Denver Homestead Exemption Form

What is the Denver Homestead Exemption

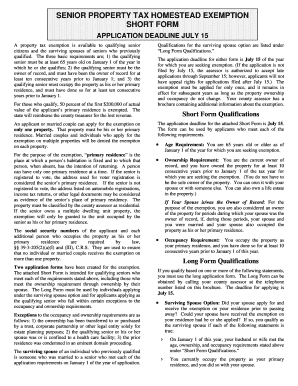

The Denver Homestead Exemption is a property tax benefit designed to assist qualifying homeowners in reducing their property tax burden. This exemption is available to individuals who meet specific criteria, including age, disability status, and residency requirements. By filing the homestead exemption form, eligible homeowners can receive a reduction in the taxable value of their primary residence, which ultimately lowers their property tax bill. This program aims to support seniors and individuals with disabilities, making homeownership more affordable in Denver.

Eligibility Criteria

To qualify for the Denver Homestead Exemption, applicants must meet several criteria:

- Be at least sixty-five years old or have a disability.

- Own and occupy the property as their primary residence.

- Have lived in Colorado for at least ten consecutive years.

- Meet income limitations as defined by the state.

These criteria ensure that the exemption primarily benefits those who may need financial assistance the most.

Steps to Complete the Denver Homestead Exemption

Completing the Denver Homestead Exemption form involves several straightforward steps:

- Obtain the homestead exemption form PDF from the local assessor's office or online.

- Carefully read the instructions provided with the form.

- Fill out the required information, ensuring accuracy.

- Gather necessary documentation to support your application, such as proof of age or disability.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

Following these steps can help ensure a smooth application process.

Required Documents

When applying for the Denver Homestead Exemption, certain documents are necessary to verify eligibility. These may include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of disability, if applicable.

- Proof of residency in Colorado for the required duration.

- Income verification documents, such as tax returns or pay stubs.

Providing accurate and complete documentation can expedite the approval process.

Form Submission Methods

Applicants have several options for submitting the Denver Homestead Exemption form:

- Online: Many counties offer electronic submission through their official websites.

- By Mail: Completed forms can be mailed to the local assessor's office.

- In-Person: Applicants can also submit their forms directly at the assessor's office.

Choosing the most convenient submission method can help ensure timely processing of the application.

Legal Use of the Denver Homestead Exemption

The Denver Homestead Exemption is governed by state laws that outline its legal use. To maintain compliance, applicants must ensure they meet the eligibility criteria and accurately report their information. Misrepresentation or failure to meet the requirements can lead to penalties, including the loss of the exemption. Understanding these legal aspects is crucial for homeowners to protect their benefits and ensure they remain compliant with local regulations.

Quick guide on how to complete denver homestead exemption

Accomplish Denver Homestead Exemption effortlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Denver Homestead Exemption on any device using the airSlate SignNow Android or iOS applications and elevate your document-centric processes today.

The easiest way to modify and eSign Denver Homestead Exemption seamlessly

- Locate Denver Homestead Exemption and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Denver Homestead Exemption and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the denver homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homestead exemption in Denver?

A homestead exemption in Denver is a legal provision that allows homeowners to reduce their property tax liability by exempting a portion of the home's value. This exemption applies to the primary residence and can signNowly lower your tax bill, making homeownership more affordable.

-

How do I apply for a homestead exemption in Denver?

To apply for a homestead exemption in Denver, you need to complete an application form available from the Denver Assessor's Office. Make sure to submit your application by the designated deadline, providing necessary documentation to prove your eligibility as a homeowner.

-

What are the benefits of the homestead exemption in Denver?

The benefits of the homestead exemption in Denver include lower property taxes and enhanced affordability for homeowners. By reducing the taxable value of your residence, this exemption can signNowly ease your financial burden and increase your disposable income.

-

Is there an age requirement for the homestead exemption in Denver?

Yes, in Denver, there is an age requirement for certain types of homestead exemptions. Homeowners who are 65 years of age or older may qualify for additional exemptions, which can further reduce their property tax liabilities and help support senior citizens.

-

Can I still benefit from the homestead exemption in Denver if I have a mortgage?

Yes, you can still benefit from the homestead exemption in Denver even if you have a mortgage. The exemption is designed to assist all homeowners, regardless of their mortgage status, making it important for all Denver residents to explore their eligibility.

-

How does the homestead exemption affect my home value in Denver?

The homestead exemption itself does not directly affect your home's market value in Denver; however, it reduces the taxable value of your property, which can lead to lower property taxes that homeowners need to pay annually. This financial aspect can influence your overall budgeting and homeownership experience.

-

What documents are required for the homestead exemption in Denver?

To qualify for the homestead exemption in Denver, you typically need to provide proof of ownership, such as your deed, and documentation to verify your primary residence. Other documents may include a driver's license and evidence of occupancy to support your application.

Get more for Denver Homestead Exemption

- Ma termination form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497309732 form

- Ma lease tenant form

- Massachusetts provisions form

- Ma provisions form

- Business credit application massachusetts form

- Individual credit application massachusetts form

- Interrogatories to plaintiff for motor vehicle occurrence massachusetts form

Find out other Denver Homestead Exemption

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile