E 536 Form

What is the E 536 Form

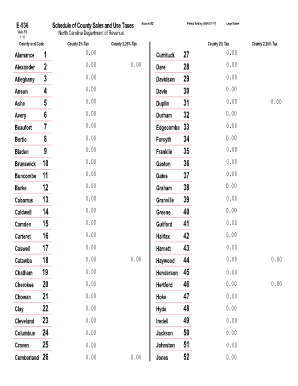

The E 536 form is a tax document utilized primarily in North Carolina for reporting sales and use tax. This form is essential for businesses and individuals who need to declare their sales tax obligations accurately. The E 536 serves as a means for the North Carolina Department of Revenue to collect necessary tax information from taxpayers, ensuring compliance with state tax laws. It is crucial for maintaining transparency and accountability in sales transactions.

How to use the E 536 Form

Using the E 536 form involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur annually. Next, gather all relevant information, including sales figures and any applicable exemptions. Fill out the form accurately, providing details such as your business name, address, and sales amounts. Once completed, review the form for any errors before submitting it to the North Carolina Department of Revenue. This ensures that your tax obligations are met without complications.

Steps to complete the E 536 Form

Completing the E 536 form requires careful attention to detail. Follow these steps for accurate submission:

- Download the latest version of the E 536 form from the North Carolina Department of Revenue website.

- Fill in your personal or business information, including name, address, and identification number.

- Report your total sales and any exempt sales accurately.

- Calculate the total tax owed based on the applicable tax rate.

- Sign and date the form to certify its accuracy.

Legal use of the E 536 Form

The E 536 form is legally binding when filled out and submitted according to North Carolina tax laws. It must be completed accurately to avoid penalties or legal issues. The form serves as a declaration of your sales tax obligations, and improper use or failure to submit it can result in fines or audits. Understanding the legal implications of the E 536 form helps ensure compliance and protects your business from potential legal challenges.

Key elements of the E 536 Form

Several key elements must be included when filling out the E 536 form to ensure its validity:

- Taxpayer Information: Name, address, and identification number.

- Sales Information: Total sales and exempt sales amounts.

- Tax Calculation: Accurate calculation of the tax owed based on reported sales.

- Signature: A signature certifying the accuracy of the information provided.

Form Submission Methods

The E 536 form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the North Carolina Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed directly to the appropriate department or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Quick guide on how to complete e 536 form

Complete E 536 Form seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely retain it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage E 536 Form on any platform using airSlate SignNow’s Android or iOS applications and streamline your document-based processes today.

The easiest way to edit and eSign E 536 Form effortlessly

- Locate E 536 Form and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign E 536 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 536 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the e 536 feature in airSlate SignNow?

The e 536 feature in airSlate SignNow allows users to easily send and sign documents electronically. This functionality streamlines the signing process, ensuring that agreements are completed quickly and efficiently. With e 536, businesses can enhance their workflows and save valuable time.

-

How much does airSlate SignNow cost for using the e 536 feature?

The pricing for airSlate SignNow, which includes the e 536 feature, is designed to be cost-effective for businesses of all sizes. Various plans cater to different needs, allowing organizations to choose an option that fits their budget while leveraging e 536's capabilities. For detailed pricing, visit our website or contact our sales team.

-

What are the benefits of using the e 536 function in airSlate SignNow?

Using the e 536 function in airSlate SignNow offers numerous benefits, including enhanced efficiency and improved document security. It reduces paper usage and helps businesses go green while ensuring that signatures are legally binding. This combination of features can signNowly streamline business operations.

-

Can I integrate airSlate SignNow's e 536 feature with other applications?

Yes, airSlate SignNow’s e 536 feature can seamlessly integrate with various third-party applications. This allows users to combine their existing workflows with e 536, enhancing productivity and collaboration. Popular integrations include CRM systems, cloud storage solutions, and project management tools.

-

Is it easy to use the e 536 feature of airSlate SignNow for beginners?

Absolutely! The e 536 feature of airSlate SignNow is designed with user-friendliness in mind, making it accessible for beginners. The intuitive interface guides users through the processes of sending and signing documents, ensuring that even those with minimal technical skills can navigate the system efficiently.

-

What types of documents can I manage using the e 536 feature?

The e 536 feature in airSlate SignNow allows users to manage a wide variety of documents, including contracts, agreements, and forms. This versatility enables businesses to use airSlate SignNow for virtually any document requiring a signature. Its compatibility with different file formats makes it a convenient solution for diverse needs.

-

Are there any security measures associated with the e 536 feature?

Yes, the e 536 feature in airSlate SignNow comes with robust security measures to protect sensitive information. Features such as encryption, secure servers, and compliance with electronic signature regulations ensure that all transactions are safe and secure. Users can have peace of mind knowing that their documents are protected.

Get more for E 536 Form

Find out other E 536 Form

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document