MIB, Inc 2014-2026

What is the MIB, Inc?

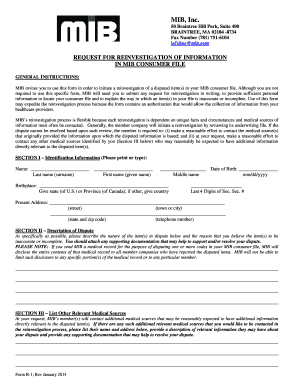

The MIB, Inc. is a membership corporation that serves the insurance industry in the United States and Canada. It provides a centralized database that helps insurers assess the risk associated with applicants for life and health insurance policies. The MIB compiles information from member companies regarding applicants' medical histories and insurance claims, which assists insurers in making informed underwriting decisions. This system helps to prevent fraud and ensures that insurance companies have access to accurate data when evaluating credit application requests.

Steps to complete the MIB, Inc

Completing a credit application request through the MIB, Inc. involves several key steps:

- Gather necessary information: Collect personal details, including your name, address, Social Security number, and employment information.

- Access the MIB application: Visit the MIB website or contact your insurance provider to obtain the necessary forms.

- Fill out the application: Provide accurate information on the credit application request, ensuring all fields are completed.

- Review your application: Double-check the information for accuracy and completeness before submission.

- Submit the application: Send the completed application to the MIB via the method specified by your insurer, whether online, by mail, or in person.

Key elements of the MIB, Inc

Understanding the key elements of the MIB, Inc. is essential for navigating the credit application process effectively. Important components include:

- Data collection: The MIB collects data from its member insurance companies regarding applicants' health and insurance histories.

- Risk assessment: Insurers use this data to evaluate the risk associated with issuing a policy to an applicant.

- Privacy regulations: The MIB adheres to strict privacy laws to protect applicants' personal information.

- Consumer rights: Individuals have the right to access their MIB report and dispute any inaccuracies.

Legal use of the MIB, Inc

The legal use of the MIB, Inc. is governed by various regulations designed to protect consumer rights while allowing insurers to assess risk. Key legal aspects include:

- Compliance with federal laws: The MIB operates under the Fair Credit Reporting Act (FCRA), which mandates how consumer information can be collected and used.

- Consumer consent: Insurers must obtain consent from applicants before accessing their MIB data.

- Dispute process: Consumers have the right to dispute inaccuracies in their MIB reports, ensuring that corrections can be made.

Eligibility Criteria

Eligibility criteria for submitting a credit application request through the MIB, Inc. typically include:

- Age requirement: Applicants must be of legal age, usually eighteen years or older.

- Residency: Applicants must reside in the United States or Canada to be eligible for coverage.

- Insurance provider affiliation: The application must be submitted through a member insurance company that participates in the MIB system.

Application Process & Approval Time

The application process for a credit application request through the MIB, Inc. generally follows these steps:

- Submission: Once the application is submitted, it is reviewed by the insurance company.

- Evaluation: The insurer assesses the information provided and checks it against the MIB database.

- Approval timeframe: The approval process can vary, but applicants typically receive a decision within a few days to a few weeks, depending on the insurer's procedures.

Quick guide on how to complete mib inc

Complete MIB, Inc effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as it allows you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without unnecessary wait times. Manage MIB, Inc on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign MIB, Inc seamlessly

- Locate MIB, Inc and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and select the Done button to save your modifications.

- Decide how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you select. Modify and eSign MIB, Inc and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mib inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit application request in airSlate SignNow?

A credit application request in airSlate SignNow is a digital form that allows businesses to securely collect and manage credit applications. By using this feature, companies can streamline the application process, reduce paperwork, and quickly assess prospective clients’ creditworthiness.

-

How does airSlate SignNow handle credit application request forms?

airSlate SignNow allows users to easily create, customize, and send credit application request forms through a user-friendly interface. The platform ensures that all forms are legally binding and can be signed electronically, making the process efficient and compliant.

-

Is airSlate SignNow affordable for managing credit application requests?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. The pricing structure is designed to provide maximum value while effectively managing numerous credit application requests without breaking the bank.

-

What features are included with the credit application request tool?

The credit application request tool in airSlate SignNow includes features such as customizable templates, eSigning capabilities, document tracking, and integration with popular applications. These features enhance the user experience and streamline the credit application process for businesses.

-

Can I integrate airSlate SignNow with other software for credit application requests?

Absolutely! airSlate SignNow offers integrations with CRM and financial software, allowing you to seamlessly manage credit application requests within your existing systems. This integration provides a smoother workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for credit application requests?

Using airSlate SignNow for credit application requests signNowly improves response times and document management. The ability to track applications and securely collect signatures ensures that businesses can efficiently process credit applications and improve customer satisfaction.

-

How secure are credit application requests sent through airSlate SignNow?

Security is a top priority at airSlate SignNow. Credit application requests are protected with bank-level encryption and compliant with various regulatory standards, ensuring that all sensitive information remains confidential and secure throughout the process.

Get more for MIB, Inc

- Application for sublease nevada form

- Inventory and condition of leased premises for pre lease and post lease nevada form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out nevada form

- Property manager agreement nevada form

- Agreement for delayed or partial rent payments nevada form

- Tenants maintenance repair request form nevada

- Guaranty attachment to lease for guarantor or cosigner nevada form

- Amendment to lease or rental agreement nevada form

Find out other MIB, Inc

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA