Declaration for Non Deduction of Tax at Source to Be Dtrj Form

What is the declaration for non-deduction of tax at source?

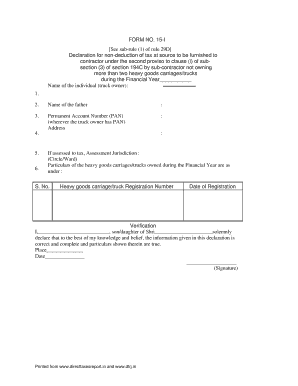

The declaration for non-deduction of tax at source is a formal document that allows taxpayers to request that no tax be withheld from their payments under specific circumstances. This form is particularly relevant for individuals and entities that qualify for exemptions under Section 194C of the Internal Revenue Code. By submitting this declaration, taxpayers can ensure that their income is received in full, without any deductions at the source, which can be beneficial for cash flow and financial planning.

Steps to complete the declaration for non-deduction of tax at source

Completing the declaration for non-deduction of tax at source involves several key steps:

- Gather necessary information: Collect all relevant details, including personal identification, tax identification number, and any supporting documents that justify the request for non-deduction.

- Fill out the form: Accurately complete the declaration form, ensuring that all fields are filled in correctly. This includes providing details about the nature of payments and the reason for requesting non-deduction.

- Review the form: Double-check all entries for accuracy and completeness to avoid any potential issues during processing.

- Submit the form: Depending on the requirements, submit the completed declaration form electronically or via mail to the appropriate tax authority.

Legal use of the declaration for non-deduction of tax at source

The legal validity of the declaration for non-deduction of tax at source hinges on compliance with relevant tax laws and regulations. To be considered legally binding, the declaration must be completed accurately and submitted in accordance with IRS guidelines. It is essential to keep records of the submitted declaration and any correspondence with tax authorities to ensure that the taxpayer can provide evidence of compliance if required.

Key elements of the declaration for non-deduction of tax at source

Several key elements must be included in the declaration for non-deduction of tax at source to ensure its effectiveness:

- Taxpayer information: Full name, address, and tax identification number of the taxpayer.

- Details of payments: A clear description of the payments for which non-deduction is requested.

- Reason for non-deduction: A valid explanation or justification for why tax should not be withheld.

- Signature: The taxpayer's signature, affirming the accuracy of the information provided.

Examples of using the declaration for non-deduction of tax at source

There are various scenarios where the declaration for non-deduction of tax at source can be utilized:

- Contractors and freelancers: Independent contractors may use this declaration to ensure that payments received for their services are not subject to withholding tax.

- Small businesses: Small business owners may file this declaration to avoid unnecessary tax deductions on payments received from clients.

- Individuals with tax exemptions: Taxpayers who qualify for specific exemptions under the tax code can submit this declaration to maintain their full income without deductions.

Filing deadlines for the declaration for non-deduction of tax at source

Filing deadlines for the declaration for non-deduction of tax at source vary depending on the specific tax year and the nature of the payments. It is crucial for taxpayers to be aware of these deadlines to ensure timely submission. Generally, the declaration should be submitted before the payment date to avoid any withholding. Staying informed about the IRS calendar and any changes in tax regulations can help ensure compliance.

Quick guide on how to complete declaration for non deduction of tax at source to be dtrj

Complete Declaration For Non deduction Of Tax At Source To Be Dtrj effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Declaration For Non deduction Of Tax At Source To Be Dtrj on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Declaration For Non deduction Of Tax At Source To Be Dtrj with ease

- Obtain Declaration For Non deduction Of Tax At Source To Be Dtrj and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Declaration For Non deduction Of Tax At Source To Be Dtrj and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration for non deduction of tax at source to be dtrj

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the declaration under section 194c 6 for non deduction of tax at source?

The declaration under section 194c 6 for non deduction of tax at source is a formal statement provided by contractors or service providers to establish that their payments are exempt from tax deduction. This declaration facilitates the smooth processing of payments without tax deductions, given specific conditions are met. Utilizing airSlate SignNow for eSigning these declarations ensures that your documents are legally binding and processed efficiently.

-

How can airSlate SignNow help in managing declarations under section 194c 6?

airSlate SignNow streamlines the process of creating, sending, and eSigning declarations under section 194c 6 for non deduction of tax at source. With our user-friendly platform, you can customize templates, send documents for signatures, and securely store signed files. This simplifies record-keeping and ensures compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers to accommodate businesses of all sizes. Each plan includes features that cater to eSigning documents, including those related to the declaration under section 194c 6 for non deduction of tax at source. You can choose a plan that best fits your organization’s needs and budget, ensuring cost-effective document management.

-

Can I integrate airSlate SignNow with other software for handling tax documents?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications that can help in managing tax-related documents, including those involving the declaration under section 194c 6 for non deduction of tax at source. These integrations allow for smoother workflows, enabling you to access all your documents and data from one central location.

-

What features distinguish airSlate SignNow from other eSigning solutions?

airSlate SignNow stands out with its intuitive user interface, robust security measures, and the ability to handle complex documents like the declaration under section 194c 6 for non deduction of tax at source. Additional features such as customizable templates, automated workflows, and real-time notifications empower users to manage their document signing processes efficiently and securely.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to support businesses of all sizes, from small enterprises to large corporations. Regardless of your business scale, you can effectively manage documents, including those pertaining to the declaration under section 194c 6 for non deduction of tax at source. The platform scales with your needs, providing flexibility as your business grows.

-

How secure is the airSlate SignNow platform for sensitive documents?

Security is a top priority at airSlate SignNow. We utilize encryption protocols and comply with industry standards to ensure that your documents, including the declaration under section 194c 6 for non deduction of tax at source, are kept safe throughout the signing process. Our platform provides audit trails and secure storage to give you peace of mind.

Get more for Declaration For Non deduction Of Tax At Source To Be Dtrj

Find out other Declaration For Non deduction Of Tax At Source To Be Dtrj

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors