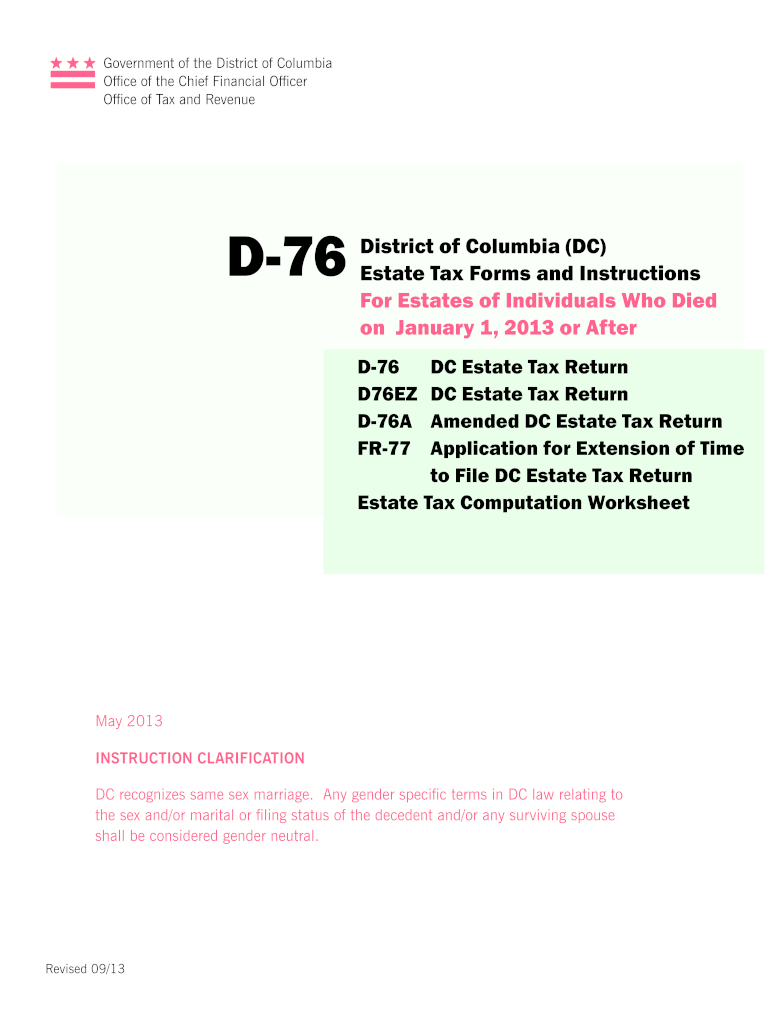

Dc Estate Tax Return Form

What is the DC Estate Tax Return

The DC estate tax return is a legal document required by the District of Columbia for reporting the value of a deceased person's estate. This form is essential for determining the estate tax liability, which is based on the total value of the estate at the time of death. Estates exceeding a certain threshold are subject to taxation, and the return must be filed within a specified timeframe following the individual's passing. Understanding the nuances of this form is crucial for executors and beneficiaries to ensure compliance with local tax laws.

Steps to Complete the DC Estate Tax Return

Completing the DC estate tax return involves several important steps:

- Gather all necessary documentation, including the deceased's will, financial statements, and property appraisals.

- Determine the total value of the estate by assessing all assets, including real estate, bank accounts, and personal property.

- Complete the estate tax return form, ensuring all information is accurate and comprehensive.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the deadline, either electronically or via mail, depending on the chosen submission method.

Required Documents

To successfully file the DC estate tax return, certain documents are necessary:

- The deceased's will or trust documents.

- Death certificate to verify the date of death.

- Financial statements, including bank statements and investment account summaries.

- Property appraisals for real estate and significant personal property.

- Any prior tax returns that may impact the estate's tax liability.

Legal Use of the DC Estate Tax Return

The DC estate tax return serves a legal purpose in the estate settlement process. It is used to report the estate's value to the DC Office of Tax and Revenue, ensuring that the correct amount of estate tax is calculated and paid. Filing this return is a legal obligation for the executor of the estate, and failure to do so can result in penalties or legal complications. It is important for executors to understand their responsibilities and the legal implications of the information provided in the return.

Filing Deadlines / Important Dates

Timely filing of the DC estate tax return is crucial. The return must be filed within nine months of the date of death, although an extension may be requested if necessary. It is important to be aware of these deadlines to avoid late fees and penalties. Executors should also keep track of any additional deadlines related to the payment of taxes owed, as these can vary based on the estate's unique circumstances.

Digital vs. Paper Version

When filing the DC estate tax return, individuals have the option to submit the form digitally or via paper. The digital version offers advantages such as faster processing times and the ability to easily track the submission status. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the chosen method, ensuring that the form is completed accurately is essential for compliance.

Quick guide on how to complete dc estate tax return

Effortlessly Prepare Dc Estate Tax Return on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed forms, allowing you to find the right document and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without hold-ups. Handle Dc Estate Tax Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to Edit and Electronically Sign Dc Estate Tax Return with Ease

- Find Dc Estate Tax Return and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign Dc Estate Tax Return while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc estate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DC estate tax return?

A DC estate tax return is a legal document required to report the estate of a deceased individual to the District of Columbia's tax authority. It outlines the assets, liabilities, and any applicable deductions to determine if taxes are owed. Completing a DC estate tax return accurately is essential to ensure compliance with local laws.

-

Who is required to file a DC estate tax return?

In Washington D.C., any estate valued above the exemption limit must file a DC estate tax return. This includes assessing all assets located within the district. If you're unsure, consulting a tax professional can help clarify your obligations regarding the DC estate tax return.

-

What documents do I need to prepare a DC estate tax return?

To prepare a DC estate tax return, you will need documents such as the decedent's will, financial statements, property deeds, and records of any debts. Gathering these important documents beforehand will help streamline the process. Ensuring you have all necessary materials is crucial for an accurate and timely DC estate tax return.

-

How can airSlate SignNow assist with filing a DC estate tax return?

airSlate SignNow simplifies the process of filing a DC estate tax return by providing a user-friendly platform for e-signing necessary documents. You can securely collect signatures from all relevant parties, ensuring compliance while saving time. Our solution makes managing the paperwork for a DC estate tax return straightforward and efficient.

-

Is there a cost associated with using airSlate SignNow for my DC estate tax return?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. The cost varies based on your chosen plan, but it is generally a cost-effective solution compared to traditional methods. Investing in airSlate SignNow can help streamline your DC estate tax return process and save you valuable time.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow provides numerous benefits, including the ability to eSign documents quickly and securely. This feature ensures that your DC estate tax return can be completed promptly without the hassle of printing or mailing paper forms. Additionally, our platform offers tracking and management tools to help you stay organized.

-

Can I integrate airSlate SignNow with other software for my DC estate tax return?

Yes, airSlate SignNow provides integration capabilities with various software applications. This allows for seamless workflows between your document management systems and simplifies the filing of your DC estate tax return. Integrating these tools enhances your operational efficiency and promotes a smoother document process.

Get more for Dc Estate Tax Return

- Ri 30 day form

- Rhode island lease form

- Ri 20 day form

- 20 day notice to remedy reoccurring breach or lease terminates for residential property rhode island form

- Assignment of mortgage by individual mortgage holder rhode island form

- Assignment of mortgage by corporate mortgage holder rhode island form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property rhode island form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497325160 form

Find out other Dc Estate Tax Return

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form