Nys App#4 20 943 Form

What is the Nys App#4 20 943 Form

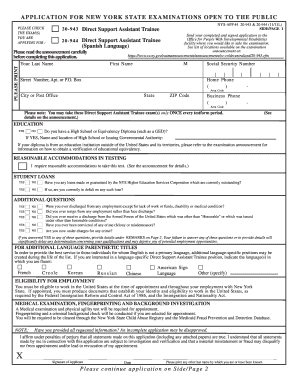

The Nys App#4 20 943 Form is a specific document used in the state of New York for various administrative purposes. This form is primarily associated with applications for benefits or services provided by state agencies. Understanding its purpose is crucial for individuals seeking to navigate state processes effectively. The form requires detailed information about the applicant, including personal identification and relevant circumstances that support the application.

How to obtain the Nys App#4 20 943 Form

Obtaining the Nys App#4 20 943 Form can be done through several methods. Individuals can visit the official New York state website, where forms are typically available for download. Alternatively, local government offices may provide physical copies of the form. It is advisable to ensure that you have the most current version of the form, as updates may occur periodically.

Steps to complete the Nys App#4 20 943 Form

Completing the Nys App#4 20 943 Form involves several steps to ensure accuracy and compliance. First, gather all necessary personal information and supporting documents. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. After completing the form, review it for any errors before submission. Finally, follow the specified submission instructions, which may include online submission, mailing, or delivering the form in person.

Legal use of the Nys App#4 20 943 Form

The legal use of the Nys App#4 20 943 Form is governed by state regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted according to the guidelines provided by the relevant state agency. In some cases, signatures may be required, and electronic submissions must comply with eSignature laws to be considered valid.

Required Documents

When completing the Nys App#4 20 943 Form, certain documents may be required to support your application. Commonly required documents include proof of identity, residency verification, and any additional information relevant to the specific type of application. It is essential to check the specific requirements for the form to ensure that all necessary documentation is included.

Form Submission Methods

The Nys App#4 20 943 Form can typically be submitted through various methods, depending on the requirements of the state agency involved. Common submission methods include:

- Online submission through the official state website

- Mailing the completed form to the designated office

- In-person delivery at local government offices

Each method has its own procedures and timelines, so it is important to follow the instructions provided with the form.

Eligibility Criteria

Eligibility criteria for the Nys App#4 20 943 Form vary based on the specific benefits or services being applied for. Generally, applicants must meet certain residency and identification requirements. It is advisable to review the eligibility guidelines associated with the form to determine if you qualify before proceeding with the application process.

Quick guide on how to complete nys app4 20 943 form

Complete Nys App#4 20 943 Form seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage Nys App#4 20 943 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nys App#4 20 943 Form effortlessly

- Obtain Nys App#4 20 943 Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Nys App#4 20 943 Form and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys app4 20 943 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys App#4 20 943 Form?

The Nys App#4 20 943 Form is a specific document used in New York for various applications. This form is essential for administrative processes and ensures compliance with state regulations. By using airSlate SignNow, you can seamlessly eSign and submit the Nys App#4 20 943 Form efficiently and securely.

-

How can airSlate SignNow help me with the Nys App#4 20 943 Form?

airSlate SignNow offers a user-friendly platform for managing your Nys App#4 20 943 Form. You can easily fill out, sign, and share the form with stakeholders, saving you time and effort. Our electronic signature feature ensures that your form is legally binding and secure.

-

Is airSlate SignNow affordable for small businesses needing the Nys App#4 20 943 Form?

Yes, airSlate SignNow provides an affordable solution for small businesses looking to manage the Nys App#4 20 943 Form. We offer flexible pricing plans tailored to different needs and budgets, making it accessible for all. You can benefit from our features without breaking the bank.

-

What features does airSlate SignNow provide for the Nys App#4 20 943 Form?

airSlate SignNow brings several features for handling the Nys App#4 20 943 Form, including customizable templates, electronic signatures, and document tracking. These tools enhance efficiency, ensuring that your form is processed quickly and accurately. You can also integrate other applications for streamlined operations.

-

Can I integrate airSlate SignNow with other tools for the Nys App#4 20 943 Form?

Absolutely! airSlate SignNow offers integrations with various third-party applications that enhance your workflow for the Nys App#4 20 943 Form. This includes popular tools like Google Drive, CRM systems, and more. Integrate seamlessly to boost your productivity and document management.

-

What are the benefits of using airSlate SignNow for the Nys App#4 20 943 Form?

Using airSlate SignNow for the Nys App#4 20 943 Form brings numerous benefits, including increased efficiency, secure electronic signing, and reduced turnaround time. Our platform automates the signing process, allowing you to focus on other important tasks. Additionally, it's compliant with legal standards, ensuring your documents are valid.

-

How do I start using airSlate SignNow for the Nys App#4 20 943 Form?

Getting started with airSlate SignNow for the Nys App#4 20 943 Form is simple. Sign up for an account on our website, and you’ll have access to tools ready for document management. Upload your form, customize it if needed, and begin the signing process with just a few clicks.

Get more for Nys App#4 20 943 Form

- Self employed independent contractor agreement 497337088 form

- Brokerage contract sample form

- Agreement self employed 497337090 form

- Lab worker employment contract self employed 497337091 form

- Tutoring agreement form contract

- Charter contract form

- Dancer independent contractor form

- Wedding planner contract form

Find out other Nys App#4 20 943 Form

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later