ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue Form

What is the ST 28F Agricultural Exemption Certificate Rev 8 14?

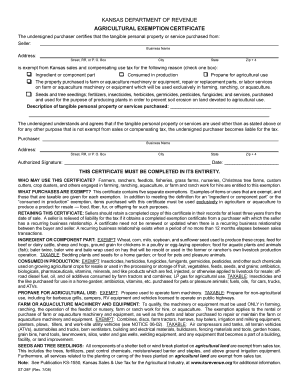

The ST 28F Agricultural Exemption Certificate Rev 8 14 is a specific form used in the United States for agricultural exemptions. This certificate allows eligible farmers and agricultural producers to purchase certain items without paying sales tax. The form is designed to facilitate the exemption process by providing a clear declaration of the buyer's eligibility based on their agricultural activities. Understanding this form is essential for those who wish to benefit from tax exemptions related to their farming operations.

How to use the ST 28F Agricultural Exemption Certificate Rev 8 14

Using the ST 28F Agricultural Exemption Certificate Rev 8 14 involves a straightforward process. First, ensure that you meet the eligibility criteria for agricultural exemptions. Next, complete the form accurately, providing all required information, such as your name, address, and details about the agricultural items being purchased. Once filled out, present the certificate to the seller at the time of purchase. This form serves as proof of your exemption status, allowing you to buy eligible items without incurring sales tax.

Steps to complete the ST 28F Agricultural Exemption Certificate Rev 8 14

Completing the ST 28F Agricultural Exemption Certificate Rev 8 14 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business details and the specific items you intend to purchase.

- Fill out the form, ensuring all fields are completed accurately.

- Sign and date the certificate to validate your claim for exemption.

- Provide the completed form to the seller when making your purchase.

By following these steps, you can ensure that your exemption claim is processed smoothly.

Legal use of the ST 28F Agricultural Exemption Certificate Rev 8 14

The legal use of the ST 28F Agricultural Exemption Certificate Rev 8 14 is governed by state laws regarding agricultural exemptions. It is important to use the form only for eligible purchases related to your agricultural activities. Misuse of the certificate, such as using it for non-qualifying items or by ineligible individuals, can result in penalties. Therefore, it is crucial to understand the legal implications and ensure compliance with all applicable regulations when utilizing this form.

Eligibility Criteria for the ST 28F Agricultural Exemption Certificate Rev 8 14

To qualify for the ST 28F Agricultural Exemption Certificate Rev 8 14, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being an active farmer or agricultural producer.

- Engaging in the production of agricultural products for sale.

- Purchasing items that are directly used in agricultural production.

It is essential to review these criteria carefully to ensure that you qualify before applying for the exemption.

How to obtain the ST 28F Agricultural Exemption Certificate Rev 8 14

Obtaining the ST 28F Agricultural Exemption Certificate Rev 8 14 is a straightforward process. You can typically access the form through your state’s revenue department website or by contacting their office directly. Ensure you have all necessary documentation to support your eligibility when requesting the form. Once you have the form, complete it as instructed and keep a copy for your records.

Quick guide on how to complete st 28f agricultural exemption certificate rev 8 14 exemption certificate ksrevenue

Effortlessly Prepare ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue on Any Device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to Modify and eSign ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue with Ease

- Locate ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 28f agricultural exemption certificate rev 8 14 exemption certificate ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 28f feature in airSlate SignNow?

The st 28f feature in airSlate SignNow allows users to manage document signing processes efficiently. This feature ensures a seamless experience for eSigning while maintaining security and compliance. By utilizing st 28f, businesses can streamline their document workflows.

-

How much does airSlate SignNow with st 28f cost?

Pricing for airSlate SignNow with the st 28f feature varies depending on the plan selected. Generally, the platform offers flexible pricing options tailored for businesses of all sizes. To get a detailed quote, visit our pricing page or contact our sales team.

-

What are the key benefits of using st 28f in airSlate SignNow?

Using st 28f in airSlate SignNow provides users with a range of benefits including improved efficiency and reduced turnaround time for document signing. It also enhances collaboration among team members by offering a centralized platform for document management. Additionally, st 28f ensures compliance with relevant regulations.

-

Can I integrate st 28f with other tools or software?

Yes, st 28f in airSlate SignNow can be integrated with various third-party applications. This includes CRM systems, cloud storage services, and other productivity tools to enhance your document management workflow. These integrations help streamline processes and improve overall efficiency.

-

Is airSlate SignNow with st 28f user-friendly?

Absolutely! airSlate SignNow designed with user experience in mind, making the st 28f feature easy to navigate for all users. Whether you're tech-savvy or a beginner, the intuitive interface simplifies the process of sending and signing documents.

-

What types of documents can I eSign using st 28f?

With st 28f in airSlate SignNow, you can eSign a wide variety of documents including contracts, agreements, and forms. This feature supports multiple document types, ensuring that you can manage all your signing needs in one place. It provides flexibility to handle different formats securely.

-

Is there a free trial available for airSlate SignNow with st 28f?

Yes, airSlate SignNow offers a free trial for users interested in the st 28f feature. This trial allows prospective customers to explore the application's functionalities without any financial commitment. Sign up today to experience the benefits of st 28f firsthand.

Get more for ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue

Find out other ST 28F Agricultural Exemption Certificate Rev, 8 14 Exemption Certificate Ksrevenue

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online