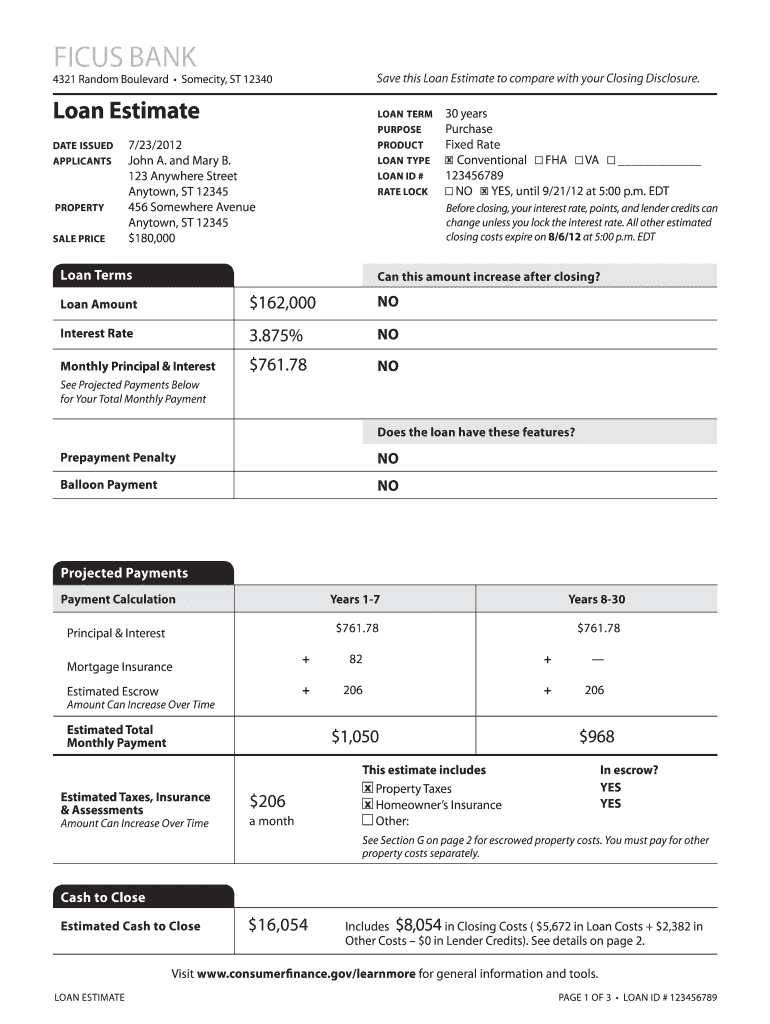

Loan Estimate Form Excel

What is the construction estimate format for bank loan?

The construction estimate format for bank loan is a detailed document that outlines the projected costs associated with a construction project. This format is essential for individuals or businesses seeking financing from banks or lending institutions. It typically includes various cost categories such as materials, labor, permits, and overhead expenses. By providing a comprehensive breakdown of expected costs, this estimate helps lenders assess the financial viability of the project and determine the loan amount that can be approved.

Key elements of the construction estimate format for bank loan

A well-structured construction estimate format includes several key elements that are crucial for clarity and accuracy. These elements typically consist of:

- Project Description: A brief overview of the construction project, including its purpose and scope.

- Cost Breakdown: Detailed itemization of costs, including materials, labor, equipment, and any additional expenses.

- Timeline: An estimated timeline for project completion, which can influence loan approval.

- Contingency Fund: A percentage of the total estimated cost set aside for unexpected expenses.

- Signature Section: A designated area for signatures to validate the estimate and signify agreement.

Steps to complete the construction estimate format for bank loan

Completing a construction estimate format for bank loan involves several steps to ensure accuracy and comprehensiveness. These steps include:

- Gather Information: Collect all necessary data regarding the project, including plans, specifications, and any relevant regulations.

- Itemize Costs: Break down costs into categories such as materials, labor, and overhead to provide a clear financial picture.

- Calculate Totals: Sum all costs and include a contingency fund to cover unforeseen expenses.

- Review and Revise: Double-check the estimate for accuracy and make necessary adjustments before finalizing.

- Obtain Signatures: Ensure that all parties involved sign the estimate to validate the document.

Legal use of the construction estimate format for bank loan

The legal use of the construction estimate format for bank loan hinges on compliance with eSignature laws and regulations. In the United States, electronic signatures are recognized as legally binding under the ESIGN Act and UETA. To ensure the estimate is legally valid, it is important to use a reliable eSignature solution that provides a digital certificate, confirming the authenticity of the signatures. This legal framework helps protect both the borrower and the lender by establishing a clear agreement on the terms outlined in the estimate.

Examples of using the construction estimate format for bank loan

Utilizing the construction estimate format for bank loan can vary depending on the project type and scope. Here are a few examples:

- Residential Construction: Homeowners seeking to build a new house may use this format to secure funding from a bank.

- Commercial Projects: Businesses planning to construct office buildings or retail spaces can present detailed estimates to attract investors or secure loans.

- Renovation Projects: Individuals or companies looking to renovate existing structures can provide estimates to demonstrate the financial requirements for the project.

How to obtain the construction estimate format for bank loan

Obtaining a construction estimate format for bank loan can be done through various means. Many online resources offer templates that can be customized to fit specific project needs. Additionally, consulting with a contractor or construction professional can provide insights into creating a comprehensive estimate. It is also possible to find software solutions that facilitate the creation of detailed estimates, ensuring all necessary components are included for loan applications.

Quick guide on how to complete home loan estimate format

Easily prepare Loan Estimate Form Excel on any device

Digital document management has gained popularity among both companies and individuals. It offers an ideal eco-friendly solution to conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Loan Estimate Form Excel on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Loan Estimate Form Excel effortlessly

- Find Loan Estimate Form Excel and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or choose to download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Loan Estimate Form Excel to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If you left a survey for burglars to fill out the next time they ransacked your home, how would they rate the experience?

How did you learn about us?Rumors about rural houses having little Security.Location: 5/10Location was alright. Around 500 meters to the nearest neighbor. But unfortunately an hour away from any sizable population (20,000 plus being a sizable population.)Transportation: 10/10Transportation was top notch. The owners of the property never lock their Minivan or Pick-up truck. The keys are always left in the vehicles. Both are moderately new and somewhat non-descriptive so a perfect getaway vehicle. Not only did they provide vehicles they also kept trailers in a easily accessible unlocked shed.Security: 9/10Security was lax. There is a gate but it isn’t locked. Doors aren’t locked unless the house is left unoccupied for more than 2 weeks. No cameras made it really easy. They did have a dog which made it a bit of a pain. He was easily disposed of as he was just a Labrador Retriever puppy. Owners are very light sleepers don’t rob if they’re around.Products: 10/10No place has better selection. The place had 3 DSLR cameras, 3 Workstation class desktops, 3 tablets, 4 drones, 6 Smartphones, 9 external monitors and 11 laptops. All of the items were of premium design and value (aka Apples or equivalent). The freezers and shelves were well stocked the rest of the property was much more appealing though.They also had a shop on the property with many tools ranging from mechanics to carpentry to fabrication. The tools were of medium quality. The shop also stored 2 ATV for added convenience. The shop wasn’t the jackpot though.The shed was the real treasure trove. This drive in shed held heavy equipment all with the keys in the ignition for easy accessibility. The average equipment’s value was around $100,000, with a combined value of around $1.5 Million. Unfortunately the heavy equipment is hard to transport and the market is too small to get away with it.The products all seemed gift wrapped for the taking. Everything was easy to find as it looked organized.Laws in the area: 10/10Owners aren’t allowed to use lethal force or even have a premeditated weapon for self defense. A robber in the area once accidentally locked himself into the garage place he was robbing. As the owners did not come home for a couple days he resorted to eating dog food. The end result was the owners were charged for negligence of the robber. Laws almost protect us. Owners are not supposed to attack us in any way or they may be charged.Would you recommend to your friends?If everybody is gone a resounding yes. Unfortunately that’s not very often as the house is occupied by Home-schooling kids, a Writer and the owner is a farmer who mostly works on property. Also if you intend to use brute force, bring a weapon. All the occupants are big. The average height is around 6 feet.BTW bring friends to help loot. It really requires a team of people to loot the place.

-

What are the criteria for SBI home loan eligibility?

SBI offers home loan[1] only post thorough scrutiny for the applicant’s request. It has fast approval processes with minimal and easy documentation. The list for the same is here:Footnotes[1] https://www.mymoneykarma.com/hom...

-

How do you qualify for a home loan with poor credit?

As a rule, poor credit advances are expensive, however you can discover pleasant arrangements through research. In this article, we will give counsel that individuals poor credit may discover valuable when searching for advances.For one thing, recollect: on the off chance that you apply for a verified poor credit advance you will be offered preferred arrangements over on the off chance that you apply for unbound Loans for poor credit.Second, you have to guarantee that mentioning poor credit advances won't contrarily influence your credit further. Credit request influence FICO assessment, and numerous banks will ask about your FICO score when you approach them for an advance. About 10% of your FICO assessment will think about what number of credit request were made. A few request are "more terrible" than others, implying that they will influence your score more than others.There are two kinds of request: "willful"/"hard" (destroyed to apply for new credit) and "uncontrolled"/"delicate" (pulled by existing leasers, approved Visas sponsors, and such). The "hard request" check the most, while "delicate" may not tally by any means. There are exemptions: a few request of a comparative kind will be considered one request, in the event that they were done in a given time frame (around about fourteen days). These request are: home loan, auto, and understudy advance. Sadly, Visa and bank advance acknowledge request are considered discrete, which you have to shoulder at the top of the priority list when searching for Loans for poor credit.Our recommendation depends on the data we found through various assets, and may not be totally exceptional. Furthermore, organizations giving credit scoring calculations are hesitant to give the majority of the insights concerning their equation. Thus, endeavor to assemble more data in such manner.We can propose a decent method to abstain from having your FICO rating drop by a couple of focuses when searching for poor credit advances – don't give your name or other individual data to the moneylender, so they can't get your credit report. Essentially approach the loan specialist for general rates for people of your gathering: salary, uses, credit value, property possession status, and such.When you find a decent arrangement for Loans for poor credit, make a point to discover increasingly about this moneylender. The central matters to get comfortable with are: expenses (administration, exchange), punishments (late/early credit installment), and notoriety. You can discover data about this current organization's notoriety on the web, for example, at gatherings and survey locales. This data can here and there be precious, as genuine clients of this organization will tell it for what it's worth, particularly in the event that they are disappointed with this loan specialist.Keep in mind: don't obtain beyond what you can bear to reimburse easily and in an opportune way. It is dependably a smart thought to acquire less with Loans for poor credit, to make sure that you can pay this cash back effortlessly.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

Create this form in 5 minutes!

How to create an eSignature for the home loan estimate format

How to create an electronic signature for the Home Loan Estimate Format in the online mode

How to create an eSignature for the Home Loan Estimate Format in Google Chrome

How to generate an eSignature for signing the Home Loan Estimate Format in Gmail

How to generate an electronic signature for the Home Loan Estimate Format straight from your smart phone

How to make an electronic signature for the Home Loan Estimate Format on iOS

How to create an electronic signature for the Home Loan Estimate Format on Android

People also ask

-

What is the Loan Estimate Form Excel and how can I use it?

The Loan Estimate Form Excel is a user-friendly template designed to help borrowers understand their mortgage costs. You can easily customize it to input your loan details, allowing for clear comparisons of loan offers. Using this form simplifies the process of evaluating loan terms and aids in making informed financial decisions.

-

How does airSlate SignNow integrate with the Loan Estimate Form Excel?

With airSlate SignNow, you can seamlessly upload your Loan Estimate Form Excel for electronic signatures. This integration allows you to send the form directly to clients for eSigning, ensuring a quick and efficient document workflow. The platform enhances your productivity by combining the ease of Excel formatting with advanced eSignature capabilities.

-

Is there a cost associated with using the Loan Estimate Form Excel in SignNow?

Using the Loan Estimate Form Excel within airSlate SignNow is cost-effective, as the platform offers affordable pricing plans tailored to various business needs. You can choose from different subscription options that grant access to unlimited document signing and storage. This means you can efficiently manage your loan documents without breaking the bank.

-

What features does the Loan Estimate Form Excel provide?

The Loan Estimate Form Excel template includes fields for loan amount, interest rates, and estimated monthly payments, making it comprehensive for users. Additionally, it allows for calculations and comparisons of costs, providing a clear understanding of financial implications. This feature set is particularly valuable for both lenders and borrowers looking to streamline their loan processes.

-

Can I customize the Loan Estimate Form Excel for my business?

Yes, the Loan Estimate Form Excel is fully customizable to meet your specific business needs. You can modify sections, add your branding, and adjust the layout to reflect your company’s identity. This flexibility ensures that the form aligns with your business processes while maintaining compliance with lending regulations.

-

How does the Loan Estimate Form Excel improve the loan application process?

The Loan Estimate Form Excel enhances the loan application process by providing clear and organized information about loan terms. This clarity helps borrowers understand their options better, leading to more informed decision-making. By using this form, lenders can also streamline client communication and reduce the time spent on explaining loan details.

-

What are the benefits of using airSlate SignNow for the Loan Estimate Form Excel?

Using airSlate SignNow for the Loan Estimate Form Excel offers numerous benefits, including rapid eSigning, document tracking, and secure storage. The platform ensures that your loan documents remain accessible and organized, which can boost client satisfaction. Additionally, it simplifies compliance with legal standards, making it a robust solution for mortgage professionals.

Get more for Loan Estimate Form Excel

Find out other Loan Estimate Form Excel

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer