It05 Form Jamaica 2015-2026

What is the It05 Form Jamaica

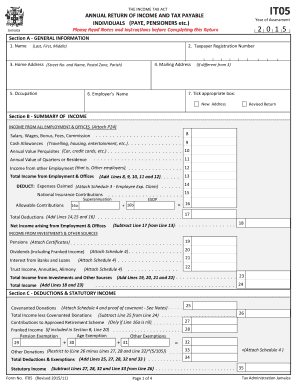

The It05 form is a crucial document used for filing income tax returns in Jamaica. This form is specifically designed for individuals and businesses to report their income, deductions, and tax liabilities to the Tax Administration Jamaica. By accurately completing the It05, taxpayers ensure compliance with local tax laws and facilitate the proper assessment of their tax obligations.

How to use the It05 Form Jamaica

Using the It05 form involves several steps that ensure accurate reporting of income and deductions. Taxpayers should first gather all necessary financial documents, including income statements, receipts for deductible expenses, and any relevant tax credits. Once all information is compiled, taxpayers can fill out the form, ensuring that each section is completed with precise figures. After completing the form, it must be submitted to the Tax Administration Jamaica by the specified deadline.

Steps to complete the It05 Form Jamaica

Completing the It05 form requires careful attention to detail. Here are the steps to follow:

- Gather all financial documents, including income statements and receipts.

- Download the It05 form from the Tax Administration Jamaica website or obtain a physical copy.

- Fill in personal information, including your name, address, and tax identification number.

- Report all sources of income, including salaries, business income, and investment earnings.

- List all eligible deductions and tax credits.

- Calculate the total tax owed or refund due.

- Review the form for accuracy before submission.

Required Documents

To complete the It05 form, taxpayers must have several documents on hand. These include:

- Income statements from employers or clients.

- Receipts for deductible expenses, such as medical bills or educational costs.

- Documentation for any tax credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods

The It05 form can be submitted in various ways to accommodate different preferences. Taxpayers may choose to file online through the Tax Administration Jamaica's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own set of guidelines and deadlines that must be adhered to.

Penalties for Non-Compliance

Failing to file the It05 form or submitting inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete it05 form jamaica

Complete It05 Form Jamaica effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage It05 Form Jamaica on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign It05 Form Jamaica with ease

- Locate It05 Form Jamaica and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether it be via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or overlooked files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign It05 Form Jamaica and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it05 form jamaica

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Jamaica return income tax?

Jamaica return income tax is a mandatory tax that residents must file annually, reporting their income to the Jamaican Revenue Authority. It ensures individuals comply with tax regulations and contribute to national revenue. Filing this tax form accurately is crucial to avoid penalties.

-

How can airSlate SignNow help with filing Jamaica return income tax?

airSlate SignNow provides an efficient platform for eSigning and sending necessary documents related to Jamaica return income tax. You can quickly gather signatures on tax forms and other relevant documents, streamlining the filing process. This ensures compliance and improves the speed of submission.

-

Is airSlate SignNow cost-effective for filing Jamaica return income tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses needing to manage Jamaica return income tax documents. With affordable pricing plans tailored to various needs, you can save time and resources by simplifying the signing process.

-

What features does airSlate SignNow offer for Jamaica return income tax management?

airSlate SignNow offers features such as template creation, secure document storage, and real-time tracking for your Jamaica return income tax documents. These tools enhance efficiency, allowing users to generate, send, and manage tax-related paperwork swiftly.

-

Can airSlate SignNow integrate with other accounting tools for Jamaica return income tax?

Absolutely! airSlate SignNow can integrate with various accounting and tax software to streamline the process of preparing and filing Jamaica return income tax. This integration allows for seamless data transfer, ensuring all your financial documentation is updated and accurate.

-

How secure is airSlate SignNow when handling Jamaica return income tax documents?

Security is a priority at airSlate SignNow, especially for sensitive documents like Jamaica return income tax forms. The platform employs advanced encryption and secure storage protocols to ensure that your data remains confidential and protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for Jamaica return income tax?

Using airSlate SignNow for Jamaica return income tax provides signNow benefits, including increased efficiency, reduced errors, and faster turnaround times. The eSigning feature eliminates the need for printing and mailing, making the process smoother and more environmentally friendly.

Get more for It05 Form Jamaica

Find out other It05 Form Jamaica

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online