Sales Tax Word Problems Worksheet Form

What is the Sales Tax Word Problems Worksheet

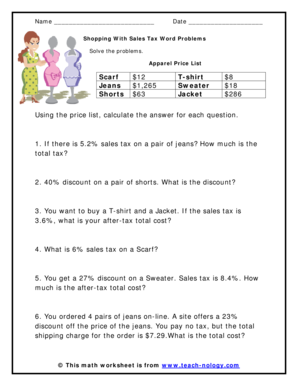

The sales tax word problems worksheet is an educational tool designed to help students and individuals practice calculating sales tax in various scenarios. This worksheet typically includes a series of math problems that require the application of sales tax rates to different purchase amounts. By working through these problems, users can enhance their understanding of how sales tax affects total costs during transactions.

How to use the Sales Tax Word Problems Worksheet

To effectively use the sales tax word problems worksheet, follow these steps:

- Begin by reviewing the sales tax rates applicable in your state, as these can vary.

- Read each problem carefully, noting the purchase amount and the sales tax rate.

- Calculate the sales tax by multiplying the purchase amount by the sales tax rate.

- Add the calculated sales tax to the original purchase amount to find the total cost.

- Check your answers against any provided solutions to ensure accuracy.

Key elements of the Sales Tax Word Problems Worksheet

Several key elements are essential for the effectiveness of the sales tax word problems worksheet:

- Realistic Scenarios: Problems should reflect typical shopping situations, such as buying clothing, electronics, or groceries.

- Varied Difficulty Levels: Include problems that range from basic calculations to more complex scenarios involving multiple items or discounts.

- Clear Instructions: Each problem should come with clear instructions to guide users through the calculation process.

- Answer Key: Providing an answer key allows users to verify their calculations and learn from any mistakes.

Steps to complete the Sales Tax Word Problems Worksheet

Completing the sales tax word problems worksheet involves a systematic approach:

- Gather necessary materials, including a calculator and a pencil.

- Read through all the problems before starting to get an overview.

- Work on one problem at a time, ensuring to write down your calculations.

- Double-check your work for accuracy, particularly the multiplication and addition steps.

- Review the answer key to understand any discrepancies in your calculations.

Examples of using the Sales Tax Word Problems Worksheet

Examples can illustrate how to apply the sales tax word problems worksheet effectively:

- A problem may state: "You buy a shirt for $30, and the sales tax rate is six percent. What is the total cost?"

- Another example could be: "If you purchase three books for $15 each, and the sales tax is eight percent, what will be the total amount due?"

Legal use of the Sales Tax Word Problems Worksheet

The sales tax word problems worksheet is a legitimate educational resource that can be used in various settings, including classrooms and tutoring sessions. It is important to ensure that the worksheet complies with any applicable educational standards and that it is used solely for learning purposes. This helps maintain its integrity as a teaching tool while fostering a better understanding of sales tax calculations among users.

Quick guide on how to complete sales tax word problems worksheet

Effortlessly Prepare Sales Tax Word Problems Worksheet on Any Device

Document management online has gained signNow traction among businesses and individuals. It serves as an ideal sustainable substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without hindrances. Manage Sales Tax Word Problems Worksheet on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric task today.

How to Edit and eSign Sales Tax Word Problems Worksheet with Ease

- Locate Sales Tax Word Problems Worksheet and click on Get Form to commence.

- Use the tools we provide to fill out your document.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which requires mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Sales Tax Word Problems Worksheet to ensure flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax word problems worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the sales tax math problems worksheet?

The sales tax math problems worksheet includes a variety of practical exercises that help users understand how to calculate sales tax on different transactions. It features real-world scenarios that guide learners through the steps needed to solve each problem, reinforcing their math skills and sales tax knowledge.

-

How can the sales tax math problems worksheet benefit my business?

The sales tax math problems worksheet is designed to enhance your employees' understanding of sales tax calculations, which can lead to improved accuracy in financial operations. By utilizing this worksheet, businesses can ensure compliance with tax regulations while minimizing errors in tax reporting.

-

Is the sales tax math problems worksheet suitable for all skill levels?

Yes, the sales tax math problems worksheet is crafted to cater to various skill levels, from beginners to advanced learners. It allows users to progressively build their confidence and competence in tackling sales tax calculations.

-

How do I access the sales tax math problems worksheet?

Upon subscribing to airSlate SignNow's document management services, you will gain access to the sales tax math problems worksheet. It is easily downloadable and available in various formats to suit your needs.

-

Are there any additional features included with the sales tax math problems worksheet?

Along with the sales tax math problems worksheet, our solution includes interactive tools that can help users simulate real-life sales tax scenarios. These features enhance learning and offer a more engaging experience, making the math problems more relatable.

-

Can the sales tax math problems worksheet be integrated into existing training programs?

Absolutely! The sales tax math problems worksheet can be seamlessly integrated into your current training programs. This allows you to enrich your curriculum and provide practical math skills that align with everyday business operations.

-

What is the pricing for the sales tax math problems worksheet?

The sales tax math problems worksheet is part of our comprehensive platform offering flexible pricing plans. You can choose a plan that fits your business needs, which includes access to various educational resources, including math worksheets.

Get more for Sales Tax Word Problems Worksheet

Find out other Sales Tax Word Problems Worksheet

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple