Tax Computation Worksheet Form

What is the Tax Computation Worksheet

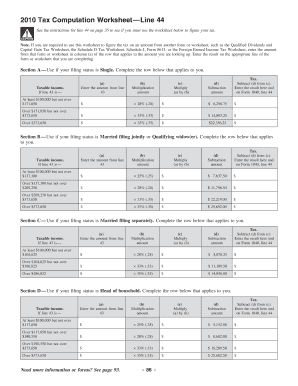

The tax computation worksheet is a vital document used by taxpayers to calculate their federal income tax liability. This worksheet provides a structured format for individuals to input their income, deductions, and credits, ultimately leading to a precise tax amount owed or refund expected. It typically aligns with the IRS Form 1040 and is essential for ensuring accurate tax reporting. Understanding its components is crucial for effective tax management.

How to use the Tax Computation Worksheet

Using the tax computation worksheet involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, follow the worksheet's prompts to enter your income figures accurately. After inputting your income, proceed to list any deductions and credits that apply to your situation. The worksheet will guide you through the calculations, helping you determine your tax liability or refund. It is important to double-check all entries to ensure accuracy.

Steps to complete the Tax Computation Worksheet

Completing the tax computation worksheet requires a systematic approach. Begin by filling in your personal information at the top of the worksheet. Then, proceed with the following steps:

- Enter your total income from all sources.

- List any adjustments to income, such as retirement contributions.

- Document your standard or itemized deductions.

- Calculate your taxable income by subtracting deductions from your total income.

- Apply the appropriate tax rates to determine your tax liability.

- Subtract any tax credits to find your final tax amount owed or refund due.

Following these steps ensures a thorough and accurate completion of the worksheet.

Legal use of the Tax Computation Worksheet

The tax computation worksheet is legally recognized as part of the tax filing process. Its proper completion is essential for compliance with IRS regulations. The worksheet serves as a supporting document that helps substantiate the figures reported on your tax return. To ensure legal validity, it is crucial to maintain accurate records and follow IRS guidelines while completing the worksheet.

IRS Guidelines

The IRS provides specific guidelines for using the tax computation worksheet effectively. Taxpayers should refer to the IRS instructions accompanying Form 1040 for detailed information on eligibility, required documentation, and filing procedures. These guidelines help ensure that taxpayers understand the requirements for completing the worksheet, including how to report income and claim deductions accurately. Staying informed about IRS updates is essential for compliance and accuracy.

Filing Deadlines / Important Dates

Filing deadlines are critical for taxpayers using the tax computation worksheet. Typically, the deadline for filing individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and ensure they file their returns on time to avoid penalties. Keeping track of these important dates is essential for effective tax planning.

Quick guide on how to complete tax computation worksheet

Execute Tax Computation Worksheet effortlessly on any device

Digital document management has become widely embraced by companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can locate the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Tax Computation Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Tax Computation Worksheet with ease

- Locate Tax Computation Worksheet and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Tax Computation Worksheet and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax computation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax computation worksheet and how can it help me?

A tax computation worksheet is a tool that helps you organize and calculate your tax liabilities efficiently. By using a tax computation worksheet, you can itemize your income, deductions, and credits, making it easier to file your taxes accurately and on time. This organized approach simplifies the tax preparation process and can save you money.

-

How does airSlate SignNow improve the use of a tax computation worksheet?

airSlate SignNow enhances the usability of a tax computation worksheet by allowing you to securely send and eSign documents related to your tax filings. With our platform, you can share your worksheet with accountants or tax professionals seamlessly. This collaboration leads to a more efficient tax filing process.

-

Is the tax computation worksheet compatible with other accounting tools?

Yes, the tax computation worksheet can be easily integrated with various accounting tools and software. By streamlining the process with airSlate SignNow, users can upload and share their worksheets and tax documents effortlessly. This ensures that all your financial tools work together effectively for comprehensive tax management.

-

What features does airSlate SignNow offer for handling tax computation worksheets?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage for your tax computation worksheets. Additionally, our platform ensures that all shared documents are encrypted, keeping your sensitive financial information secure. These features make airSlate SignNow a perfect fit for managing your tax-related documentation.

-

How cost-effective is airSlate SignNow for small businesses managing tax computation worksheets?

AirSlate SignNow provides a cost-effective solution for small businesses looking to manage their tax computation worksheets. With competitive pricing plans, businesses can access all the essential features without breaking the bank. This enables small businesses to stay organized and compliant while managing their tax documents.

-

Can I track changes made to my tax computation worksheet using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to track changes made to your tax computation worksheet through its version history feature. This capability ensures that you can view and revert to previous versions if necessary, providing peace of mind during the tax preparation process.

-

What benefits can I expect by using airSlate SignNow for my tax computation worksheet?

Using airSlate SignNow for your tax computation worksheet comes with multiple benefits, including enhanced collaboration, improved accuracy in calculations, and reduced turnaround time. The platform simplifies documentation processes, allowing you to focus on your finances rather than paperwork. Users also benefit from the security and reliability of our electronic signatures.

Get more for Tax Computation Worksheet

Find out other Tax Computation Worksheet

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure