Employee Earnings Form

What is the Employee Earnings Record Form

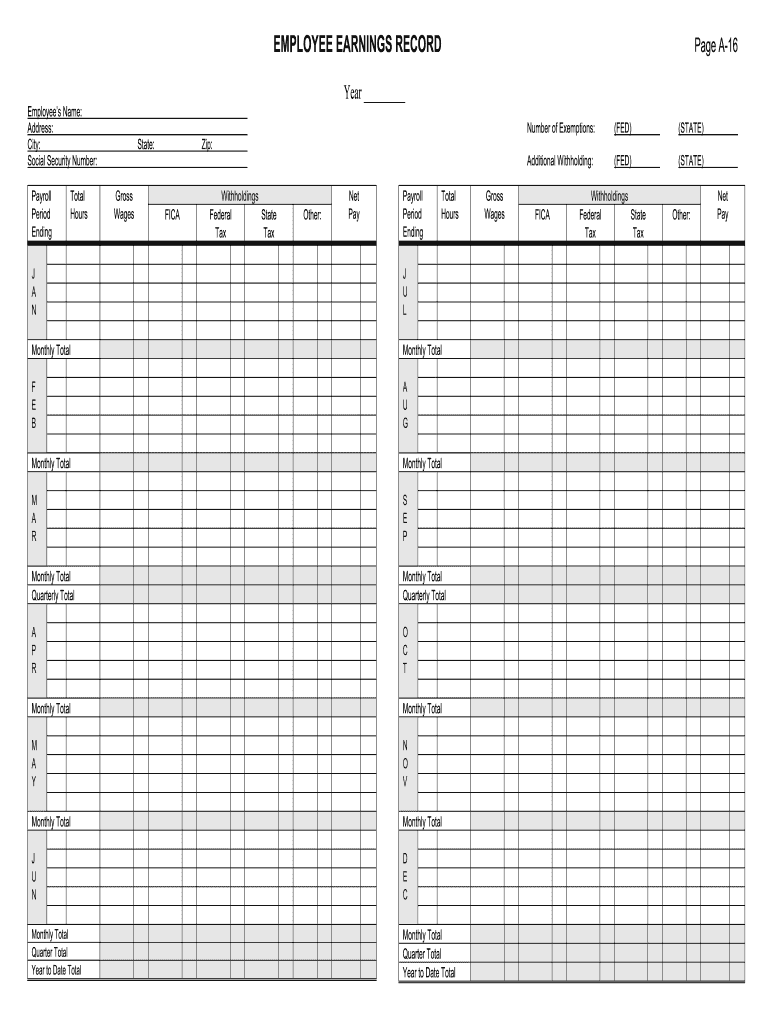

The employee earnings record form is a crucial document used to track an employee's earnings over a specific period. This form typically includes details such as the employee's name, Social Security number, job title, and the total earnings for the reporting period. It is essential for both employers and employees to maintain accurate records of earnings for payroll, tax reporting, and compliance with labor laws.

Steps to Complete the Employee Earnings Record Form

Completing the employee earnings record form involves several straightforward steps:

- Gather necessary employee information, including name, Social Security number, and job title.

- Calculate the total earnings for the specified period, including wages, bonuses, and any deductions.

- Fill in the form accurately, ensuring all fields are completed to avoid errors.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate department or agency as required.

Legal Use of the Employee Earnings Record Form

The employee earnings record form is legally binding when completed accurately and submitted in compliance with applicable laws. It serves as an official record of an employee's earnings, which can be referenced in case of disputes or audits. Employers must ensure that the form adheres to federal and state regulations regarding payroll documentation and employee rights.

Key Elements of the Employee Earnings Record Form

Important components of the employee earnings record form include:

- Employee Information: Name, Social Security number, and job title.

- Earnings Details: Total earnings for the reporting period, including regular and overtime wages.

- Deductions: Any applicable deductions such as taxes, benefits, or retirement contributions.

- Employer Information: Name and contact information of the employer or payroll department.

How to Obtain the Employee Earnings Record Form

Employers can typically obtain the employee earnings record form through their payroll software or human resources department. Additionally, many templates are available online for download. It is important to ensure that the version used complies with current legal requirements and includes all necessary fields for accurate reporting.

Form Submission Methods

The employee earnings record form can be submitted through various methods, depending on the employer's policies and state regulations. Common submission methods include:

- Online: Many employers offer electronic submission through payroll systems.

- Mail: The form can be printed and sent via postal service to the appropriate department.

- In-Person: Employees may also submit the form directly to their employer's HR or payroll office.

Quick guide on how to complete pdf paycheck deduction form

Complete Employee Earnings Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without holdups. Manage Employee Earnings Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Employee Earnings Form with ease

- Obtain Employee Earnings Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Employee Earnings Form to ensure excellent communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the pdf paycheck deduction form

How to make an eSignature for the Pdf Paycheck Deduction Form online

How to make an electronic signature for your Pdf Paycheck Deduction Form in Chrome

How to create an electronic signature for putting it on the Pdf Paycheck Deduction Form in Gmail

How to create an electronic signature for the Pdf Paycheck Deduction Form straight from your smartphone

How to generate an eSignature for the Pdf Paycheck Deduction Form on iOS devices

How to create an eSignature for the Pdf Paycheck Deduction Form on Android devices

People also ask

-

What is an Employee Earnings Form and how is it used?

An Employee Earnings Form is a document that details an employee's income, including wages, bonuses, and deductions. This form is essential for payroll processing and tax reporting, ensuring compliance with financial regulations. With airSlate SignNow, you can easily create, send, and eSign your Employee Earnings Form, streamlining your payroll process.

-

How does airSlate SignNow simplify the process of handling Employee Earnings Forms?

airSlate SignNow simplifies the handling of Employee Earnings Forms by providing a user-friendly platform for document creation and electronic signatures. You can customize your forms, collect necessary information from employees, and securely store signed documents, all in one place. This efficiency saves time and reduces errors in payroll management.

-

Is there a cost associated with using airSlate SignNow for Employee Earnings Forms?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Our plans are designed to be cost-effective, ensuring you get the best value when managing Employee Earnings Forms and other documents. You can choose a plan that best fits your needs and take advantage of our features without breaking the bank.

-

What features does airSlate SignNow offer for Employee Earnings Forms?

airSlate SignNow provides several features for managing Employee Earnings Forms, including customizable templates, real-time collaboration, and secure eSignatures. You can track the status of your documents, send reminders for signing, and access a comprehensive audit trail for compliance purposes. These features make managing Employee Earnings Forms efficient and secure.

-

Can I integrate airSlate SignNow with other software for Employee Earnings Form management?

Absolutely! airSlate SignNow offers seamless integrations with popular HR and accounting software. This allows you to sync your Employee Earnings Forms with your existing systems, enhancing your workflow and ensuring data is consistently updated across platforms.

-

What are the benefits of using airSlate SignNow for Employee Earnings Forms?

Using airSlate SignNow for Employee Earnings Forms offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. By digitizing your forms and utilizing eSignatures, you can expedite your payroll process and minimize the risk of errors. Moreover, our secure platform ensures that sensitive employee information is protected.

-

How secure is the information on my Employee Earnings Forms with airSlate SignNow?

airSlate SignNow prioritizes the security of your Employee Earnings Forms by implementing advanced encryption and compliance measures. Our platform adheres to industry-standard security protocols, ensuring that your employees' sensitive information is safeguarded from unauthorized access. You can trust us to keep your data secure and private.

Get more for Employee Earnings Form

Find out other Employee Earnings Form

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation