What is Payment Type in Vat 317 Form

What is the What Is Payment Type In Vat 317 Form

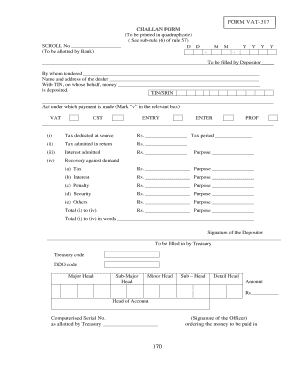

The What Is Payment Type In Vat 317 Form is a specific document used in the context of value-added tax (VAT) in the United States. This form helps businesses report and categorize the payment types they utilize for tax purposes. Understanding the details of this form is essential for accurate tax reporting and compliance with federal regulations. The form requires businesses to specify the payment methods used for transactions, which can include cash, credit, debit, or electronic payments. Properly completing this form ensures that businesses maintain transparency and adhere to tax obligations.

Steps to complete the What Is Payment Type In Vat 317 Form

Completing the What Is Payment Type In Vat 317 Form involves several clear steps to ensure accuracy and compliance. First, gather all relevant financial records that detail your transactions for the reporting period. Next, identify the different payment types used during these transactions. The form will require you to categorize these payments accurately. After filling in the necessary information, review the form for any errors or omissions. Finally, submit the completed form according to the specified guidelines, ensuring that you keep a copy for your records.

Legal use of the What Is Payment Type In Vat 317 Form

The legal use of the What Is Payment Type In Vat 317 Form is crucial for businesses to avoid penalties and ensure compliance with tax laws. This form serves as an official record of payment types used in transactions, which can be audited by tax authorities. To be considered legally binding, the form must be filled out accurately and submitted within the required deadlines. Additionally, businesses must retain copies of the form and any supporting documentation to substantiate their claims in case of an audit.

Examples of using the What Is Payment Type In Vat 317 Form

Examples of using the What Is Payment Type In Vat 317 Form include various scenarios where businesses report their payment types for tax purposes. For instance, a retail store may use this form to report payments received through cash, credit cards, and mobile payment applications. Similarly, a service provider may categorize payments from clients, including checks and electronic transfers. These examples illustrate how different industries utilize the form to ensure accurate reporting and compliance with VAT regulations.

Filing Deadlines / Important Dates

Filing deadlines for the What Is Payment Type In Vat 317 Form are critical for businesses to remain compliant with tax regulations. Typically, the form must be submitted by a specific date following the end of the reporting period. It is essential for businesses to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar with important dates related to VAT filing can help ensure timely submission and maintain good standing with tax authorities.

Who Issues the Form

The What Is Payment Type In Vat 317 Form is issued by the relevant tax authority responsible for VAT collection in the United States. This may vary by state, as some states have their own VAT regulations and forms. Businesses should check with their state tax agency to obtain the correct version of the form and understand any specific requirements associated with its completion and submission.

Quick guide on how to complete what is payment type in vat 317 form

Easily Prepare What Is Payment Type In Vat 317 Form on Any Device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage What Is Payment Type In Vat 317 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign What Is Payment Type In Vat 317 Form Effortlessly

- Find What Is Payment Type In Vat 317 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign What Is Payment Type In Vat 317 Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is payment type in vat 317 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Is Payment Type In Vat 317 Form?

The Payment Type in VAT 317 Form refers to the specific classification of payments that influence VAT calculations. Understanding this aspect is crucial for businesses to ensure compliance and accurate reporting. By correctly identifying the Payment Type, you can avoid errors in your tax submissions.

-

How does airSlate SignNow help with filling VAT 317 Form?

airSlate SignNow offers a streamlined process for completing the VAT 317 Form, ensuring that all necessary fields, including Payment Type, are properly filled out. Our solution simplifies document handling, allowing businesses to focus on compliance rather than paperwork. This feature signNowly reduces the risk of errors in your submissions.

-

Is airSlate SignNow affordable for small businesses managing VAT forms?

Yes, airSlate SignNow is a cost-effective solution designed specifically for businesses of all sizes, including small enterprises. Our pricing structures are flexible and can cater to different needs, ensuring you get the best value while managing documents like the VAT 317 Form. With signNow savings on printing and mailing, it’s a wise investment for efficient operations.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and financial management software to streamline your processes. This integration ensures that the information related to the VAT 317 Form, including the Payment Type, is synchronized across platforms, enhancing accuracy and efficiency.

-

What features does airSlate SignNow offer for VAT management?

Our platform includes features like electronic signatures, document tracking, and customizable templates, all tailored to facilitate the management of VAT documents. With airSlate SignNow, users can easily fill out the VAT 317 Form, ensuring that all aspects, including Payment Type, are accurately represented. These features simplify the overall management of VAT compliance.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We adhere to industry standards and best practices to safeguard your information, especially regarding sensitive documents like the VAT 317 Form. With encryption and secure access, you can confidently manage all details, including the Payment Type, without compromising your data's integrity.

-

Can airSlate SignNow assist with electronic submissions of VAT forms?

Yes, airSlate SignNow supports electronic submissions of VAT forms, allowing for faster and more efficient filing. This capability means you can quickly complete and submit your VAT 317 Form online, minimizing delays. Our solution ensures that all information, including Payment Type, is properly captured and submitted.

Get more for What Is Payment Type In Vat 317 Form

- Ma quitclaim 497309999 form

- Massachusetts quitclaim deed 497310000 form

- Legal last will and testament form for single person with no children massachusetts

- Legal last will and testament form for a single person with minor children massachusetts

- Legal last will and testament form for single person with adult and minor children massachusetts

- Legal last will and testament form for single person with adult children massachusetts

- Legal last will and testament for married person with minor children from prior marriage massachusetts form

- Legal last will and testament for civil union partner with minor children from prior marriage massachusetts form

Find out other What Is Payment Type In Vat 317 Form

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA