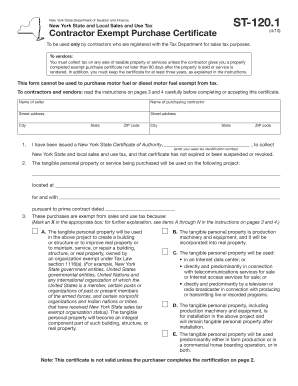

St120 1 Form

What is the ST120 1 form?

The ST120 1 form is a tax exempt form used in the United States for specific transactions that qualify for sales tax exemption. This form is typically utilized by organizations, such as non-profits and government entities, to certify that they are exempt from sales tax on certain purchases. By completing the ST120 1 form, eligible entities can ensure compliance with state tax regulations while avoiding unnecessary tax expenses.

How to use the ST120 1 form

To effectively use the ST120 1 form, follow these steps:

- Identify your eligibility for tax exemption based on your organization type.

- Complete the form with accurate information, including the name of the organization, address, and the reason for the exemption.

- Submit the completed form to the vendor from whom you are purchasing goods or services.

- Keep a copy of the form for your records in case of future audits or inquiries.

Steps to complete the ST120 1 form

Completing the ST120 1 form involves several key steps:

- Download the ST120 1 form from an official source.

- Fill in the required fields, ensuring that all information is accurate and up to date.

- Sign and date the form, confirming that the information provided is correct.

- Provide the form to the vendor before making a purchase to ensure the exemption is applied.

Legal use of the ST120 1 form

The legal use of the ST120 1 form is crucial for maintaining compliance with state tax laws. This form serves as a legal document that certifies an organization's tax-exempt status. It is important to ensure that the form is only used for eligible transactions and that all information is accurate to avoid penalties or audits from tax authorities.

Required Documents

When completing the ST120 1 form, certain documents may be required to support your tax-exempt status. These may include:

- Proof of the organization’s tax-exempt status, such as a 501(c)(3) determination letter.

- Identification documents for the organization, like an Employer Identification Number (EIN).

- Any additional documentation that may be requested by the vendor to verify eligibility.

Who Issues the Form

The ST120 1 form is typically issued by state tax authorities. Organizations seeking to utilize this form should check with their respective state’s department of revenue or taxation for the most current version and specific instructions regarding its use.

Quick guide on how to complete st120 1

Prepare St120 1 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage St120 1 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign St120 1 with ease

- Find St120 1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign St120 1 and assure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st120 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st120 1 form, and why is it important?

The st120 1 form is a crucial document used for sales tax exemption in various transactions. Understanding this form can help businesses avoid unnecessary tax expenses, ensuring compliance with tax regulations.

-

How can I fill out the st120 1 form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the st120 1 form by uploading it to our platform and accessing user-friendly editing tools. The platform allows you to complete and eSign the document efficiently, making the process seamless.

-

What features does airSlate SignNow offer for the st120 1 form?

AirSlate SignNow provides features like document templates, eSignatures, and secure cloud storage, specifically designed to streamline the process of managing the st120 1 form. These features ensure that you can handle all your documentation needs with ease and security.

-

Is airSlate SignNow pricing competitive for handling documents like the st120 1 form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing our service, you not only get access to the st120 1 form capabilities but also a suite of features that enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the st120 1 form?

The benefits of using airSlate SignNow for the st120 1 form include improved efficiency in document handling, ease of collaboration, and enhanced security features. Our platform simplifies the eSigning process, ultimately saving time and resources for your business.

-

Can airSlate SignNow integrate with other software for managing the st120 1 form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enabling you to manage the st120 1 form alongside your other business processes. This integration helps create a more streamlined workflow for your team's documentation efforts.

-

How secure is the airSlate SignNow platform when using the st120 1 form?

Security is a top priority for airSlate SignNow. When you use the st120 1 form on our platform, you can trust that your data is protected with advanced encryption and industry-standard security measures, ensuring the confidentiality of your documents.

Get more for St120 1

- De2501fc form

- Fortigate iso image download form

- Esl monitoring forms

- Mary kay outside order form 389463350

- Scholastic classroom essentials form

- Nomination and declaration form for unexempted exempted establishments sample

- Medicare secondary payer development form

- Transcript request form fisher college

Find out other St120 1

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online