Form 21cc Kerala Vat

What is the Form 21cc Kerala Vat

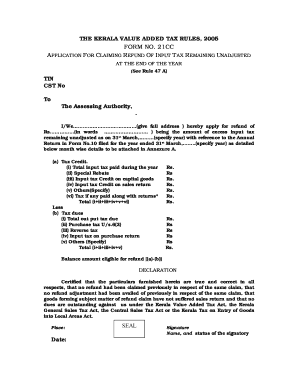

The Form 21cc Kerala VAT is a crucial document used for the Value Added Tax (VAT) in the state of Kerala, India. This form is essential for businesses that are registered under the Kerala VAT Act, enabling them to report their VAT transactions accurately. The form captures details such as sales, purchases, and tax collected, ensuring compliance with state tax regulations. It is important for businesses to understand the purpose and requirements of this form to avoid penalties and ensure smooth operations.

How to use the Form 21cc Kerala Vat

Using the Form 21cc Kerala VAT involves several steps to ensure accurate reporting and compliance. First, businesses must gather all relevant financial data, including sales and purchase invoices. Next, the form should be filled out with precise details, including the total sales, total purchases, and the amount of VAT collected. Once completed, the form must be submitted to the appropriate tax authority. It is advisable to keep copies of the submitted form and supporting documents for future reference and audits.

Steps to complete the Form 21cc Kerala Vat

Completing the Form 21cc Kerala VAT requires attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including invoices and receipts.

- Fill in the business details, such as name, address, and VAT registration number.

- Enter total sales and purchases for the reporting period.

- Calculate the VAT collected and payable.

- Review the form for accuracy before submission.

- Submit the completed form to the relevant tax authority, either online or in person.

Legal use of the Form 21cc Kerala Vat

The legal use of the Form 21cc Kerala VAT is governed by the Kerala VAT Act, which outlines the obligations of registered businesses. To ensure the form is legally binding, it must be filled out accurately and submitted within the stipulated deadlines. Non-compliance can lead to penalties, including fines or legal action. Therefore, it is essential for businesses to understand their legal responsibilities regarding VAT reporting and to use the form correctly.

Key elements of the Form 21cc Kerala Vat

The Form 21cc Kerala VAT includes several key elements that are critical for accurate reporting. These elements typically encompass:

- Business identification details, including the name and VAT registration number.

- Details of total sales and purchases during the reporting period.

- Calculation of VAT collected and payable.

- Signature of the authorized signatory, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 21cc Kerala VAT are crucial for compliance. Businesses must be aware of the specific dates for submission to avoid penalties. Typically, the form must be filed on a monthly or quarterly basis, depending on the business's turnover. It is advisable to keep track of these dates and set reminders to ensure timely filing, as late submissions can result in fines or interest on unpaid taxes.

Quick guide on how to complete form 21cc kerala vat

Effortlessly Prepare Form 21cc Kerala Vat on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without any hold-ups. Handle Form 21cc Kerala Vat on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

How to Modify and eSign Form 21cc Kerala Vat with Ease

- Locate Form 21cc Kerala Vat and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential details with the tools that airSlate SignNow specifically provides for this task.

- Create your eSignature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to confirm your modifications.

- Select your preferred method to send the form: via email, text message (SMS), invitation link, or download it to your computer.

Forget the hassle of lost or misplaced files, time-consuming form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 21cc Kerala Vat to ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 21cc kerala vat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT in Kerala and how does it affect my business?

VAT, or Value Added Tax, in Kerala is a consumption tax applied to the sale of goods and services. It affects businesses as it requires compliance with state tax regulations. Understanding VAT Kerala is crucial for financial planning and ensuring that your business remains compliant.

-

How can airSlate SignNow help with VAT compliance in Kerala?

airSlate SignNow offers an easy-to-use platform for eSigning and managing documents related to VAT compliance in Kerala. With automated workflows, you can ensure that all your VAT documents are properly signed and stored, making tax filing smoother and keeping your business compliant.

-

What are the pricing options for airSlate SignNow that cater to VAT regulations in Kerala?

airSlate SignNow offers flexible pricing plans that can be tailored to your business needs, including features for managing VAT documentation. Understanding your VAT Kerala obligations can help you choose a plan that optimally supports your business compliance needs.

-

What features of airSlate SignNow are beneficial for managing VAT-related documents in Kerala?

Key features of airSlate SignNow include cloud storage, automated reminders, and secure eSign workflows that simplify the management of VAT-related documents in Kerala. These tools enhance efficiency, reducing the time spent on document handling and ensuring compliance.

-

How does airSlate SignNow integrate with other tools for VAT management in Kerala?

airSlate SignNow seamlessly integrates with various accounting and business management tools that help with VAT management in Kerala. This integration allows you to streamline your document workflows and maintain accurate records for VAT purposes without any hassle.

-

Can airSlate SignNow assist in tracking VAT invoices for my Kerala business?

Yes, airSlate SignNow provides features that allow you to track VAT invoices efficiently for your Kerala business. With its document management capabilities, you can easily access and manage invoices, ensuring you meet all necessary VAT documentation requirements.

-

What are the benefits of using airSlate SignNow for VAT processes in Kerala?

The benefits of using airSlate SignNow for VAT processes in Kerala include increased efficiency in document handling, improved compliance through automated workflows, and secure storage of important VAT documentation. This tool is designed to save time and reduce errors in your VAT processes.

Get more for Form 21cc Kerala Vat

- South carolina limited liability company llc formation package south carolina

- Limited liability company llc operating agreement south carolina form

- Sc llc form

- Sc pllc form

- Renunciation and disclaimer of property received by intestate succession south carolina form

- Notice furnishing 497325540 form

- Quitclaim deed from individual to husband and wife south carolina form

- Warranty deed from individual to husband and wife south carolina form

Find out other Form 21cc Kerala Vat

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will