Form 1099 Misc Fillable Form

What is the Form 1099 Misc Fillable Form

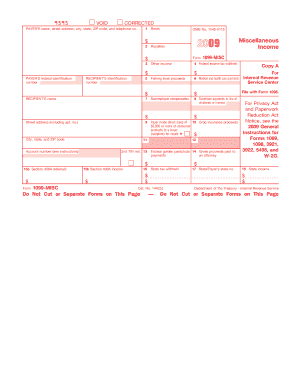

The Form 1099 Misc Fillable Form is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. It serves as a record for the Internal Revenue Service (IRS) and helps ensure that all income is accurately reported for tax purposes. The fillable format allows users to complete the form digitally, making it easier to fill out and submit.

How to use the Form 1099 Misc Fillable Form

Using the Form 1099 Misc Fillable Form involves several key steps. First, gather the necessary information about the recipient, including their name, address, and Social Security number or Employer Identification Number (EIN). Next, identify the type of income being reported, such as rent, royalties, or non-employee compensation. Fill in the appropriate boxes on the form, ensuring accuracy to avoid potential penalties. Once completed, the form can be submitted electronically or printed for mailing.

Steps to complete the Form 1099 Misc Fillable Form

Completing the Form 1099 Misc Fillable Form requires careful attention to detail. Follow these steps:

- Download the Form 1099 Misc Fillable Form from a reliable source.

- Enter the payer's information, including name, address, and taxpayer identification number.

- Fill in the recipient's information accurately, ensuring the name and identification number match IRS records.

- Indicate the type and amount of income being reported in the designated boxes.

- Review the completed form for errors or omissions.

- Submit the form electronically through an e-filing service or print and mail it to the IRS and the recipient.

Legal use of the Form 1099 Misc Fillable Form

The legal use of the Form 1099 Misc Fillable Form is governed by IRS regulations. It is essential that the form is completed accurately and submitted by the required deadlines to avoid penalties. The form must be issued to any individual or entity that has received at least $600 in reportable payments during the tax year. Proper use of this form ensures compliance with tax laws and helps maintain accurate records for both payers and recipients.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 Misc Fillable Form are crucial for compliance. Typically, the form must be sent to recipients by January 31 of the following year. Additionally, if filing electronically, the deadline is usually extended to March 31. It is important to keep track of these dates to avoid late filing penalties, which can add up significantly. Always verify the specific deadlines for the current tax year, as they may vary.

Who Issues the Form

The Form 1099 Misc Fillable Form is typically issued by businesses or individuals who have made payments to non-employees. This includes companies hiring independent contractors, landlords receiving rent payments, and businesses paying royalties. It is the responsibility of the payer to ensure that the form is completed accurately and submitted to both the IRS and the recipient in a timely manner.

Quick guide on how to complete form 1099 misc fillable form

Accomplish Form 1099 Misc Fillable Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without interruptions. Manage Form 1099 Misc Fillable Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 1099 Misc Fillable Form without hassle

- Find Form 1099 Misc Fillable Form and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for that task.

- Create your eSignature using the Sign function, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would prefer to deliver your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Set aside concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Modify and eSign Form 1099 Misc Fillable Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 misc fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 1099 Misc Fillable Form?

A Form 1099 Misc Fillable Form is a tax document used to report various types of income other than wages or salaries. This fillable version allows you to easily complete and submit the form online, ensuring accuracy and compliance with tax regulations.

-

How can airSlate SignNow help me complete a Form 1099 Misc Fillable Form?

airSlate SignNow streamlines the process of filling out the Form 1099 Misc Fillable Form by providing intuitive tools and templates. You can fill, sign, and send this essential tax document efficiently, minimizing the hassle of managing paperwork.

-

Is airSlate SignNow a cost-effective solution for handling Form 1099 Misc Fillable Forms?

Yes, airSlate SignNow offers a budget-friendly approach to handling Form 1099 Misc Fillable Forms. Our subscription plans are designed to cater to businesses of all sizes, providing valuable features that enhance document processing without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for my Form 1099 Misc Fillable Form?

Absolutely! airSlate SignNow supports integrations with various accounting software solutions, making it easy to import data for your Form 1099 Misc Fillable Form. This capability helps streamline your workflow and maintain accuracy across your financial records.

-

What features does airSlate SignNow offer for managing Form 1099 Misc Fillable Forms?

airSlate SignNow includes features like customizable templates, form tracking, and secure e-signature capabilities specifically for Form 1099 Misc Fillable Forms. These tools not only simplify form completion but also enhance the overall efficiency of your document management.

-

Is it safe to use airSlate SignNow for my sensitive Form 1099 Misc Fillable Form information?

Yes, airSlate SignNow prioritizes the security of your sensitive information when handling Form 1099 Misc Fillable Forms. Our platform uses robust encryption and security protocols to ensure that your data remains confidential and protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for my Form 1099 Misc Fillable Form needs?

Using airSlate SignNow for your Form 1099 Misc Fillable Form needs offers numerous benefits, including improved accuracy, enhanced speed, and reduced paperwork. You'll save time and reduce errors while ensuring compliance with IRS regulations in a straightforward manner.

Get more for Form 1099 Misc Fillable Form

- Form 51 pdf

- Klb chemistry book 2 notes pdf form

- Cpt code guidelines for x ray ct and mri form

- T20 cricket score sheet pdf form

- Neurovascular assessment chart form

- Upper miramichi firearms club incorporated form

- Application for utility service starkville utilities form

- Electrical service agreement template form

Find out other Form 1099 Misc Fillable Form

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer