Nhifta Form

What is the IFTA 100 Form?

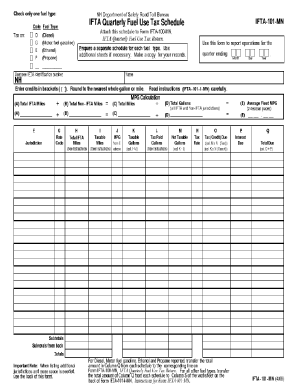

The IFTA 100 form, or International Fuel Tax Agreement form, is a crucial document for interstate motor carriers operating in the United States and Canada. This form is used to report fuel use and calculate the appropriate fuel tax owed to various jurisdictions. The IFTA 100 form simplifies the process for carriers by allowing them to file a single quarterly tax return instead of separate returns for each state or province in which they operate. This form is essential for maintaining compliance with fuel tax regulations across multiple jurisdictions.

Steps to Complete the IFTA 100 Form

Completing the IFTA 100 form involves several key steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather necessary information, including total miles driven and fuel purchased in each jurisdiction.

- Calculate the total miles and fuel used in each state or province.

- Determine the tax rate for each jurisdiction to calculate the tax owed.

- Complete the IFTA 100 form by entering the calculated figures in the appropriate sections.

- Review the form for accuracy before submission.

Legal Use of the IFTA 100 Form

The IFTA 100 form is legally binding when completed correctly and submitted on time. It is essential for carriers to comply with both federal and state regulations regarding fuel tax reporting. Failure to submit the form or inaccuracies in reporting can result in penalties, interest, and potential audits. Understanding the legal implications of the IFTA 100 form helps ensure that carriers remain compliant and avoid costly mistakes.

Filing Deadlines / Important Dates

Carriers must be aware of the filing deadlines associated with the IFTA 100 form to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. The quarterly deadlines are as follows:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31

Timely submission is crucial for maintaining compliance and avoiding late fees.

Required Documents

To complete the IFTA 100 form, carriers need to gather specific documents and information, including:

- Total miles driven in each jurisdiction

- Total gallons of fuel purchased in each jurisdiction

- Fuel tax rates for each state or province

- Previous IFTA returns for reference

Having these documents ready can streamline the completion process and help ensure accurate reporting.

Form Submission Methods

The IFTA 100 form can be submitted through various methods, depending on the jurisdiction. Common submission methods include:

- Online submission through the state's IFTA portal

- Mailing a paper copy of the form to the appropriate state agency

- In-person submission at designated state offices

Choosing the appropriate method can depend on the carrier's preferences and the specific requirements of the state in which they are filing.

Quick guide on how to complete nhifta

Prepare Nhifta with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Nhifta on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Nhifta seamlessly

- Find Nhifta and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or disorganized documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Nhifta while ensuring outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nhifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IFTA 100 form and why is it important?

The IFTA 100 form is a crucial document used by interstate motor carriers to report and pay fuel taxes. This form simplifies the reporting process and ensures compliance with various state regulations, making it essential for businesses operating in multiple states.

-

How can airSlate SignNow help me with the IFTA 100 form?

airSlate SignNow streamlines the completion and submission of the IFTA 100 form by allowing users to eSign documents quickly. Our platform ensures that you can fill out, sign, and send your forms efficiently, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the IFTA 100 form?

Yes, airSlate SignNow offers several pricing plans, allowing you to choose an option that fits your budget while providing full access to features for managing your IFTA 100 form. Our affordable pricing model ensures you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for handling the IFTA 100 form?

AirSlate SignNow includes features such as customizable templates, cloud storage, and audit trails specifically designed for the IFTA 100 form. These tools enhance the efficiency of document handling and keep your submissions organized and compliant.

-

Can I integrate airSlate SignNow with other software for the IFTA 100 form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and fleet management software, allowing you to easily manage your IFTA 100 form alongside your other business processes. This integration ensures a cohesive workflow and better data management.

-

What benefits will I see when using airSlate SignNow for my IFTA 100 form?

Using airSlate SignNow for your IFTA 100 form can signNowly reduce processing time and improve accuracy. With features like eSignature and cloud-based access, you'll enjoy a more efficient and hassle-free experience while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for submitting IFTA 100 forms?

Yes, airSlate SignNow is committed to security and compliance, utilizing advanced encryption and secure storage to protect your IFTA 100 form data. We ensure that every document sent through our platform remains confidential and secure for our users.

Get more for Nhifta

- Reinigungsnachweis pdf kostenlos form

- Mmu vehicle sticker form

- Florida probation community service form

- Charles jones 1099 s reporting form

- Washington residential lease agreement form

- Vodacom insurance claim form

- Declaration of deceased estate form e172 declaration of deceased estate form e172

- Familienname und vorname der kindergeldberechtigten person form

Find out other Nhifta

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter