Iht409 Form

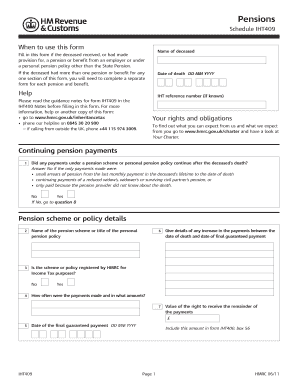

What is the IHT409?

The IHT409 form, also known as the Inheritance Tax Account for a Deceased Person, is a critical document used in the United States for reporting the estate of a deceased individual. This form is essential for calculating the inheritance tax owed to the government and ensuring compliance with legal requirements. It includes details about the deceased's assets, liabilities, and any exemptions that may apply. Understanding the IHT409 is vital for executors and administrators of estates to fulfill their responsibilities accurately and efficiently.

How to Use the IHT409

Using the IHT409 form involves several steps that ensure accurate reporting of the deceased's estate. First, gather all necessary information regarding the deceased's assets, including real estate, bank accounts, and personal property. Next, complete the form by providing details such as the value of each asset, any debts owed, and the total estate value. It is crucial to review the form for accuracy before submission, as errors can lead to delays or penalties. Once completed, the form must be submitted to the appropriate tax authority, along with any required supporting documents.

Steps to Complete the IHT409

Completing the IHT409 form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents related to the deceased's estate.

- List all assets, including real estate, investments, and personal belongings, along with their estimated values.

- Document any outstanding debts or liabilities that the deceased had at the time of death.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Fill out the IHT409 form accurately, ensuring all information is complete and correct.

- Review the form for any errors before submission.

- Submit the completed form along with any required documentation to the tax authority.

Legal Use of the IHT409

The IHT409 form is legally binding when completed and submitted according to the guidelines set forth by tax authorities. It serves as an official record of the estate's value and is necessary for calculating any inheritance tax owed. To ensure legal compliance, it is essential to adhere to all relevant laws and regulations regarding estate reporting. Failure to submit the form or inaccuracies in reporting can result in penalties or legal repercussions.

Required Documents for the IHT409

When completing the IHT409 form, several supporting documents may be required to substantiate the information provided. These documents typically include:

- Death certificate of the deceased.

- Documents proving ownership of assets, such as property deeds and bank statements.

- Records of any debts or liabilities, including loan agreements and credit statements.

- Any previous tax returns that may provide insight into the deceased's financial situation.

Form Submission Methods

The IHT409 form can be submitted through various methods, depending on the preferences of the executor or administrator. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete iht409

Easily prepare Iht409 on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers since you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents quickly without hold-ups. Manage Iht409 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Iht409 effortlessly

- Locate Iht409 and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and press the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Iht409 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht409

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht409 and how does it relate to airSlate SignNow?

The iht409 is a specific document requirement that businesses may need to address when managing eSignatures. With airSlate SignNow, you can easily create, send, and eSign iht409 documents, ensuring compliance and smooth workflow throughout the process.

-

How much does airSlate SignNow cost for handling iht409 documents?

Pricing for airSlate SignNow varies based on your needs and the features you choose. Our plans are designed to be cost-effective, providing you with all the necessary tools to manage iht409 documents without breaking your budget.

-

What features does airSlate SignNow offer for processing iht409 documents?

airSlate SignNow provides several features tailored for iht409 documents, including customizable templates, automated workflows, and secure cloud storage. These tools make it easy to send and receive eSignatures efficiently.

-

How does airSlate SignNow enhance the eSigning experience for iht409 documents?

With airSlate SignNow's intuitive interface, the eSigning process for iht409 documents is streamlined and user-friendly. Users can complete their transactions quickly, ensuring they can meet important deadlines with minimal hassle.

-

Can I integrate airSlate SignNow with other tools for managing iht409 documents?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Microsoft Office. This flexibility allows you to effectively manage iht409 documents alongside your existing tools.

-

Is airSlate SignNow compliant with regulations for iht409 eSignatures?

Absolutely, airSlate SignNow complies with various electronic signature regulations, ensuring that your iht409 documents are legally binding and secure. We provide a trustworthy solution that meets essential legal requirements.

-

What are the benefits of using airSlate SignNow for iht409 document management?

Using airSlate SignNow for iht409 document management delivers numerous benefits, including increased efficiency, reduced transaction times, and better document tracking. These advantages help businesses save time and enhance productivity.

Get more for Iht409

Find out other Iht409

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy