Form 501n

What is the Form 501n

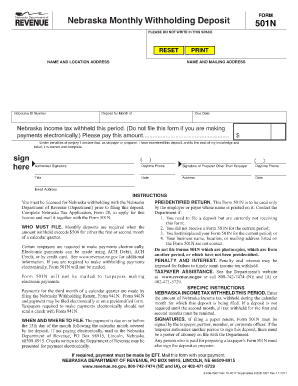

The Form 501n is a specific document used in Nebraska for various administrative purposes. It serves as an essential tool for individuals and businesses in the state, particularly for those needing to report specific information or apply for certain benefits. Understanding the purpose of the 501n form is crucial for ensuring compliance with state regulations and fulfilling necessary obligations.

How to use the Form 501n

Using the Form 501n involves several steps to ensure accurate completion. First, gather all necessary information required for the form, including personal details and any relevant financial data. Next, carefully fill out each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for accuracy before submission. Utilizing electronic tools can streamline this process, allowing for easier edits and secure submission.

Steps to complete the Form 501n

Completing the Form 501n involves a systematic approach:

- Gather required documentation, such as identification and financial records.

- Access the form online or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Review the information for any errors or omissions.

- Submit the completed form according to the specified guidelines.

Legal use of the Form 501n

The legal use of the Form 501n is governed by state regulations. To ensure that the form is recognized as valid, it must be completed in accordance with these laws. This includes providing accurate information and adhering to submission deadlines. Utilizing a reliable electronic signature solution can enhance the legal standing of the document, ensuring compliance with eSignature laws.

Key elements of the Form 501n

Key elements of the Form 501n include:

- Identification details of the individual or business submitting the form.

- Specific information relevant to the purpose of the form, such as financial data or application details.

- Signature section, which may require electronic or handwritten signatures for validation.

- Submission instructions, outlining how and where to send the completed form.

Form Submission Methods

The Form 501n can be submitted through various methods, including:

- Online submission via an authorized platform, providing a quick and efficient process.

- Mailing a physical copy to the designated office, ensuring it is sent well before any deadlines.

- In-person submission at local government offices, which may allow for immediate confirmation of receipt.

Quick guide on how to complete form 501n

Manage Form 501n seamlessly on any device

Digital document management has gained traction among both businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the functionalities necessary to create, edit, and eSign your documents quickly and without delays. Handle Form 501n on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 501n effortlessly

- Locate Form 501n and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the details and click the Done button to save your alterations.

- Select how you wish to deliver your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 501n and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 501n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 501n and why is it important?

The form 501n is a specific document used for a variety of administrative purposes, particularly in tax contexts. It helps in streamlining compliance and ensuring that businesses meet their regulatory requirements efficiently. Understanding the form 501n is crucial for businesses to avoid penalties and maintain smooth operations.

-

How can airSlate SignNow assist with form 501n?

airSlate SignNow provides a user-friendly platform for managing the form 501n, allowing users to complete, sign, and send documents electronically. This process minimizes paper usage and speeds up transaction times. By utilizing airSlate SignNow, you can ensure that your form 501n is handled with care and efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs, starting from a basic plan for small teams to more comprehensive solutions for larger organizations. Each plan includes features tailored to handle documents like the form 501n efficiently. You can choose a plan that aligns with how often you need to manage and sign forms.

-

What features are included with airSlate SignNow for form 501n?

With airSlate SignNow, you get features such as customizable templates, secure electronic signatures, and tracking capabilities for your form 501n. These tools simplify the document management process and enhance compliance. Additionally, you can integrate your workflows seamlessly for better team collaboration.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow supports multiple integrations with popular applications like Google Drive, Salesforce, and Dropbox. This ensures that you can easily manage your form 501n alongside your business tools. With numerous integrations available, you can customize the solution to fit your workflow perfectly.

-

How does airSlate SignNow enhance the signing process for form 501n?

airSlate SignNow simplifies the signing process for form 501n by allowing users to sign documents electronically from anywhere, at any time. This convenience leads to quicker turnaround times and enhances user experience. Features like reminders and notifications also help keep tasks on track and organized.

-

Is airSlate SignNow secure for handling sensitive documents like form 501n?

Absolutely, airSlate SignNow places a strong emphasis on security, utilizing encryption and compliant storage solutions. This makes it a safe choice for managing sensitive documents like form 501n. You can trust that your information is secure throughout the signing and document management process.

Get more for Form 501n

Find out other Form 501n

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation