Texas Sales Tax Exemption Form

What is the Texas Sales Tax Exemption Form

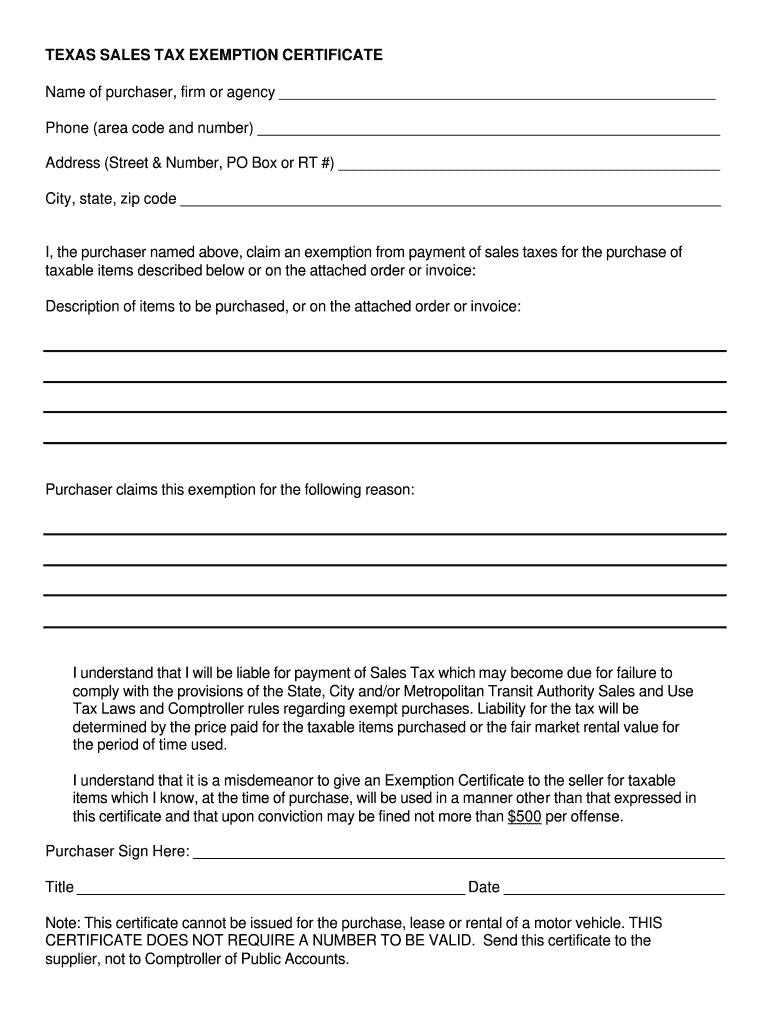

The Texas Sales Tax Exemption Certificate is a legal document that allows eligible purchasers to buy certain items without paying sales tax. This form is essential for businesses and individuals who qualify for tax exemptions, such as non-profit organizations, government entities, and specific types of businesses. By presenting this certificate at the time of purchase, the buyer can avoid the additional cost of sales tax on qualifying items. Understanding the purpose and proper use of this form is crucial for compliance with Texas tax laws.

How to use the Texas Sales Tax Exemption Form

To effectively use the Texas Sales Tax Exemption Certificate, it is important to complete the form accurately. The buyer must fill in their details, including the name, address, and the reason for the exemption. When making a purchase, the buyer should present this completed certificate to the seller. It is advisable for sellers to keep a copy of the certificate on file for their records, ensuring they can validate the tax-exempt status of the transaction if needed. Proper usage helps prevent tax liabilities and ensures compliance with state regulations.

Steps to complete the Texas Sales Tax Exemption Form

Completing the Texas Sales Tax Exemption Certificate involves several straightforward steps:

- Obtain the form from a reliable source, such as the Texas Comptroller's website or through your business's accounting department.

- Fill in the required information, including the name and address of the purchaser and the type of exemption being claimed.

- Sign and date the certificate to validate it.

- Provide the completed form to the seller at the time of purchase.

Ensuring all information is accurate and complete is essential to avoid any issues with tax compliance.

Legal use of the Texas Sales Tax Exemption Form

The Texas Sales Tax Exemption Certificate is legally binding when used correctly. It is important for users to understand that misuse of the form can lead to penalties. The certificate must only be used for eligible purchases, and the buyer must meet the criteria for exemption as defined by Texas law. Sellers are responsible for verifying the legitimacy of the certificate, which protects them from potential tax liabilities. Compliance with legal requirements ensures that both buyers and sellers can engage in tax-exempt transactions without complications.

Eligibility Criteria

Eligibility for using the Texas Sales Tax Exemption Certificate varies based on the type of purchaser and the nature of the purchase. Common eligible entities include:

- Non-profit organizations that hold a valid exemption certificate.

- Government agencies making purchases for official use.

- Businesses purchasing items for resale.

It is essential for purchasers to verify their eligibility before using the certificate to avoid any legal issues or tax liabilities.

Form Submission Methods

The Texas Sales Tax Exemption Certificate can be submitted in various ways, depending on the seller's preferences. Common submission methods include:

- Presenting a physical copy of the completed form at the point of sale.

- Providing an electronic version of the certificate if the seller accepts digital documentation.

Understanding the preferred submission method of the seller can facilitate a smoother transaction and ensure compliance with tax regulations.

Quick guide on how to complete texas sales tax exemption form

Complete Texas Sales Tax Exemption Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Texas Sales Tax Exemption Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign Texas Sales Tax Exemption Form effortlessly

- Locate Texas Sales Tax Exemption Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Texas Sales Tax Exemption Form and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas tax exemption certificate?

A Texas tax exemption certificate is a document that allows qualifying businesses to purchase goods without paying sales tax. This certificate is crucial for businesses that meet certain criteria and want to benefit from tax exemptions while making purchases in Texas. Understanding how to obtain and utilize this certificate can signNowly aid in your overall tax management strategy.

-

How can airSlate SignNow help with the Texas tax exemption certificate process?

AirSlate SignNow streamlines the process of creating, sending, and eSigning your Texas tax exemption certificate documents. By providing an easy-to-use platform, businesses can quickly prepare these certificates and share them with vendors, ensuring a smooth transaction without delays. This efficient process saves time and reduces the chances of errors.

-

Are there any fees associated with obtaining a Texas tax exemption certificate through airSlate SignNow?

Using airSlate SignNow to create and manage your Texas tax exemption certificate documents is very cost-effective. While the certificate itself is free to obtain from the state, our competitive subscription plans provide a cost-efficient solution for all your eSigning needs. We ensure our platform's pricing is transparent, with no hidden fees.

-

What features does airSlate SignNow offer for managing tax exemption certificates?

AirSlate SignNow offers robust features such as document templates, collaborative eSigning, and secure cloud storage for your Texas tax exemption certificates. Our user-friendly interface also allows easy tracking of document statuses, making it simple to manage multiple certificates at once. These features enhance efficiency and organization for your business transactions.

-

Can airSlate SignNow integrate with other accounting software for tax exemption tracking?

Yes, airSlate SignNow integrates seamlessly with many popular accounting and financial software platforms, enhancing your ability to track Texas tax exemption certificates. This integration allows for smooth data flow, ensuring that your exemptions are accurately reflected in your financial records. You can focus on your business while we handle the paperwork.

-

What are the benefits of using eSigning for Texas tax exemption certificates?

Utilizing eSigning for Texas tax exemption certificates offers convenience and speed without sacrificing security. With airSlate SignNow, you can sign and share documents electronically, reducing turnaround times and simplifying workflows. This modern approach helps businesses stay compliant while improving overall productivity.

-

Is it easy to update a Texas tax exemption certificate in airSlate SignNow?

Absolutely! AirSlate SignNow makes it simple to update your Texas tax exemption certificate whenever necessary. You can easily edit existing documents and resend them for eSignature, ensuring that all your information remains accurate and up-to-date. This flexibility is essential for keeping your business compliant and efficient.

Get more for Texas Sales Tax Exemption Form

- Child care services package idaho form

- Special or limited power of attorney for real estate sales transaction by seller idaho form

- Closing real estate transaction 497305868 form

- Limited power of attorney where you specify powers with sample powers included idaho form

- Limited power of attorney for stock transactions and corporate powers idaho form

- Special durable power of attorney for bank account matters idaho form

- Idaho small business startup package idaho form

- Idaho property management package idaho form

Find out other Texas Sales Tax Exemption Form

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe