05 163 Form

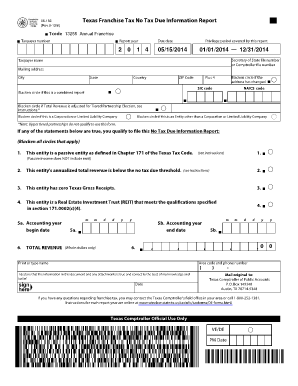

What is the Form 163?

The Form 163, also known as the no tax due information report, is a document used primarily in Texas for reporting tax status. This form is essential for businesses and individuals who need to certify that they do not owe any taxes for a specific reporting period. Understanding the purpose and significance of the Form 163 is crucial for compliance with state tax regulations.

How to Use the Form 163

Using the Form 163 involves several steps to ensure accurate completion. First, gather all necessary information regarding your tax status, including previous tax filings and any relevant financial data. Next, fill out the form with the required details, ensuring that all sections are completed accurately. Once the form is filled out, it can be submitted electronically or via mail, depending on your preference and the requirements set by the Texas Comptroller's office.

Steps to Complete the Form 163

Completing the Form 163 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including previous tax returns and financial statements.

- Access the Form 163 through the official Texas Comptroller website or other authorized sources.

- Fill in your personal or business information accurately, including your name, address, and tax identification number.

- Indicate the tax year for which you are reporting no tax due.

- Review the form for accuracy before submission.

Legal Use of the Form 163

The Form 163 is legally recognized in Texas as a valid document for certifying that no taxes are owed. To ensure its legal standing, it must be completed accurately and submitted to the appropriate state authorities. Compliance with state laws regarding tax reporting is essential to avoid penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 163 can vary depending on the tax year and specific circumstances. It is important to be aware of these deadlines to ensure timely submission. Typically, the form should be filed by the due date of the tax return for the corresponding year. Keeping track of these dates helps maintain compliance with state tax regulations.

Required Documents

To complete the Form 163, certain documents are required. These may include:

- Previous tax returns for verification.

- Financial statements that support your no tax due status.

- Identification documents, such as a driver's license or business registration.

Penalties for Non-Compliance

Failure to file the Form 163 when required can result in penalties imposed by the Texas Comptroller's office. These penalties may include fines or additional taxes owed. It is crucial to understand the implications of non-compliance and to ensure that the form is filed accurately and on time to avoid any financial repercussions.

Quick guide on how to complete 05 163

Effortlessly Prepare 05 163 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed materials, enabling you to find the appropriate template and securely store it digitally. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle 05 163 on any device with airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

The Easiest Way to Edit and Electrically Sign 05 163 with Ease

- Obtain 05 163 and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 05 163 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 163

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 163, and how does airSlate SignNow help with it?

Form 163 is a document often used for specific compliance and regulatory purposes. airSlate SignNow streamlines the completion and signing of form 163 by providing an easy-to-use platform that simplifies document management and ensures secure electronic signatures.

-

Is there a cost associated with using airSlate SignNow for form 163?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Each plan includes features that facilitate the signing and management of documents like form 163, ensuring a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for form 163?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure electronic signatures. These functionalities help streamline the process of filling out and signing form 163, saving time and reducing errors.

-

Can airSlate SignNow integrate with other applications for handling form 163?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Dropbox. This makes managing form 163 easy by allowing users to access, sign, and store documents across multiple platforms seamlessly.

-

What are the benefits of using airSlate SignNow for form 163?

Using airSlate SignNow for form 163 enhances efficiency and reduces processing time. The platform ensures the security and legality of your signatures, which is vital for compliance with regulatory standards surrounding form 163.

-

Is airSlate SignNow user-friendly for signing form 163?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to easily navigate the platform for signing form 163 without any prior technical knowledge, making it accessible for everyone.

-

How secure is airSlate SignNow when managing form 163?

airSlate SignNow prioritizes security with features like data encryption, secure cloud storage, and compliance with industry regulations. This ensures that your sensitive information related to form 163 remains protected and confidential.

Get more for 05 163

- Edinburgh postpartum depression scale form

- Staar science tutorial 30 answer key form

- Emudhra form download

- Maybank account opening form pdf

- Form no fa 02

- Bakery confectionery pension direct deposit form

- Use of form use of this form is mandatory for family child care centers to comply with dcf 250

- Hospice intake form 422241911

Find out other 05 163

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple