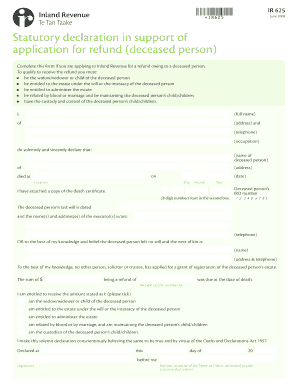

Ir625 Form

What is the IR625?

The IR625 form is a document used for specific tax-related purposes, primarily within the United States. It serves as a means for taxpayers to report certain financial information to the Internal Revenue Service (IRS). Understanding the IR625 is essential for individuals and businesses to ensure compliance with tax regulations. This form is particularly relevant for those who need to disclose specific income or deductions that may not be covered by standard tax forms.

How to use the IR625

Using the IR625 form involves several critical steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the information required on the form. This may include income statements, receipts for deductions, and any relevant tax documents. Next, carefully fill out the form, making sure to provide accurate and complete information. After completing the form, review it for any errors or omissions before submitting it to the IRS. It is advisable to keep a copy of the completed form for your records.

Steps to complete the IR625

Completing the IR625 form involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Gather necessary documentation, including income statements and deduction receipts.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or missing details.

- Sign and date the form where required.

- Submit the form to the IRS through the appropriate method, such as online, by mail, or in person.

Legal use of the IR625

The legal use of the IR625 form is governed by IRS regulations, which outline the requirements for its completion and submission. To be considered legally valid, the form must be filled out correctly and submitted within the designated deadlines. Additionally, using a reliable eSignature solution can enhance the legal standing of the document, ensuring that it meets the necessary electronic signature regulations. Compliance with these legal standards is crucial for avoiding potential penalties or issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IR625 form are critical to ensure timely compliance with tax regulations. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special provisions for certain taxpayers. It is essential to stay informed about any changes in deadlines to avoid late filing penalties.

Required Documents

When completing the IR625 form, several documents are typically required to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductions claimed.

- Previous tax returns for reference.

- Any additional documentation specific to the information being reported.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete ir625

Effortlessly manage Ir625 on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Ir625 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Ir625 seamlessly

- Locate Ir625 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, either via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ir625 to ensure top-notch communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ir625

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ir625 and how can it benefit my business?

The ir625 is a part of airSlate SignNow's suite of features designed to streamline document signing. By using ir625, businesses can enhance their workflow efficiency and reduce turnaround times for important documents. This solution ensures that your documents are signed securely and are legally binding, giving your business a reliable way to manage electronic signatures.

-

How does pricing for ir625 work?

airSlate SignNow offers competitive pricing plans that include access to ir625 functionalities. Depending on your business needs, you can choose from various subscription options that fit your budget. Each plan includes the core features of ir625, making it an economical choice for businesses looking to optimize their document signing process.

-

What features are included with ir625?

The ir625 encompasses several key features, including customizable templates, real-time tracking, and secure storage for signed documents. These features allow businesses to manage their documents efficiently from initiation to completion. With ir625, you can also easily integrate your existing workflows, making the transition seamless.

-

Can I integrate ir625 with other tools my business uses?

Yes, ir625 is designed to integrate smoothly with various business tools such as CRMs and project management software. This integration allows for automated workflows and enhanced productivity, ensuring that your document signing process is consistent across all platforms. By leveraging these integrations, you can utilize ir625 to its fullest potential.

-

Is ir625 secure and compliant with industry standards?

Absolutely, ir625 prioritizes security and compliance to protect your sensitive information. The solution complies with major regulations such as GDPR and eIDAS, ensuring that your electronic signatures are both secure and legally valid. You can trust airSlate SignNow and ir625 to safeguard your business's data during the signing process.

-

How can ir625 improve document turnaround times?

By implementing ir625 from airSlate SignNow, document turnaround times are signNowly reduced. The automated reminders and notifications keep the signing process moving swiftly, decreasing delays often associated with traditional signing methods. Your team can focus on core tasks while ir625 handles the paperwork efficiently.

-

What customer support options are available for users of ir625?

Users of ir625 have access to various customer support options, including live chat, email support, and an extensive knowledge base. Our support team is dedicated to assisting you with any questions or challenges you might encounter. This ensures that you can make the most out of ir625 and keep your operations running smoothly.

Get more for Ir625

- What adaptive technologies might disabled people use with a computer form

- The new car assessment program suggested approaches for form

- Certificate of residence schenectady county 521146745 form

- Green xxx vdeo form

- M 40 2 requerimento de carto profissional psp form

- Ship management agreement template 787747507 form

- Shipper carrier agreement template form

- Shipper broker agreement template form

Find out other Ir625

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy