D 1 D 128 Sctax Form

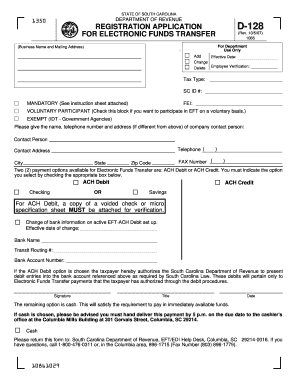

What is the D-1 D-128 Sctax?

The D-1 D-128 Sctax form is a specific tax document used primarily in the United States for reporting certain tax obligations. This form is essential for individuals and businesses who need to disclose specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance with federal tax laws.

How to use the D-1 D-128 Sctax

Using the D-1 D-128 Sctax form involves a series of steps to ensure accurate completion and submission. First, gather all necessary financial documents that relate to the information required on the form. Next, fill out the form with precise details, ensuring that all entries are correct to avoid delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on the guidelines provided by the IRS.

Steps to complete the D-1 D-128 Sctax

Completing the D-1 D-128 Sctax form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Provide detailed information regarding your income and any deductions you intend to claim.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, ensuring that you keep a copy for your records.

Legal use of the D-1 D-128 Sctax

The D-1 D-128 Sctax form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal standing, it is important to follow all instructions carefully and provide truthful information. Falsifying information on this form can lead to severe penalties, including fines and potential legal action.

Filing Deadlines / Important Dates

Filing deadlines for the D-1 D-128 Sctax form are critical to ensure compliance with tax laws. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any potential extensions.

Required Documents

To complete the D-1 D-128 Sctax form, certain documents are required to support the information you provide. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Bank statements and investment income documentation.

Penalties for Non-Compliance

Failing to comply with the requirements of the D-1 D-128 Sctax form can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal repercussions. It is essential to understand the implications of non-compliance and to file the form accurately and on time to avoid these consequences.

Quick guide on how to complete d 1 d 128 sctax

Easily Prepare D 1 D 128 Sctax on Any Device

The management of documents online has become increasingly favored by both companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as it allows you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle D 1 D 128 Sctax on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign D 1 D 128 Sctax Effortlessly

- Find D 1 D 128 Sctax and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Select your preferred method for sending your form, such as email, SMS, or invitation link, or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any chosen device. Modify and electronically sign D 1 D 128 Sctax while ensuring outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 1 d 128 sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is D 1 D 128 Sctax?

D 1 D 128 Sctax is an essential feature within airSlate SignNow that streamlines document signing processes for businesses. It enhances efficiency by allowing users to sign documents electronically, ensuring that transactions are quicker and more secure.

-

How does D 1 D 128 Sctax improve document management?

D 1 D 128 Sctax simplifies document management by centralizing eSigning tasks in one platform. Users can track document statuses in real time, reducing the chances of misplaced files and enhancing overall organization.

-

What are the pricing options for D 1 D 128 Sctax?

airSlate SignNow offers competitive pricing plans for D 1 D 128 Sctax that cater to different business needs. These plans typically include features like unlimited document uploads and integrations, making it a cost-effective solution for teams of all sizes.

-

What are the key features of D 1 D 128 Sctax?

The key features of D 1 D 128 Sctax include user-friendly document templates, customizable workflows, and secure electronic signature capabilities. These features are designed to enhance productivity and ensure compliance with industry standards.

-

Can I integrate D 1 D 128 Sctax with other software?

Yes, D 1 D 128 Sctax seamlessly integrates with various popular software applications, including CRMs and document management systems. This enables businesses to create a cohesive workflow and enhance productivity across their operations.

-

What benefits does D 1 D 128 Sctax offer for businesses?

D 1 D 128 Sctax offers numerous benefits such as reducing turnaround time for document signing, enhancing security with electronic signatures, and improving overall operational efficiency. Businesses can expect to save both time and resources while reducing paper usage.

-

Is D 1 D 128 Sctax secure for sensitive documents?

Absolutely, D 1 D 128 Sctax prioritizes security by using encryption and compliance with legal standards for electronic signatures. Users can confidently manage sensitive documents without compromising data integrity.

Get more for D 1 D 128 Sctax

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property illinois form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497306197 form

- Illinois lease tenant form

- Illinois right form

- Breach lease tenant 497306202 form

- Illinois violating form

Find out other D 1 D 128 Sctax

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple