Ptax 329 Form Whiteside County

What is the Ptax 329 Form Whiteside County

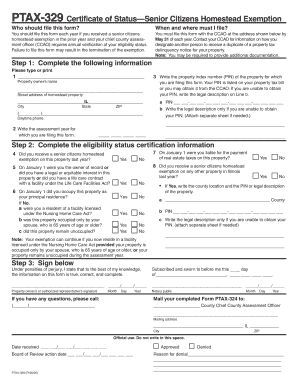

The Ptax 329 form in Whiteside County is a property tax exemption application designed for individuals who own property and seek to claim specific exemptions. This form is particularly relevant for homeowners who may qualify for various tax relief programs, which can significantly reduce their property tax burden. The form collects essential information about the property and the owner, ensuring that applicants meet the necessary criteria to benefit from these exemptions.

How to obtain the Ptax 329 Form Whiteside County

To obtain the Ptax 329 form in Whiteside County, individuals can visit the official Whiteside County government website or contact the local assessor's office directly. The form is typically available for download in a PDF format, allowing users to print it for completion. Additionally, physical copies may be available at the assessor's office, where staff can assist with any questions regarding the application process.

Steps to complete the Ptax 329 Form Whiteside County

Completing the Ptax 329 form involves several key steps:

- Gather necessary documentation, including proof of ownership and any relevant tax identification numbers.

- Fill out the form accurately, providing all required information about the property and the owner.

- Review the completed form for accuracy and completeness, ensuring that all sections are filled out as required.

- Submit the form by the specified deadline to the appropriate office, either electronically or by mail.

Legal use of the Ptax 329 Form Whiteside County

The Ptax 329 form is legally binding once submitted and accepted by the relevant authorities. It is essential for applicants to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. The form must comply with local laws and regulations governing property tax exemptions to be considered valid.

Key elements of the Ptax 329 Form Whiteside County

Key elements of the Ptax 329 form include:

- Property identification details, such as the parcel number and address.

- Owner information, including name, contact details, and tax identification number.

- Specific exemption types being applied for, along with supporting documentation.

- Signature of the applicant, affirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Ptax 329 form can be submitted through various methods to accommodate different preferences:

- Online: Some counties may offer an electronic submission option through their official website.

- Mail: Completed forms can be mailed to the appropriate office, ensuring they are sent before the deadline.

- In-Person: Applicants may also choose to deliver the form directly to the local assessor's office for immediate processing.

Quick guide on how to complete ptax 329 form whiteside county

Complete Ptax 329 Form Whiteside County easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Ptax 329 Form Whiteside County on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign Ptax 329 Form Whiteside County effortlessly

- Find Ptax 329 Form Whiteside County and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Ptax 329 Form Whiteside County and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 329 form whiteside county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 329 form whiteside county?

The PTAX 329 form whiteside county is a property tax exemption application for specific property classifications. It is essential for residents looking to reduce their property tax liability. Understanding how to fill out this form can ensure you maximize your potential savings on property taxes.

-

How can airSlate SignNow help me with the PTAX 329 form whiteside county?

airSlate SignNow offers a user-friendly platform to eSign and submit the PTAX 329 form whiteside county efficiently. With its intuitive interface, you can prepare the form, collect necessary signatures, and send it directly to the relevant county offices. This streamlines the process and minimizes the risk of errors.

-

What are the pricing options for using airSlate SignNow for the PTAX 329 form whiteside county?

airSlate SignNow provides various pricing plans that cater to different needs. Whether you are a small business or a larger organization, there’s a plan that allows you to prepare and sign the PTAX 329 form whiteside county affordably. Additionally, you can take advantage of a free trial to see if it fits your requirements.

-

Is airSlate SignNow secure for signing the PTAX 329 form whiteside county?

Yes, airSlate SignNow ensures robust security for all documents, including the PTAX 329 form whiteside county. With advanced encryption and secure access protocols, your sensitive information remains safe and compliant with regulations. Trust us to protect your data throughout the eSigning process.

-

Can I integrate airSlate SignNow with other tools for the PTAX 329 form whiteside county?

Absolutely! airSlate SignNow offers various integrations with popular tools to facilitate the completion of the PTAX 329 form whiteside county. Whether it’s CRM systems, document management platforms, or email services, you can easily connect and enhance your workflow.

-

What features does airSlate SignNow offer for completing the PTAX 329 form whiteside county?

airSlate SignNow includes features like templates, bulk sending, and real-time tracking that are especially useful for processing the PTAX 329 form whiteside county. These features help ensure that the form is correctly filled out, signed, and submitted on time, making the experience hassle-free.

-

Will airSlate SignNow help me save time with the PTAX 329 form whiteside county?

By using airSlate SignNow, you can signNowly reduce the time needed to prepare and file the PTAX 329 form whiteside county. The platform automates many steps in the signing process, allowing you to focus on other important tasks. This efficiency reduces delays and streamlines your operations.

Get more for Ptax 329 Form Whiteside County

Find out other Ptax 329 Form Whiteside County

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe