Bank Personal Loan involves several key steps:

- Gather the required documents and ensure all information is accurate.

- Access the online application portal and fill out the necessary forms.

- Submit the application and wait for the bank's review.

- If approved, review the loan terms and conditions before accepting the offer.

- Sign the loan agreement electronically and provide any additional information requested.

- Receive the funds in your designated account once the process is finalized.

Legal Use of the Affin Bank Personal Loan

The Affin Bank Personal Loan can be utilized for various legal purposes, including but not limited to personal expenses, debt consolidation, and home renovations. It is essential for borrowers to understand the terms of the loan agreement and ensure that the funds are used responsibly. Compliance with the loan's stipulations is crucial to avoid legal repercussions and maintain a good credit standing.

Quick guide on how to complete affin bank personal loan

Effortlessly prepare Affin Bank Personal Loan on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Affin Bank Personal Loan on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Affin Bank Personal Loan with ease

- Locate Affin Bank Personal Loan and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Affin Bank Personal Loan to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affin bank personal loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the syarat personal loan affin bank?

To qualify for a personal loan from Affin Bank, you need to meet specific syarat personal loan affin bank criteria, including a minimum monthly income and a good credit rating. Additionally, age and employment stability may also be considered. It's essential to review these requirements to ensure you are eligible before applying.

-

How do I apply for a personal loan at Affin Bank?

Applying for a personal loan at Affin Bank typically involves submitting an application form along with the necessary documentation based on syarat personal loan affin bank. You can apply online or visit a branch for assistance. Make sure to have your identification and income proof ready to streamline the process.

-

What is the interest rate for the personal loan at Affin Bank?

The interest rate for a personal loan at Affin Bank varies depending on the syarat personal loan affin bank you meet and the amount you wish to borrow. Generally, the rates are competitive within the market. To get the exact rate applicable to you, consider contacting Affin Bank directly or checking their website for the latest information.

-

What documents are required to fulfill the syarat personal loan affin bank?

To meet the syarat personal loan affin bank, you will need to provide key documents such as your identity card, proof of income, and bank statements. Additional documentation may be requested depending on your employment status and loan amount. Make sure to have these documents ready for a smooth application process.

-

Are there any fees associated with the personal loan from Affin Bank?

Yes, there are fees associated with obtaining a personal loan from Affin Bank, which you should be aware of as part of the syarat personal loan affin bank. These may include processing fees, early repayment fees, and other administrative costs. It’s advisable to review all potential fees before signing the agreement.

-

What are the benefits of taking a personal loan from Affin Bank?

Taking a personal loan from Affin Bank offers several benefits, including competitive interest rates and flexible repayment options, which align with the syarat personal loan affin bank. Additionally, you can use the funds for various purposes, such as consolidating debt or funding personal projects. Quick processing times can also be a plus.

-

Can I make early repayments on my Affin Bank personal loan?

Yes, Affin Bank allows early repayments on personal loans, but be sure to check the syarat personal loan affin bank regarding any applicable fees. Making early repayments can help reduce the overall interest paid on the loan. It’s wise to consult with the bank to understand the terms related to early settlements.

Get more for Affin Bank Personal Loan

- Statement of decline of vocational rehabilitation for workers compensation california 497299507 form

- Evaluation workers compensation california form

- Report workers form

- California treating form

- Employee compensation form

- Ca work compensation form

- Ca satisfaction 497299513 form

- Reconveyance deed form

Find out other Affin Bank Personal Loan

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe