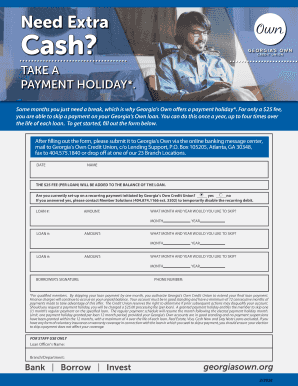

Georgia's Own Skip a Payment Form

What is the Georgia's Own Skip A Payment

The Georgia's Own Skip A Payment program allows eligible members to temporarily defer their loan payments, providing financial relief during challenging times. This option is particularly useful for members facing unexpected expenses or financial hardships. By participating in this program, members can skip one or more payments on their loans, such as personal loans, auto loans, or credit cards, without incurring penalties. It is essential to understand the specific terms and conditions associated with this program, as they may vary based on the type of loan and individual circumstances.

How to use the Georgia's Own Skip A Payment

To utilize the Georgia's Own Skip A Payment option, members must first ensure they meet the eligibility criteria. This typically involves being in good standing with their loans and having made a certain number of payments prior to applying. Members can then submit a request through their online banking portal or by contacting customer service. Once the request is approved, the skipped payment will be processed, and members will receive confirmation. It is important to note that interest may continue to accrue during the skipped payment period, which could affect the overall loan balance.

Steps to complete the Georgia's Own Skip A Payment

Completing the Georgia's Own Skip A Payment process involves several straightforward steps:

- Review eligibility requirements to ensure compliance.

- Log into your Georgia's Own online banking account or contact customer service.

- Submit a request to skip a payment, specifying the loan type and payment date.

- Receive confirmation of your request and any additional information regarding interest accrual.

Following these steps will help ensure a smooth process for deferring your loan payment.

Legal use of the Georgia's Own Skip A Payment

The Georgia's Own Skip A Payment program is designed to comply with applicable laws and regulations governing loan agreements. Members should be aware that while skipping a payment can provide immediate financial relief, it is crucial to understand the legal implications, such as the potential impact on credit scores and loan terms. The program is structured to ensure that all participants are informed about their rights and responsibilities, fostering a transparent and supportive environment.

Eligibility Criteria

Eligibility for the Georgia's Own Skip A Payment program typically includes several key factors:

- Members must have an active loan with Georgia's Own.

- Loans must be in good standing, meaning all previous payments are current.

- Members may need to have made a minimum number of payments prior to applying.

- Specific loan types may be excluded from the program, so it is important to verify details.

Meeting these criteria is essential for a successful application to skip a payment.

Quick guide on how to complete georgias own skip a payment

Complete Georgia's Own Skip A Payment easily on any device

Digital document management has become increasingly popular among companies and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the instruments necessary to create, edit, and eSign your documents quickly without delays. Work with Georgia's Own Skip A Payment on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Georgia's Own Skip A Payment effortlessly

- Locate Georgia's Own Skip A Payment and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Modify and eSign Georgia's Own Skip A Payment and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgias own skip a payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does Georgia's Own Credit Union have Zelle?

Yes, Georgia's Own Credit Union does offer Zelle as a payment option, allowing members to send and receive money quickly and conveniently. With Zelle, you can transfer funds directly from your Georgia's Own Credit Union account to friends and family using just their email address or mobile number. This integration provides an easy, secure way to manage your finances.

-

How do I enroll in Zelle through Georgia's Own Credit Union?

To enroll in Zelle through Georgia's Own Credit Union, simply log into your online banking account or the mobile app. Navigate to the Zelle section and follow the prompts to set up your account using your email or mobile number. Once enrolled, you can start using Zelle to send and receive money instantly.

-

What are the fees associated with using Zelle at Georgia's Own Credit Union?

There are no fees for using Zelle through Georgia's Own Credit Union. The service is complimentary for members, making it a cost-effective solution for sending money to others. This allows you to perform transactions without incurring additional charges.

-

Are there limits on how much I can send or receive with Zelle through Georgia's Own Credit Union?

Yes, Georgia's Own Credit Union does impose limits on the amount you can send and receive with Zelle. These limits may vary based on your account type and activity. It’s a good idea to check with the credit union for specific details on limits to better manage your transfers.

-

Can I use Zelle if I'm not a member of Georgia's Own Credit Union?

No, you need to be a member of Georgia's Own Credit Union to use Zelle through their services. However, if you have a Zelle account through another financial institution, you can still send or receive money from members of Georgia's Own who use Zelle.

-

What benefits does using Zelle provide when banking with Georgia's Own Credit Union?

Using Zelle with Georgia's Own Credit Union offers many benefits, including instant money transfers that are both secure and easy to use. You can directly send money from your credit union account, which helps avoid third-party apps. Additionally, Zelle is fully integrated within the banking app for seamless transactions.

-

How does Zelle compare to other payment services offered by Georgia's Own Credit Union?

Zelle stands out among other payment services offered by Georgia's Own Credit Union due to its instant transfer capability and ease of use. Unlike traditional methods like checks or wire transfers that can take time, Zelle transactions occur in real-time. This efficiency makes it a preferred choice for many members.

Get more for Georgia's Own Skip A Payment

- Warranty deed from corporation to two individuals iowa form

- Warranty deed from individual to a trust iowa form

- Warranty deed from husband and wife to a trust iowa form

- Warranty deed from husband to himself and wife iowa form

- Iowa quitclaim form

- Quitclaim deed from husband and wife to husband and wife iowa form

- Iowa warranty deed form

- Iowa revocation form

Find out other Georgia's Own Skip A Payment

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors