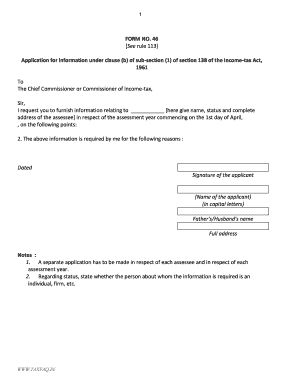

Form 46 Income Tax

What is the Form 46 Income Tax

The Form 46 income tax is a document used by taxpayers in the United States to report specific income details to the Internal Revenue Service (IRS). This form is essential for individuals who need to disclose certain types of income that may not be reported on standard tax forms. It helps ensure compliance with tax regulations and provides the IRS with necessary information for accurate tax assessment.

How to use the Form 46 Income Tax

Using the Form 46 income tax involves several steps to ensure accurate reporting. Taxpayers must gather all relevant income information, including wages, dividends, and other sources of income. Once the form is obtained, individuals need to fill it out with precise details. After completing the form, it should be submitted to the IRS along with any other required tax documents. Proper use of this form can help prevent issues with tax compliance and potential penalties.

Steps to complete the Form 46 Income Tax

Completing the Form 46 income tax involves a systematic approach:

- Gather all necessary income documentation, including W-2s and 1099s.

- Obtain the latest version of the Form 46 income tax from the IRS website or authorized sources.

- Fill in personal information, including name, address, and Social Security number.

- Report all applicable income sources on the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following IRS guidelines.

Legal use of the Form 46 Income Tax

The legal use of the Form 46 income tax is governed by IRS regulations. It must be filled out truthfully and accurately to comply with federal tax laws. Misrepresentation or failure to file this form when required can lead to penalties, including fines and interest on unpaid taxes. Ensuring that the form is completed correctly and submitted on time is crucial for maintaining legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 46 income tax are typically aligned with the general tax filing deadlines set by the IRS. Taxpayers should be aware of the annual deadline, which is usually April 15, unless it falls on a weekend or holiday. Extensions may be available, but they must be requested in advance. Staying informed about these important dates helps ensure timely submission and compliance.

Required Documents

To complete the Form 46 income tax, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Records of any additional income sources.

- Previous year’s tax return for reference.

Having these documents ready can streamline the completion process and help ensure accuracy in reporting.

Quick guide on how to complete form 46 income tax

Prepare Form 46 Income Tax effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate template and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 46 Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Form 46 Income Tax with ease

- Find Form 46 Income Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method of sending your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 46 Income Tax to ensure seamless communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 46 income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 46 of income tax?

Form 46 of income tax is a declaration that is used to request information regarding tax deductions related to salary or income. It helps taxpayers understand their tax liability and ensures that the correct amount of tax is withheld by their employer.

-

How does airSlate SignNow help with Form 46 of income tax?

airSlate SignNow enables businesses to efficiently send and eSign Form 46 of income tax documents. This streamlines the process of submitting required tax forms securely, making it easier for both employers and employees to manage their tax documentation.

-

Is there a cost associated with using airSlate SignNow for Form 46 of income tax?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides features that assist in managing Form 46 of income tax efficiently, offering great value for the ease of document management.

-

Can I integrate airSlate SignNow with other tools for managing Form 46 of income tax?

Absolutely! airSlate SignNow offers seamless integrations with popular tools and applications, enabling users to manage Form 46 of income tax along with other financial documents. This interoperability enhances productivity and ensures a smooth workflow.

-

What features does airSlate SignNow offer for eSigning Form 46 of income tax?

airSlate SignNow provides a user-friendly platform for eSigning Form 46 of income tax, including templates, tracking, and audit trails. These features ensure that the signing process is both secure and compliant with legal standards.

-

How can airSlate SignNow benefit businesses dealing with Form 46 of income tax?

Using airSlate SignNow helps businesses streamline their tax documentation processes for Form 46 of income tax, reducing time spent on paperwork. It enhances efficiency, lowers the chance of errors, and improves overall compliance with tax regulations.

-

Is customer support available for queries related to Form 46 of income tax?

Yes, airSlate SignNow offers extensive customer support to assist users with any queries related to Form 46 of income tax. Whether you need help with setting up a document or understanding the eSigning process, assistance is readily available.

Get more for Form 46 Income Tax

- Quitclaim deed from corporation to individual new york form

- New york warranty form

- Quitclaim deed from corporation to llc new york form

- Ny corrective deed form

- Quitclaim deed from corporation to corporation new york form

- Warranty deed from corporation to corporation new york form

- Quitclaim deed from corporation to two individuals new york form

- Warranty deed from corporation to two individuals new york form

Find out other Form 46 Income Tax

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement