Eic Schedule Form

What is the Eic Schedule Form

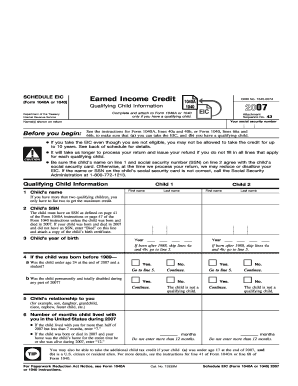

The Eic Schedule Form, also known as the Earned Income Credit Schedule, is a crucial document used by taxpayers in the United States to claim the Earned Income Tax Credit (EITC). This form helps individuals and families with low to moderate income reduce their tax liability and potentially receive a refund. The EIC Schedule Form is typically filed alongside the federal tax return and requires detailed information about income, filing status, and qualifying children, if applicable.

How to use the Eic Schedule Form

To effectively use the Eic Schedule Form, begin by gathering all necessary documentation, including income statements, Social Security numbers for qualifying children, and any other relevant financial information. Fill out the form accurately, ensuring all details are correct to avoid delays or issues with your tax return. Once completed, attach the EIC Schedule Form to your federal tax return and submit it to the IRS. It is essential to review the form for completeness and accuracy before submission to ensure eligibility for the credit.

Steps to complete the Eic Schedule Form

Completing the Eic Schedule Form involves several key steps:

- Gather necessary documents, including W-2 forms and any other income records.

- Determine your eligibility for the Earned Income Credit based on your income and filing status.

- Fill out the form, providing accurate information about your income and any qualifying children.

- Review the form for accuracy, ensuring all entries are correct.

- Attach the completed form to your federal tax return before submission.

Legal use of the Eic Schedule Form

The Eic Schedule Form is legally binding when filled out and submitted correctly. It is essential to comply with IRS regulations regarding eligibility and documentation. Falsifying information on the form can lead to penalties, including fines and disqualification from receiving the credit in future tax years. Understanding the legal implications of the EIC Schedule Form ensures that taxpayers can confidently claim the credit while adhering to tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Eic Schedule Form align with the federal tax return deadlines. Generally, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines or extensions announced by the IRS to ensure timely submission of the EIC Schedule Form and avoid penalties.

Required Documents

To complete the Eic Schedule Form, taxpayers must provide several essential documents, including:

- W-2 forms from employers showing earned income.

- 1099 forms for additional income sources, if applicable.

- Social Security numbers for all qualifying children.

- Any other relevant financial documents that support income claims.

Eligibility Criteria

Eligibility for claiming the Earned Income Credit using the Eic Schedule Form depends on several factors, including:

- Your filing status (single, married filing jointly, etc.).

- Your earned income level, which must fall below specific thresholds set by the IRS.

- The number of qualifying children you have, if any.

- Meeting residency requirements in the United States for the tax year.

Quick guide on how to complete eic schedule form

Effortlessly Prepare Eic Schedule Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Eic Schedule Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Eic Schedule Form seamlessly

- Locate Eic Schedule Form and click on Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Eic Schedule Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eic schedule form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Eic Schedule Form?

An Eic Schedule Form is a standardized document used for tracking and reporting financial information. With airSlate SignNow, you can easily create, manage, and eSign your Eic Schedule Form, ensuring accuracy and compliance with financial regulations.

-

How does airSlate SignNow streamline the Eic Schedule Form process?

airSlate SignNow simplifies the Eic Schedule Form process by offering a user-friendly interface and customizable templates. This allows users to quickly fill out and send their forms electronically, reducing the time spent on paperwork.

-

Can I integrate airSlate SignNow with other software for Eic Schedule Form management?

Yes, airSlate SignNow offers a range of integrations with popular software solutions, making it easy to manage your Eic Schedule Form alongside your existing tools. This ensures seamless workflows and enhances productivity.

-

What are the pricing options for using airSlate SignNow with the Eic Schedule Form?

airSlate SignNow provides flexible pricing plans that accommodate businesses of all sizes. You can choose a plan that fits your needs, allowing you to efficiently manage your Eic Schedule Form while staying within budget.

-

Is it easy to access and edit an Eic Schedule Form in airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily access and edit their Eic Schedule Form from any device. The platform ensures that you can make necessary changes quickly and conveniently, no matter where you are.

-

What benefits does airSlate SignNow offer for Eic Schedule Form eSigning?

Using airSlate SignNow for eSigning your Eic Schedule Form provides numerous benefits, including enhanced security, audit trails, and the ability to sign from anywhere. This simplifies the signing process and improves efficiency.

-

Are there any templates available for the Eic Schedule Form?

Yes, airSlate SignNow offers a variety of customizable templates for the Eic Schedule Form. These templates help you save time and ensure that all required fields are completed accurately.

Get more for Eic Schedule Form

- Coyote application form

- Avid prepaid card form

- Sample of a choir form

- Printable ca 17 form

- Job fair form

- Form 411033 04 10 application for replacement of i

- Nwcg task book for the position of financeadministration section chief type 1 fsc1 form

- Financeadministration section chief type 2 fsc2 financeadministration section chief type 1 fsc1 fsc2 fsc1 position task book form

Find out other Eic Schedule Form

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later