Minnesota Tax Form M4np

What is the Minnesota Tax Form M4np

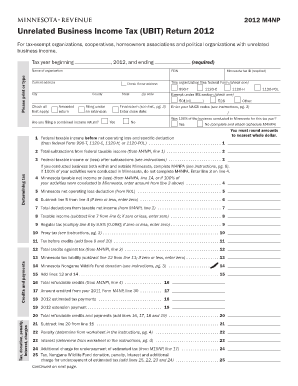

The Minnesota Tax Form M4np is a specific tax document used by individuals and businesses in Minnesota to report certain income and claim applicable deductions. This form is essential for ensuring compliance with state tax regulations and is typically utilized during the annual filing process. It is designed to capture detailed financial information relevant to the taxpayer's situation, allowing for accurate assessment of tax liabilities.

How to use the Minnesota Tax Form M4np

Using the Minnesota Tax Form M4np involves several steps to ensure that all information is accurately reported. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that each section is completed according to the instructions provided. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Minnesota Tax Form M4np

Completing the Minnesota Tax Form M4np requires a systematic approach:

- Gather all relevant financial documents, such as W-2s and 1099s.

- Review the instructions for the M4np to understand the required information.

- Fill out each section of the form, ensuring accuracy in reporting income and deductions.

- Double-check all calculations and entries for potential errors.

- Sign and date the form before submission.

Legal use of the Minnesota Tax Form M4np

The Minnesota Tax Form M4np is legally binding when filled out correctly and submitted in accordance with state laws. It is crucial to adhere to all guidelines set forth by the Minnesota Department of Revenue to ensure that the form is accepted without issue. Compliance with tax laws protects taxpayers from potential penalties and ensures that they meet their legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Tax Form M4np are typically aligned with the federal tax deadlines. Generally, individual taxpayers must submit their forms by April 15 of each year. However, it is important to verify specific dates each tax year, as they may vary slightly. Late submissions may incur penalties, so timely filing is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota Tax Form M4np can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically through the Minnesota Department of Revenue's e-filing system.

- Mail: Completed forms can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also choose to deliver their forms in person at local tax offices, if applicable.

Quick guide on how to complete minnesota tax form m4np

Prepare Minnesota Tax Form M4np seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Minnesota Tax Form M4np on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and electronically sign Minnesota Tax Form M4np effortlessly

- Find Minnesota Tax Form M4np and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Minnesota Tax Form M4np to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota tax form m4np

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m4np feature in airSlate SignNow?

The m4np feature in airSlate SignNow allows users to automate document signing processes efficiently. By streamlining workflows, businesses can save time and reduce the potential for errors. This feature is designed to accommodate various industries, making document management easier for everyone.

-

How much does airSlate SignNow cost if I want to use the m4np feature?

Pricing for airSlate SignNow varies depending on the plan chosen, but all plans include access to the m4np feature. Businesses can benefit from competitive pricing designed to fit different budgets. It’s advisable to check the website for the latest pricing details and choose a plan that suits your needs.

-

What are the key benefits of using m4np with airSlate SignNow?

Utilizing the m4np feature with airSlate SignNow provides multiple benefits, such as enhanced efficiency and reduced turnaround times for document signing. It allows for seamless collaboration among team members and ensures that all documents are securely stored. Additionally, this system helps keep your compliance in check.

-

Can I integrate m4np with other tools?

Yes, airSlate SignNow offers extensive integrations with various third-party platforms, allowing you to incorporate the m4np feature into your existing workflows. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility ensures a smoother and more connected user experience.

-

Is the m4np feature suitable for small businesses?

Absolutely! The m4np feature in airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Small businesses can leverage this feature to streamline their document signing processes and enhance operational efficiency without breaking the bank. It’s an ideal solution for fostering business growth.

-

What makes airSlate SignNow's m4np feature stand out from competitors?

What sets the m4np feature apart is its user-friendly interface combined with powerful automation capabilities. Unlike many competitors, airSlate SignNow focuses on both affordability and functionality, ensuring that users get the best value. The commitment to customer service further enhances the overall user experience.

-

How do I get started with the m4np feature?

Getting started with the m4np feature is simple. First, sign up for an airSlate SignNow account and choose a pricing plan that meets your needs. From there, you can easily navigate to the m4np feature through the user-friendly dashboard and begin automating your document signing processes immediately.

Get more for Minnesota Tax Form M4np

Find out other Minnesota Tax Form M4np

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document