Ncui 101 a Form

What is the Ncui 101 A

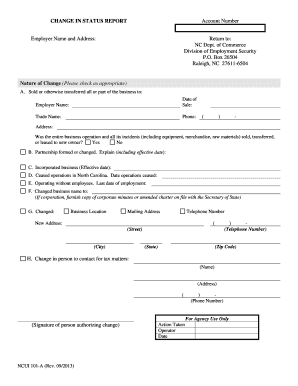

The Ncui 101 A is a specific form used primarily for reporting certain information to the relevant authorities. This form is essential for individuals and businesses to ensure compliance with various regulations. It serves as a formal declaration of specific data that may be required for tax, legal, or administrative purposes. Understanding its purpose is crucial for proper completion and submission.

How to use the Ncui 101 A

Using the Ncui 101 A involves several steps to ensure accurate reporting. First, gather all necessary information that pertains to the requirements of the form. This may include personal identification details, financial data, or other relevant documentation. Once you have the required information, fill out the form carefully, ensuring all fields are completed accurately. After completing the form, review it for any errors before submission.

Steps to complete the Ncui 101 A

Completing the Ncui 101 A requires a systematic approach:

- Begin by downloading the latest version of the form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal and financial information as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Legal use of the Ncui 101 A

The Ncui 101 A is legally binding when completed and submitted in accordance with applicable laws and regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal consequences. Compliance with the relevant legal frameworks is essential for the validity of the form.

Key elements of the Ncui 101 A

Key elements of the Ncui 101 A include:

- Personal identification information, such as name and address.

- Details regarding financial transactions or other relevant data.

- Signature and date fields to validate the form.

- Instructions for submission and any deadlines associated with the form.

Required Documents

To complete the Ncui 101 A, you may need to provide several supporting documents. These can include:

- Proof of identity, such as a driver's license or passport.

- Financial statements or tax documents relevant to the information being reported.

- Any additional forms or documentation as specified in the instructions.

Form Submission Methods

The Ncui 101 A can typically be submitted through various methods, including:

- Online submission through a designated portal.

- Mailing a physical copy to the appropriate address.

- In-person submission at designated offices, if applicable.

Quick guide on how to complete ncui 101 a 56078332

Effortlessly prepare Ncui 101 A on any device

Digital document management has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Ncui 101 A on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Ncui 101 A with ease

- Obtain Ncui 101 A and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ncui 101 A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ncui 101 a 56078332

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ncui101a and how does it relate to airSlate SignNow?

ncui101a refers to a unique integration feature of airSlate SignNow that streamlines the document signing process. This integration allows businesses to efficiently manage their document workflows and enhance collaboration within teams. Utilizing ncui101a can greatly simplify the eSigning experience, making it more accessible and user-friendly.

-

What pricing options are available for using ncui101a with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that accommodate various business needs, including features tied to ncui101a. You can choose from monthly or annual subscriptions, and special discounts are available for long-term commitments. This versatility ensures that businesses can find a cost-effective solution that fits their budget while leveraging the benefits of ncui101a.

-

What are the key features of ncui101a in airSlate SignNow?

The ncui101a feature includes advanced document management, secure eSignature capabilities, and seamless integration with popular applications. These features are designed to enhance productivity by enabling users to manage their documents from a centralized platform. With ncui101a, you can also customize templates and automate workflows, signNowly reducing the time spent on administrative tasks.

-

How can ncui101a benefit my business?

Implementing ncui101a within airSlate SignNow can lead to increased efficiency and reduced turnaround times for document approvals. Businesses can automate repetitive tasks, allowing teams to focus on higher-value activities. This efficiency not only saves time but also improves overall customer satisfaction by expediting the signing process.

-

Does airSlate SignNow with ncui101a support mobile use?

Yes, airSlate SignNow is optimized for both desktop and mobile devices, making ncui101a available on-the-go. Users can easily send, receive, and eSign documents from their smartphones or tablets, ensuring business continuity. This mobile compatibility empowers teams to stay productive, whether in the office or working remotely.

-

What integrations are available with ncui101a in airSlate SignNow?

airSlate SignNow with ncui101a integrates with a variety of popular business applications, including CRM systems and cloud storage solutions. This compatibility allows for a smooth flow of information between platforms, enhancing overall productivity. By utilizing these integrations, users can streamline their workflows and optimize their document management processes.

-

Is there a trial period available for ncui101a in airSlate SignNow?

Yes, airSlate SignNow offers a free trial period, allowing users to explore the features of ncui101a and assess its benefits for their business. The trial provides full access to all tools, enabling prospective customers to evaluate how effectively it meets their needs. This is a great opportunity to experience the advantages of ncui101a without any initial commitment.

Get more for Ncui 101 A

- Connecticut forest products timber sale contract connecticut form

- Connecticut easement form

- Conservation easement agreement form

- Easement utility agreement form

- Assumption agreement of mortgage and release of original mortgagors connecticut form

- Ct judgment form 497301227

- Connecticut small form

- Ct eviction form

Find out other Ncui 101 A

- Create eSignature Document Mobile

- Create eSignature Document Free

- Create eSignature Document Simple

- Create eSignature Document Easy

- Create eSignature Form Online

- Create eSignature Document Mac

- Create eSignature Form Free

- How To Create eSignature Document

- Create eSignature PPT Free

- Create eSignature PPT Fast

- Create eSignature Presentation Online

- Erase eSignature PDF Computer

- How Do I Erase eSignature PDF

- Create eSignature Presentation Fast

- Create eSignature Presentation Simple

- Redact eSignature PDF Online

- Erase eSignature Presentation Safe

- Redact eSignature Word Later

- How To Redact eSignature PDF

- How Do I Redact eSignature Document