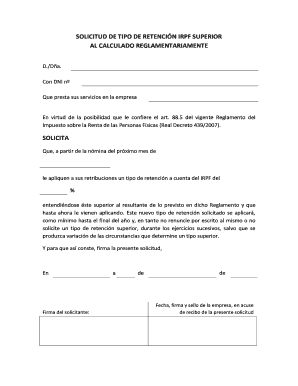

SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR Form

What is the solicitud de tipo de retención IRPF superior?

The solicitud de tipo de retención IRPF superior is a formal request used by taxpayers in the United States to adjust their income tax withholding. This form allows individuals to request a higher withholding rate than the standard rate calculated by the IRS. This adjustment may be necessary for various reasons, including changes in income, additional sources of income, or to ensure that adequate taxes are withheld to avoid owing money at tax time.

Steps to complete the solicitud de tipo de retención IRPF superior

Completing the solicitud de tipo de retención IRPF superior involves several key steps:

- Gather necessary information, such as your Social Security number, income details, and any deductions or credits that may apply.

- Obtain the correct form, which can typically be downloaded in Word format for easy editing.

- Fill out the form accurately, ensuring that all required fields are completed, including your personal information and the desired withholding rate.

- Review the completed form for any errors or omissions before submission.

- Submit the form to your employer or the appropriate tax authority as required.

Legal use of the solicitud de tipo de retención IRPF superior

The legal use of the solicitud de tipo de retención IRPF superior is governed by IRS regulations. This form must be filled out accurately and submitted to ensure compliance with tax laws. Failure to use the form correctly may result in incorrect withholding, which can lead to tax liabilities or penalties. It is essential to keep a copy of the submitted form for your records and to ensure that your employer processes the request appropriately.

Required documents for the solicitud de tipo de retención IRPF superior

When completing the solicitud de tipo de retención IRPF superior, certain documents may be required to support your request:

- Your most recent pay stub, which provides details about your current withholding and income.

- Any additional income statements, such as 1099 forms, if applicable.

- Documentation of deductions or credits that may affect your tax situation.

Filing deadlines for the solicitud de tipo de retención IRPF superior

Filing deadlines for the solicitud de tipo de retención IRPF superior are typically aligned with tax year deadlines. It is advisable to submit the form as soon as any changes in your financial situation occur to ensure that the correct withholding rate is applied. Generally, changes should be submitted before the end of the tax year to affect withholding for that year.

Examples of using the solicitud de tipo de retención IRPF superior

There are several scenarios in which a taxpayer might use the solicitud de tipo de retención IRPF superior:

- A self-employed individual expecting higher income may request a higher withholding rate to cover potential tax liabilities.

- A taxpayer who has recently received a raise may wish to increase their withholding to avoid underpayment at tax time.

- Individuals with multiple income sources may find it necessary to adjust their withholding to account for the total income received throughout the year.

Quick guide on how to complete solicitud de tipo de retencin irpf superior

Effortlessly Prepare SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR with Ease

- Locate SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, either via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Modify and electronically sign SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the solicitud de tipo de retencin irpf superior

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'modelo solicitud aumento irpf'?

The 'modelo solicitud aumento irpf' is a formal request used to apply for an increase in the personal income tax (IRPF) in Spain. This template simplifies the process for individuals seeking adjustments to their tax obligations. By utilizing airSlate SignNow, you can easily fill out and send this model electronically.

-

How can airSlate SignNow help me with the 'modelo solicitud aumento irpf'?

airSlate SignNow offers a user-friendly platform to create, edit, and eSign the 'modelo solicitud aumento irpf'. Our tool streamlines the document preparation process, ensuring that you can submit your request efficiently and securely. Plus, it minimizes paperwork, enhancing your overall experience.

-

Is there a cost associated with using airSlate SignNow for the 'modelo solicitud aumento irpf'?

Yes, airSlate SignNow provides various pricing plans based on your needs. The cost-effective solutions we offer ensure that you can manage your documents, including the 'modelo solicitud aumento irpf', without breaking the bank. Check our pricing page for detailed information on the plans available.

-

What are the key features of airSlate SignNow that benefit my 'modelo solicitud aumento irpf' submission?

airSlate SignNow includes features such as electronic signatures, document templates, and secure storage, all of which are beneficial for completing your 'modelo solicitud aumento irpf' submission. Additionally, our platform allows for collaborative editing and real-time updates, making the process seamless and efficient.

-

Can I integrate airSlate SignNow with other tools for managing my 'modelo solicitud aumento irpf'?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enabling you to manage your 'modelo solicitud aumento irpf' alongside your other business tools. Whether you use CRM systems or cloud storage, our integrations enhance your productivity and streamline your documentation process.

-

What are the benefits of using airSlate SignNow for my tax-related documents like the 'modelo solicitud aumento irpf'?

Using airSlate SignNow for your tax-related documents, including the 'modelo solicitud aumento irpf', offers numerous benefits such as reduced turnaround time, enhanced security, and improved accuracy. Our platform's ease of use allows you to focus on your financial matters without worrying about complicated procedures.

-

Is support available if I have questions about the 'modelo solicitud aumento irpf' on airSlate SignNow?

Yes, airSlate SignNow provides customer support to assist you with any inquiries regarding the 'modelo solicitud aumento irpf' or the platform itself. Our support team is ready to help you navigate any challenges and ensure that your experience is as smooth as possible.

Get more for SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR

Find out other SOLICITUD DE TIPO DE RETENCIN IRPF SUPERIOR

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online