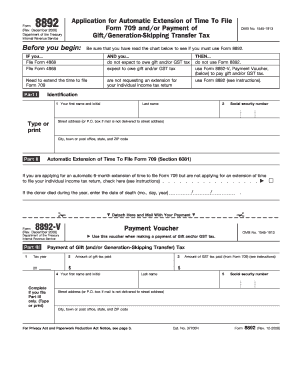

Form 8892

What is the Form 8892

The Form 8892 is a tax form used by certain U.S. taxpayers to request an extension of time to file their tax returns. Specifically, it is designed for individuals who need additional time to submit their income tax returns and is crucial for ensuring compliance with IRS regulations. This form is particularly relevant for those who may not be able to meet the standard filing deadlines due to various circumstances.

How to use the Form 8892

Using the Form 8892 involves a few straightforward steps. First, you need to gather the necessary information, including your personal details and the tax year for which you are requesting an extension. Next, accurately fill out the form, ensuring that all required fields are completed. After filling it out, you can submit the form electronically or via mail, depending on your preference and the IRS guidelines for the specific tax year.

Steps to complete the Form 8892

Completing the Form 8892 requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and Social Security number at the top of the form.

- Indicate the tax year for which you are requesting an extension.

- Provide any additional information as required, such as your filing status.

- Review the form for accuracy to ensure all information is correct.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form 8892

The legal use of the Form 8892 is governed by IRS regulations. Submitting this form grants taxpayers an extension for filing their returns, provided it is completed correctly and submitted on time. It is important to note that while the form allows for an extension to file, it does not extend the time to pay any taxes owed. Therefore, taxpayers should ensure that any estimated payments are made by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8892 are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by the original due date of the tax return you are extending. For most individual taxpayers, this date falls on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be adjusted accordingly. It is essential to keep track of these dates to avoid any potential penalties.

Key elements of the Form 8892

Several key elements are essential to understand when working with the Form 8892. These include:

- Taxpayer Information: Accurate personal details, including name and Social Security number.

- Tax Year: Clearly indicating the tax year for which the extension is requested.

- Signature: A signature is required to validate the form, confirming that the information provided is accurate.

Quick guide on how to complete form 8892

Effortlessly Prepare Form 8892 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to design, alter, and electronically sign your papers quickly without delays. Manage Form 8892 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven operation today.

Steps to Alter and Electronically Sign Form 8892 Effortlessly

- Obtain Form 8892 and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information carefully and then click the Done button to save your changes.

- Select your preferred method of delivering your document, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Alter and electronically sign Form 8892 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8892

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8892 fill in form used for?

The 8892 fill in form is a key document used for various applications where electronic signatures are required. By utilizing airSlate SignNow, businesses can fill in the 8892 form seamlessly and ensure compliance with legal standards. This efficient process saves time and allows for quicker transaction completion.

-

How can I sign the 8892 fill in form electronically?

With airSlate SignNow, signing the 8892 fill in form electronically is straightforward. Simply upload the form to our platform, add your signature, and send it off. Our user-friendly interface makes it easy for anyone to sign documents without hassle.

-

What are the pricing options for using airSlate SignNow for the 8892 fill in form?

AirSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to essential features for managing the 8892 fill in form, ensuring you can choose a cost-effective solution that fits your budget. Visit our pricing page for detailed information on each plan.

-

Does airSlate SignNow support integrations with other applications for the 8892 fill in form?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing you to streamline the process of filling out and signing the 8892 fill in form. Whether it’s CRM tools or cloud storage services, these integrations enhance workflow efficiency while maintaining document security.

-

What benefits does airSlate SignNow offer for filling out the 8892 fill in form?

AirSlate SignNow enables users to fill out the 8892 form quickly and securely. With features like templates, collaboration tools, and cloud storage access, it improves productivity and ensures all data is accurate and easily accessible. Emphasizing user-friendliness, airSlate makes the process faster and more reliable.

-

Is it safe to use airSlate SignNow for the 8892 fill in form?

Absolutely! AirSlate SignNow implements industry-leading security measures to protect your data, especially when dealing with sensitive documents like the 8892 fill in form. With features like encryption and secure access, users can be assured that their information remains private and safeguarded.

-

Can I track the status of my 8892 fill in form once sent?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of their sent 8892 fill in form. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 8892

- Disclaimer property template form

- New mexico notice claim form

- Quitclaim deed from individual to husband and wife new mexico form

- Warranty deed from individual to husband and wife new mexico form

- Quitclaim deed from corporation to husband and wife new mexico form

- Warranty deed from corporation to husband and wife new mexico form

- Quitclaim deed from corporation to individual new mexico form

- Nm warranty deed form

Find out other Form 8892

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF