City of St Louis Earnings Tax Return Form E 234

What is the City Of St Louis Earnings Tax Return Form E 234

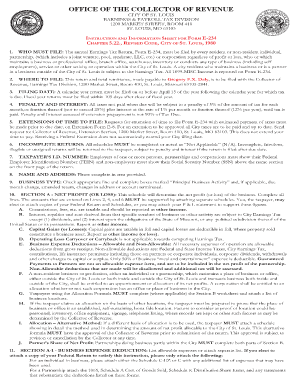

The City Of St Louis Earnings Tax Return Form E 234 is a tax document required for individuals who earn income within the city limits of St Louis. This form is specifically designed for residents and non-residents who are subject to the city's earnings tax. It captures essential financial information, including total earnings, deductions, and tax liabilities. Properly completing this form ensures compliance with local tax regulations and allows the city to assess the correct amount of earnings tax owed.

Steps to complete the City Of St Louis Earnings Tax Return Form E 234

Completing the City Of St Louis Earnings Tax Return Form E 234 involves several key steps:

- Gather necessary financial documents, such as W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total earnings from all sources, ensuring accuracy to avoid penalties.

- Apply any eligible deductions as specified in the form instructions.

- Calculate your total tax liability based on the earnings reported and the applicable tax rates.

- Review the completed form for accuracy before submission.

How to obtain the City Of St Louis Earnings Tax Return Form E 234

The City Of St Louis Earnings Tax Return Form E 234 can be obtained through various methods. It is available online on the official St Louis city website, where you can download a printable version. Additionally, physical copies can be requested from the City Collector's office or local tax offices. Ensuring you have the correct and most recent version of the form is crucial for accurate filing.

Legal use of the City Of St Louis Earnings Tax Return Form E 234

The legal use of the City Of St Louis Earnings Tax Return Form E 234 requires adherence to local tax laws and regulations. This form must be filled out truthfully and submitted by the designated deadline to avoid penalties. The form serves as a legal document that may be audited by the city’s tax authorities, making it essential to provide accurate and complete information. Compliance with the legal requirements surrounding this form ensures that taxpayers fulfill their obligations and avoid potential legal issues.

Key elements of the City Of St Louis Earnings Tax Return Form E 234

Key elements of the City Of St Louis Earnings Tax Return Form E 234 include:

- Personal Information: Name, address, and Social Security number.

- Total Earnings: Comprehensive reporting of all income sources.

- Deductions: Applicable deductions that can reduce taxable income.

- Tax Calculation: Methodology for calculating the total earnings tax owed.

- Signature: Required signature to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the City Of St Louis Earnings Tax Return Form E 234 are typically aligned with the federal tax deadlines. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. It is important to stay informed about any changes to these deadlines, as they can vary based on local regulations or extensions granted by the city. Timely submission is crucial to avoid penalties and interest on unpaid taxes.

Quick guide on how to complete city of st louis earnings tax return form e 234

Effortlessly Prepare City Of St Louis Earnings Tax Return Form E 234 on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage City Of St Louis Earnings Tax Return Form E 234 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Edit and Electronically Sign City Of St Louis Earnings Tax Return Form E 234 with Ease

- Find City Of St Louis Earnings Tax Return Form E 234 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks on any device of your choice. Modify and electronically sign City Of St Louis Earnings Tax Return Form E 234 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of st louis earnings tax return form e 234

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form e 234 and how does it work?

Form e 234 is a vital document that streamlines the process of signing and submitting forms electronically. With airSlate SignNow, you can easily create, fill out, and eSign your form e 234, ensuring a seamless workflow. This feature helps businesses save time and reduce errors in document handling.

-

How can airSlate SignNow simplify filling out form e 234?

airSlate SignNow simplifies filling out form e 234 by providing a user-friendly interface that allows you to complete the form quickly and accurately. You can access templates, fill in necessary information, and set up eSignatures all in one place. This reduces the risk of mistakes and enhances productivity.

-

What are the pricing plans for using airSlate SignNow for form e 234?

airSlate SignNow offers flexible pricing plans tailored to your business needs, including options for individual users and teams. Each plan provides access to enhanced features that support the handling of form e 234 and other essential documents. You can choose a plan that best fits your budget and workflow requirements.

-

Can I integrate airSlate SignNow with other software for handling form e 234?

Yes, airSlate SignNow easily integrates with various third-party applications, making it convenient to manage form e 234 alongside your existing tools. Whether you use CRM systems, project management tools, or cloud storage services, these integrations enhance productivity and document collaboration.

-

What benefits does airSlate SignNow offer for form e 234 users?

Using airSlate SignNow for form e 234 brings numerous benefits such as improved efficiency, reduced turnaround time, and enhanced security for your documents. The platform allows for real-time tracking of signatures and provides a legally binding eSignature solution. This not only streamlines your processes but also ensures compliance with legal standards.

-

Is there customer support available for issues related to form e 234?

Absolutely! airSlate SignNow provides comprehensive customer support for any issues related to form e 234. Whether you need help with setup, troubleshooting, or general inquiries, our dedicated support team is here to assist you via email, chat, or phone.

-

How secure is my data when using airSlate SignNow for form e 234?

The security of your data is a top priority for airSlate SignNow. We implement robust security measures, including encryption, to protect your form e 234 and all associated documents. This ensures that your sensitive information remains confidential and secure during the signing process.

Get more for City Of St Louis Earnings Tax Return Form E 234

- Lifeline florida form

- Medical documentation form 614266963

- Dr george mandelarisdr george mandelaris ampamp dr degroot form

- Service learning hours verification form

- Patient form

- Www dnb combusiness directorycompany profilesoak brook behavioral health ltd company profileoakbrook form

- 1 of 10 confidential patient information central illinois chiropractic

- Foster parent application a heart for animals form

Find out other City Of St Louis Earnings Tax Return Form E 234

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe