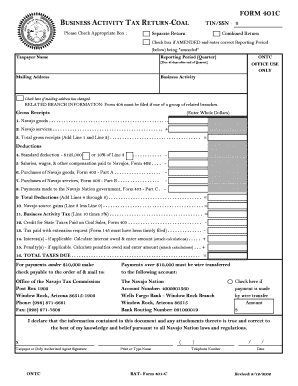

401c Form

What is the 401c

The 401c form is a specific tax document used by businesses and individuals to report various financial information related to retirement plans. This form is crucial for ensuring compliance with IRS regulations and for maintaining the tax-advantaged status of retirement accounts. Understanding the 401c form is essential for anyone involved in managing retirement plans, as it outlines contributions, distributions, and other pertinent financial activities that affect tax liabilities.

How to use the 401c

Using the 401c form involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial information related to your retirement plan, including contributions made during the tax year, distributions taken, and any applicable fees. Next, complete the form by entering the required data in the designated fields. It is important to double-check all entries for accuracy to avoid potential penalties. Once completed, the form should be submitted to the IRS by the specified deadline to ensure compliance with tax regulations.

Steps to complete the 401c

Completing the 401c form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including contribution records and distribution statements.

- Fill out the form by entering your business or personal information in the appropriate sections.

- Report contributions made to the retirement plan, including both employee and employer contributions.

- Document any distributions taken from the plan, ensuring to include the amounts and dates.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the deadline.

Legal use of the 401c

The legal use of the 401c form is governed by IRS regulations, which mandate accurate reporting of retirement plan activities. This form must be completed in accordance with the guidelines set forth by the IRS to ensure that the retirement plan maintains its tax-advantaged status. Failure to comply with these regulations can result in penalties, including taxes on contributions and distributions that are not properly reported. Therefore, it is essential to understand the legal implications of the 401c form and to use it correctly.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 401c form. These guidelines outline the required information, filing deadlines, and compliance standards necessary for maintaining the integrity of retirement plans. It is crucial for filers to familiarize themselves with these guidelines to avoid errors that could lead to penalties. The IRS also updates these guidelines periodically, so staying informed about any changes is important for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 401c form are critical for compliance with IRS regulations. Typically, the form must be submitted by the end of the tax year, which is December thirty-first for most taxpayers. However, extensions may be available under certain circumstances. It is essential to mark your calendar with these important dates to ensure timely submission and avoid any potential penalties associated with late filings.

Quick guide on how to complete 401c

Complete 401c effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 401c on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign 401c smoothly

- Obtain 401c and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet signature.

- Verify the information and click on the Done button to save your alterations.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign 401c and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 401c form?

The 401c form is a key document often used by businesses to outline employee contributions to specific retirement plans. Understanding its structure and purpose can help you navigate benefits for your workforce more effectively. Leveraging a platform like airSlate SignNow allows you to manage 401c forms electronically, streamlining the process.

-

How does airSlate SignNow simplify signing a 401c form?

AirSlate SignNow offers an intuitive eSigning solution that enables users to complete their 401c form quickly and securely. You can send the form to multiple parties, track their progress, and ensure that signatures are gathered in a timely manner. This efficiency minimizes delays and enhances the overall user experience.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers a range of pricing plans to accommodate different business needs, ensuring that managing your 401c form is both affordable and accessible. Pricing varies based on features and user requirements, making it scalable for both small businesses and larger enterprises. You can explore our website for detailed plan comparisons.

-

Can I integrate airSlate SignNow with my existing HR software for 401c forms?

Yes, airSlate SignNow integrates seamlessly with various HR software solutions, making it easy to incorporate the management of 401c forms into your existing workflow. This integration helps streamline document processes, ensuring that your HR team can handle employee benefits paperwork efficiently. Check our integrations page for specific compatibility.

-

What are the benefits of using airSlate SignNow for my 401c form?

Using airSlate SignNow to manage your 401c form enhances security, improves turnaround times, and simplifies the signing process for all parties involved. The platform also provides tracking features that keep you updated on the document's status. Overall, this fosters better compliance and improves employee satisfaction.

-

Is it secure to eSign my 401c form through airSlate SignNow?

Absolutely! AirSlate SignNow employs state-of-the-art security measures to protect your documents, including the 401c form, ensuring that sensitive information remains confidential. With robust encryption and authentication methods, your data integrity is defended against unauthorized access, making eSigning a safe option.

-

How can I track the status of my 401c form in airSlate SignNow?

AirSlate SignNow provides real-time tracking capabilities for your 401c form, allowing you to monitor who has signed and who still needs to complete the process. You will receive notifications regarding the progress, enabling you to follow up promptly. This feature helps ensure that everyone's on the same page, streamlining document workflows.

Get more for 401c

Find out other 401c

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed