Roundpoint Mortgage Third Party Authorization Form

What is the Roundpoint Mortgage Third Party Authorization Form

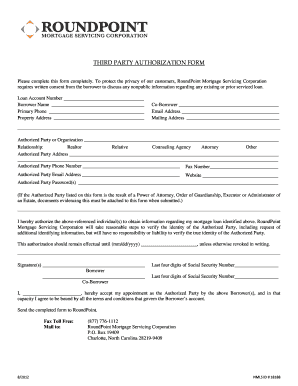

The Roundpoint Mortgage Third Party Authorization Form is a crucial document that allows a borrower to designate another individual or entity to receive information regarding their mortgage account. This form is particularly useful for individuals who may want a family member, financial advisor, or attorney to handle their mortgage-related matters on their behalf. By completing this form, borrowers can ensure that their designated third party has access to necessary account details, facilitating smoother communication and management of their mortgage obligations.

How to Use the Roundpoint Mortgage Third Party Authorization Form

Using the Roundpoint Mortgage Third Party Authorization Form involves several straightforward steps. First, borrowers need to obtain the form, which can typically be found on the Roundpoint Mortgage website or requested directly from customer service. Once the form is in hand, borrowers should fill in their personal information, including their mortgage account number and the details of the third party they wish to authorize. It is important to ensure that all information is accurate to avoid any delays. After completing the form, borrowers should sign and date it before submitting it to Roundpoint Mortgage for processing.

Key Elements of the Roundpoint Mortgage Third Party Authorization Form

The Roundpoint Mortgage Third Party Authorization Form includes several key elements that must be completed for it to be valid. These elements typically include:

- Borrower Information: Full name, address, and mortgage account number.

- Authorized Party Information: Name, relationship to the borrower, and contact details.

- Scope of Authorization: Specific permissions granted to the third party, such as access to account statements or the ability to discuss account details with Roundpoint representatives.

- Signature and Date: The borrower must sign and date the form to validate the authorization.

Steps to Complete the Roundpoint Mortgage Third Party Authorization Form

Completing the Roundpoint Mortgage Third Party Authorization Form involves a series of clear steps:

- Obtain the form from the Roundpoint Mortgage website or customer service.

- Fill in your personal information accurately, including your mortgage account number.

- Provide the details of the third party you wish to authorize, ensuring correct spelling and contact information.

- Clearly outline the scope of the authorization you are granting.

- Sign and date the form to confirm your authorization.

- Submit the completed form to Roundpoint Mortgage via the preferred submission method.

Legal Use of the Roundpoint Mortgage Third Party Authorization Form

The legal use of the Roundpoint Mortgage Third Party Authorization Form hinges on compliance with applicable laws and regulations. This form serves as a binding agreement between the borrower and Roundpoint Mortgage, allowing for the authorized third party to act on behalf of the borrower regarding mortgage-related inquiries. It is essential that borrowers understand the implications of granting such authority, including the potential for sensitive information to be shared. Proper completion and submission of the form ensure that the authorization is recognized and upheld by Roundpoint Mortgage.

Quick guide on how to complete roundpoint mortgage third party authorization form

Effortlessly complete Roundpoint Mortgage Third Party Authorization Form on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Roundpoint Mortgage Third Party Authorization Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Roundpoint Mortgage Third Party Authorization Form with ease

- Find Roundpoint Mortgage Third Party Authorization Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Roundpoint Mortgage Third Party Authorization Form and ensure superb communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the roundpoint mortgage third party authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a roundpoint mortgagee clause, and why is it important?

A roundpoint mortgagee clause is a stipulation within a mortgage agreement that protects the lender's interest in the property. It ensures that in the event of a loss or damage, insurance proceeds are paid to the mortgagee before the borrower. This clause is crucial for lenders to maintain their investment and ensures compliance in the event of insurance claims.

-

How does airSlate SignNow simplify managing the roundpoint mortgagee clause?

With airSlate SignNow, managing the roundpoint mortgagee clause is streamlined through our easy-to-use platform. You can seamlessly integrate the clause into your documents, ensuring all parties are aware and compliant. Our solution allows for quick edits and updates, making it easier to handle any changes to your mortgage agreements.

-

What features does airSlate SignNow offer for handling the roundpoint mortgagee clause?

airSlate SignNow offers features like document templates, real-time collaboration, and secure eSigning that cater specifically to managing the roundpoint mortgagee clause. Our user-friendly interface allows you to customize documents easily, ensuring that vital clauses are included accurately. Additionally, our platform provides tracking capabilities to keep you updated on document status.

-

Is airSlate SignNow cost-effective for small businesses managing the roundpoint mortgagee clause?

Absolutely! airSlate SignNow provides a cost-effective solution for small businesses needing to manage the roundpoint mortgagee clause. Our competitive pricing plans offer great value, allowing businesses to access premium features without breaking the bank. This makes it an ideal choice for small to medium-sized businesses looking to streamline their document management processes.

-

Can airSlate SignNow integrate with other software to manage a roundpoint mortgagee clause?

Yes! airSlate SignNow offers robust integrations with various platforms, allowing you to manage the roundpoint mortgagee clause efficiently. Integration with CRM systems, project management tools, and cloud storage services ensures seamless workflows. This capability enhances your productivity by centralizing document handling and agreements.

-

What benefits does airSlate SignNow provide when dealing with the roundpoint mortgagee clause?

Using airSlate SignNow for the roundpoint mortgagee clause delivers numerous benefits, including improved accuracy, speed, and compliance. The ability to eSign documents quickly eliminates delays typically associated with traditional signatures. Additionally, our automated workflows reduce human error, ensuring that all necessary clauses and stipulations are correctly incorporated.

-

How secure is airSlate SignNow when handling sensitive documents like the roundpoint mortgagee clause?

airSlate SignNow prioritizes security, especially when dealing with sensitive documents such as the roundpoint mortgagee clause. Our platform uses advanced encryption methods to protect your data and comply with legal standards. This ensures that your documents remain confidential and secure throughout the signing and management process.

Get more for Roundpoint Mortgage Third Party Authorization Form

- It 140 pit_forms_and_instructions ty2022 initial draft 20220803indd

- Fiduciary income tax virginia tax form

- 2022 d 101a form 1 es instructions estimated income tax for

- Form vp 1

- 2019 form mo personal property tax waiver application

- Select oneri am updating my business tax account ri signnow form

- Fillable form 943 request for tax clearance 1 does missouri

- How to get a resale certificate ampamp tax exemption for amazon form

Find out other Roundpoint Mortgage Third Party Authorization Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF