Crt 61 Form

What is the CRT 61?

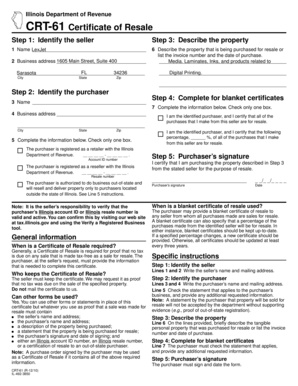

The CRT 61 is an Illinois tax exempt form used primarily by organizations seeking to claim exemption from certain state taxes. This form is essential for entities that meet specific criteria under Illinois tax laws. By completing and submitting the CRT 61, organizations can demonstrate their eligibility for tax-exempt status, which can lead to significant financial savings. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance.

How to Obtain the CRT 61

To obtain the CRT 61 form, individuals or organizations can visit the official Illinois Department of Revenue website. The form is typically available for download in a PDF format, allowing users to print and fill it out. Additionally, some local tax offices may provide physical copies of the form. It is important to ensure that the most current version of the CRT 61 is used, as outdated forms may not be accepted.

Steps to Complete the CRT 61

Completing the CRT 61 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect all relevant details about your organization, including its tax identification number, address, and the specific tax exemptions being claimed.

- Fill out the form: Input the required information accurately, ensuring that all sections are completed. Pay special attention to the eligibility criteria for tax exemption.

- Review for accuracy: Double-check the completed form for any errors or omissions. Inaccuracies can lead to delays or rejection.

- Submit the form: Follow the submission guidelines provided on the form. This may involve mailing it to the appropriate tax authority or submitting it electronically if available.

Legal Use of the CRT 61

The CRT 61 must be used in compliance with Illinois tax laws to be considered legally valid. Organizations must ensure they meet the eligibility criteria for tax exemption before submitting the form. Misuse or fraudulent claims can result in penalties, including fines or loss of tax-exempt status. Understanding the legal implications of the CRT 61 is essential for maintaining compliance and protecting the organization’s interests.

Key Elements of the CRT 61

Several key elements must be included in the CRT 61 for it to be processed correctly:

- Organization Information: The name, address, and tax identification number of the organization claiming the exemption.

- Type of Exemption: A clear indication of the specific tax exemptions being requested.

- Signature: The form must be signed by an authorized representative of the organization, affirming the accuracy of the information provided.

Examples of Using the CRT 61

Organizations such as non-profits, educational institutions, and religious entities often utilize the CRT 61 to claim tax exemptions. For instance, a non-profit organization that provides community services may use the CRT 61 to exempt itself from sales tax on purchases made for its operations. Similarly, a religious institution may claim exemptions related to property taxes through this form. These examples illustrate the practical applications of the CRT 61 in various organizational contexts.

Quick guide on how to complete crt 61 77984443

Easily prepare Crt 61 on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and safely retain it online. airSlate SignNow provides all the tools you require to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage Crt 61 on any system using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to adjust and electronically sign Crt 61 effortlessly

- Locate Crt 61 and select Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, either by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Crt 61 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crt 61 77984443

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the crt 61 feature in airSlate SignNow?

The crt 61 feature in airSlate SignNow allows users to efficiently manage and automate document signing processes. It streamlines workflows, ensuring that all parties can sign documents easily and securely, enhancing productivity in document management.

-

How much does crt 61 cost with airSlate SignNow?

The pricing for the crt 61 feature within airSlate SignNow is designed to be cost-effective, catering to businesses of all sizes. You can start with a free trial to explore its functionalities, and pricing plans vary based on features and user requirements.

-

What benefits does crt 61 offer for businesses?

The crt 61 feature in airSlate SignNow offers numerous benefits, including improved efficiency, reduced turnaround time for document signing, and enhanced security for sensitive information. It helps businesses save time and resources while ensuring compliance with digital signature regulations.

-

Can I integrate crt 61 with other software solutions?

Yes, airSlate SignNow offers seamless integrations with various software solutions, making it easy to incorporate the crt 61 feature into your existing workflows. This capability allows for enhanced collaboration across platforms like CRM and project management tools.

-

Is the crt 61 feature user-friendly?

Absolutely! The crt 61 feature in airSlate SignNow is designed with user experience in mind, ensuring that even those less familiar with digital tools can navigate it easily. Its intuitive interface simplifies the signing process for all users.

-

What types of documents can be signed using crt 61?

With crt 61, you can sign a wide range of documents, including contracts, agreements, and forms, allowing for comprehensive document management. The capability to handle various document types increases flexibility and functionality for your business.

-

How secure is the crt 61 signing process?

The crt 61 feature in airSlate SignNow ensures a high level of security for your documents. It employs advanced encryption and complies with industry standards, keeping your sensitive information safe during the signing process.

Get more for Crt 61

Find out other Crt 61

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast