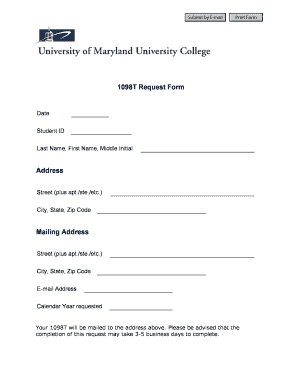

Umgc 1098 T Form

What is the UMGC 1098-T?

The UMGC 1098-T is a tax form issued by the University of Maryland Global Campus (UMGC) that reports qualified tuition and related expenses for students. This form is essential for individuals who are eligible to claim educational tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. The UMGC 1098-T includes details such as the student’s enrollment status, qualified expenses, and the institution’s federal identification number, which is crucial for accurate tax reporting.

How to Obtain the UMGC 1098-T

Students can access their UMGC 1098-T form through the university's online portal. Typically, the form is made available by January 31 of each year, reflecting the previous tax year’s information. Students should log into their account, navigate to the financial or tax documents section, and download the form. If a student cannot locate their 1098-T online, they can contact the university’s financial aid office for assistance in obtaining a copy.

Steps to Complete the UMGC 1098-T

Completing the UMGC 1098-T involves several steps to ensure accuracy and compliance with IRS regulations. First, verify that all personal information, including the student's name and Social Security number, is correct. Next, review the amounts reported in the qualified expenses section to ensure they reflect the actual tuition and fees paid during the tax year. Finally, use the information from the UMGC 1098-T to fill out the appropriate tax forms when filing, ensuring to claim any eligible tax credits.

Legal Use of the UMGC 1098-T

The UMGC 1098-T is legally binding and serves as an official record for tax purposes. To ensure its legal validity, it must be filled out accurately and submitted in accordance with IRS guidelines. The form is protected under federal regulations, and its use is governed by laws such as the Family Educational Rights and Privacy Act (FERPA), which safeguards student information. Students should retain a copy of the form for their records, as it may be required for future reference or audits.

Key Elements of the UMGC 1098-T

Several key elements are included in the UMGC 1098-T that are important for tax reporting. These elements include:

- Student Information: Name, address, and Social Security number.

- Institution Information: Name and federal identification number of UMGC.

- Qualified Expenses: Amounts paid for tuition and related fees.

- Scholarships and Grants: Any financial aid received that offsets tuition costs.

Understanding these components helps students accurately report their educational expenses and claim any applicable tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the UMGC 1098-T and related tax forms are crucial for students to keep in mind. Generally, the IRS requires that tax returns be filed by April 15 of each year. It is advisable for students to review their 1098-T as soon as it becomes available in January to ensure they have ample time to prepare their tax returns. Additionally, any corrections to the 1098-T must be addressed promptly to avoid issues with tax filings.

Quick guide on how to complete umgc 1098 t

Accomplish Umgc 1098 T seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Umgc 1098 T on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest method to modify and eSign Umgc 1098 T effortlessly

- Locate Umgc 1098 T and then click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Umgc 1098 T and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the umgc 1098 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UMGC 1098 T form, and why is it important?

The UMGC 1098 T form is an IRS document that provides information about qualified tuition and related expenses paid during the tax year. It's essential for students attending the University of Maryland Global Campus (UMGC) to claim tax credits for educational expenses.

-

How can I obtain my UMGC 1098 T form?

You can obtain your UMGC 1098 T form through your student account portal on the UMGC website. The form is usually available during tax season, making it easy for you to access and download for your tax preparation.

-

Is the UMGC 1098 T form available electronically?

Yes, the UMGC 1098 T form is available electronically. This means you can securely access it online, reducing paper waste and allowing for easier record-keeping.

-

What if my UMGC 1098 T form has errors?

If you notice any errors on your UMGC 1098 T form, it’s crucial to contact UMGC's financial office immediately. They can assist in correcting any discrepancies to ensure your tax information is accurate.

-

Do I need the UMGC 1098 T form if I am receiving financial aid?

Yes, you will still need the UMGC 1098 T form even if you are receiving financial aid. The form outlines all qualified tuition and expenses, which is necessary for understanding your tax obligations and benefits.

-

How does eSigning documents help with UMGC 1098 T processing?

eSigning documents can streamline the process of submitting and managing your UMGC 1098 T forms. With airSlate SignNow, you can easily sign and send required documents electronically, saving time and ensuring security.

-

Does airSlate SignNow integrate with UMGC's systems for document management?

Yes, airSlate SignNow offers integrations that can streamline document management processes for UMGC students. This simplifies the handling of your UMGC 1098 T forms and related paperwork, enhancing efficiency.

Get more for Umgc 1098 T

Find out other Umgc 1098 T

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors