8300 Form Letter to Customer

What is the 8300 Form Letter to Customer

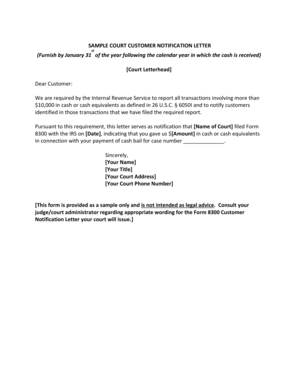

The 8300 Form Letter to Customer is a notification document used by businesses to inform clients about the reporting of cash transactions exceeding $10,000. This form is part of the IRS requirements to combat money laundering and ensure compliance with the Bank Secrecy Act. The letter outlines the details of the transaction, including the amount and the date, and serves as a formal communication to the customer regarding their financial activities. It is essential for businesses to provide this letter to maintain transparency and adhere to federal regulations.

How to Use the 8300 Form Letter to Customer

Using the 8300 Form Letter to Customer involves several steps to ensure compliance with IRS guidelines. First, businesses must accurately fill out the IRS Form 8300 when a cash transaction exceeds $10,000. Once completed, the business should generate the corresponding letter to notify the customer. This letter should include the transaction details, such as the cash amount and the date of the transaction. It is crucial to send this letter within a specified timeframe to meet legal obligations and maintain proper records.

Steps to Complete the 8300 Form Letter to Customer

Completing the 8300 Form Letter to Customer requires careful attention to detail. Follow these steps:

- Gather all relevant transaction details, including the customer's information and the cash amount.

- Fill out the IRS Form 8300 accurately, ensuring all fields are completed.

- Create the letter using a clear and professional format, incorporating the transaction details.

- Review the letter for accuracy and compliance with IRS requirements.

- Send the letter to the customer promptly, ideally within 15 days of the transaction.

Key Elements of the 8300 Form Letter to Customer

When drafting the 8300 Form Letter to Customer, certain key elements must be included to ensure it meets legal standards. These elements are:

- Business Information: Include the name, address, and contact information of the business.

- Customer Information: Clearly state the customer's name and address.

- Transaction Details: Specify the amount of cash received and the date of the transaction.

- IRS Compliance Statement: Mention that the transaction is being reported to the IRS as required by law.

- Signature: Include a space for the authorized person to sign, confirming the letter's authenticity.

IRS Guidelines for the 8300 Form Letter to Customer

The IRS provides specific guidelines for the 8300 Form Letter to Customer to ensure compliance with federal regulations. According to IRS rules, businesses must report cash transactions exceeding $10,000 within 15 days. The letter must be clear and concise, providing all necessary information to the customer. Additionally, businesses should keep a copy of the letter and the completed Form 8300 for their records. Adhering to these guidelines helps businesses avoid penalties and ensures transparency in financial dealings.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the 8300 Form Letter to Customer can result in significant penalties. The IRS may impose fines for not reporting cash transactions exceeding $10,000 or for failing to provide the notification letter to the customer. These penalties can vary depending on the severity of the violation and can include both monetary fines and potential criminal charges in cases of willful neglect. It is essential for businesses to understand these risks and ensure they follow all legal requirements to avoid repercussions.

Quick guide on how to complete 8300 form letter to customer

Complete 8300 Form Letter To Customer effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents rapidly without delays. Manage 8300 Form Letter To Customer on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and electronically sign 8300 Form Letter To Customer with ease

- Find 8300 Form Letter To Customer and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 8300 Form Letter To Customer to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8300 form letter to customer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an 8300 letter to customer template?

An 8300 letter to customer template is a customizable document designed for businesses to inform customers about specific transactions. It complies with IRS requirements for reporting cash payments exceeding $10,000. Utilizing an 8300 letter to customer template simplifies compliance and enhances your professional communication.

-

How can I create an 8300 letter to customer template using airSlate SignNow?

Creating an 8300 letter to customer template with airSlate SignNow is straightforward. You can start by selecting from our customizable templates or creating your own from scratch. The platform allows easy editing, so you can tailor the letter to meet your specific business needs.

-

What are the pricing options for using airSlate SignNow's 8300 letter to customer template?

airSlate SignNow offers flexible pricing plans for businesses of all sizes. Access to the 8300 letter to customer template is included in our subscription plans, which provide a cost-effective solution for document management and e-signatures. Visit our pricing page to find the best plan for your needs.

-

What features does the airSlate SignNow 8300 letter to customer template include?

The airSlate SignNow 8300 letter to customer template comes with various features like customizable fields, e-signature functionality, and document tracking. These features streamline the process of sending and signing documents, ensuring compliance while enhancing customer interactions.

-

What are the benefits of using an 8300 letter to customer template?

Using an 8300 letter to customer template improves your business's efficiency and compliance. It reduces the time spent on document preparation and ensures that you meet IRS regulations seamlessly. Additionally, it enhances your credibility by providing your customers with accurate and professional documentation.

-

Can I integrate the 8300 letter to customer template with other software?

Yes, airSlate SignNow allows integration with various software applications to streamline your workflow. You can easily connect our platform with CRM systems, email clients, and other productivity tools. This integration ensures that your 8300 letter to customer template works within your existing ecosystem for maximum efficiency.

-

Is it secure to use the 8300 letter to customer template on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents. Our 8300 letter to customer template is protected with advanced encryption and complies with industry standards to safeguard your data. You can trust that your customer information remains confidential and secure.

Get more for 8300 Form Letter To Customer

Find out other 8300 Form Letter To Customer

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online