Fin405 Form

What is the Fin405?

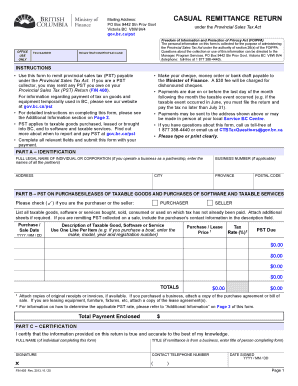

The Fin405, also known as the casual remittance return, is a specific form used primarily for reporting and remitting certain payments to the government. This form is essential for individuals and businesses that need to report casual remittances, ensuring compliance with tax regulations. It is designed to streamline the process of submitting payments and maintaining accurate records.

How to use the Fin405

Using the Fin405 involves several straightforward steps. First, gather all necessary information, including your identification details and payment amounts. Next, access the form, which is available in a fillable format online, allowing for easy completion. After filling out the required fields, review the information for accuracy, and then submit the form either electronically or by mail, depending on your preference and the requirements set forth by the issuing authority.

Steps to complete the Fin405

Completing the Fin405 requires careful attention to detail. Follow these steps:

- Download or access the form in its fillable format.

- Enter your personal and payment information accurately.

- Double-check all entries to ensure there are no errors.

- Sign the document electronically or by hand, as required.

- Submit the completed form through the designated method, either online or via postal mail.

Legal use of the Fin405

The Fin405 is legally binding when completed and submitted according to the established guidelines. It is crucial to ensure that all information provided is accurate and truthful to avoid any legal repercussions. The form must comply with relevant regulations, including those set forth by the IRS and state tax authorities, ensuring that it serves its intended purpose without legal complications.

Key elements of the Fin405

Several key elements must be included when filling out the Fin405 to ensure its validity:

- Accurate identification of the individual or business submitting the form.

- Clear details regarding the payment being remitted.

- Signature of the responsible party, confirming the accuracy of the information.

- Submission date, which is critical for compliance with filing deadlines.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Fin405. Typically, these deadlines align with specific tax periods or payment schedules. Missing a deadline can result in penalties or interest charges. Therefore, individuals and businesses should keep track of these dates to ensure timely submission and compliance with tax obligations.

Quick guide on how to complete fin405

Complete Fin405 effortlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fin405 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to edit and eSign Fin405 with ease

- Obtain Fin405 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to secure your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring the printing of new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Fin405 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin405

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fin405 and how does it relate to airSlate SignNow?

Fin405 is a financial document management solution that integrates seamlessly with airSlate SignNow. It allows users to streamline their document workflow while ensuring compliance and security, enhancing the overall eSigning experience.

-

How much does airSlate SignNow cost for fin405 users?

AirSlate SignNow offers flexible pricing plans for fin405 users, with options for individuals and businesses. By choosing the right plan, you can enjoy features designed to enhance your document management efficiency without breaking the bank.

-

What are the key features of airSlate SignNow that benefit fin405 users?

Fin405 users will appreciate the intuitive eSigning interface, customizable templates, and secure cloud storage offered by airSlate SignNow. These features are designed to simplify the document signing process while maximizing productivity.

-

Can I integrate airSlate SignNow with other tools while using fin405?

Absolutely! AirSlate SignNow supports integrations with numerous applications, making it easy for fin405 users to connect with their favorite tools. This ensures a seamless workflow and enhances the overall efficiency of your business operations.

-

How does airSlate SignNow enhance security for fin405 transactions?

AirSlate SignNow implements robust security measures, including encryption and multi-factor authentication, to protect fin405 transactions. This commitment to security allows businesses to send and eSign documents confidently.

-

What benefits does using airSlate SignNow provide for fin405 customers?

Fin405 customers benefit from a streamlined signing process, reduced turnaround times, and improved collaboration. AirSlate SignNow focuses on creating an efficient experience for managing financial documents.

-

Is there a free trial available for fin405 users interested in airSlate SignNow?

Yes, airSlate SignNow offers a free trial for fin405 users, allowing them to explore its features and discover how it can benefit their document management needs. This risk-free opportunity helps customers make informed decisions.

Get more for Fin405

Find out other Fin405

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage