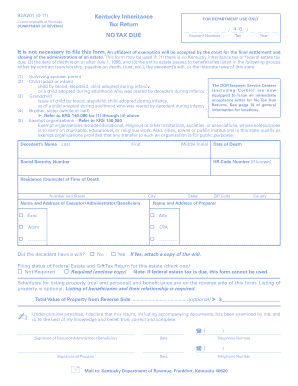

Kentucky Inheritance Tax Form

What is the Kentucky Inheritance Tax

The Kentucky inheritance tax is a tax imposed on the transfer of property from a deceased person to their heirs or beneficiaries. This tax is calculated based on the value of the estate and the relationship between the deceased and the inheritor. In Kentucky, the tax rate varies depending on the relationship to the deceased, with closer relatives typically facing lower rates. The tax is applicable to both real and personal property, and it is essential for beneficiaries to understand their obligations under this law.

Steps to Complete the Kentucky Inheritance Tax

Completing the Kentucky inheritance tax forms involves several key steps to ensure compliance and accuracy. First, gather all necessary documentation, including the will, property valuations, and any previous tax returns related to the estate. Next, determine the appropriate form to use, which may include the Kentucky inheritance tax return or the affidavit of exemption. After filling out the forms, review them carefully for any errors or omissions. Finally, submit the completed forms to the Kentucky Department of Revenue by the deadline, along with any required payments.

Required Documents

To complete the Kentucky inheritance tax forms, several documents are necessary. These typically include:

- The decedent's will, if applicable.

- Death certificate of the deceased.

- Property appraisals or valuations.

- Documentation of debts and expenses related to the estate.

- Previous tax returns, if relevant.

Having these documents ready will facilitate a smoother process when filling out the forms.

Form Submission Methods

In Kentucky, inheritance tax forms can be submitted through various methods. Beneficiaries may choose to file online, which offers a convenient and efficient way to complete the process. Alternatively, forms can be mailed directly to the Kentucky Department of Revenue or submitted in person at designated offices. Each method has its own advantages, and it is important to choose the one that best suits your needs and timeline.

Penalties for Non-Compliance

Failure to comply with Kentucky inheritance tax requirements can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is crucial for beneficiaries to be aware of their responsibilities and ensure that all forms are submitted accurately and on time to avoid these consequences. Understanding the penalties associated with non-compliance can help motivate timely and correct filing.

Eligibility Criteria

Eligibility for the Kentucky inheritance tax depends on several factors, including the relationship to the deceased and the value of the inherited property. Generally, all beneficiaries receiving property from an estate are subject to the tax, but exemptions may apply based on the relationship to the decedent. Spouses and children often qualify for lower rates or exemptions, while distant relatives may face higher tax obligations. Understanding these criteria is essential for accurate tax planning.

Quick guide on how to complete kentucky inheritance tax

Complete Kentucky Inheritance Tax effortlessly on any device

Digital document management has become popular with businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and safely preserve it online. airSlate SignNow offers all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Kentucky Inheritance Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Kentucky Inheritance Tax with ease

- Obtain Kentucky Inheritance Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting document searches, or mistakes that require new copies to be printed. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Edit and electronically sign Kentucky Inheritance Tax while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky inheritance tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are KY inheritance tax forms and why are they important?

KY inheritance tax forms are documents required to report and pay any inheritance tax owed in Kentucky when a beneficiary inherits assets. These forms are crucial for compliance with state tax laws and help ensure that the correct amount of tax is paid on inherited property.

-

How can airSlate SignNow assist with KY inheritance tax forms?

airSlate SignNow provides an easy-to-use platform for completing and eSigning KY inheritance tax forms efficiently. With our solution, you can upload, fill out, and send these forms securely, ensuring that your documents are handled with care and legality.

-

What are the pricing plans for using airSlate SignNow for KY inheritance tax forms?

Our pricing plans for airSlate SignNow are designed to be cost-effective for individuals and businesses dealing with KY inheritance tax forms. We offer different tiers based on your needs, allowing for ample document management and signing capabilities at competitive rates.

-

Are there any features specifically for managing KY inheritance tax forms?

Yes, airSlate SignNow includes features like templates specifically for KY inheritance tax forms, automated reminders, and secure cloud storage. These features streamline the completion process and ensure that your forms are easily accessible when needed.

-

Is airSlate SignNow compliant with legal requirements for KY inheritance tax forms?

Absolutely. airSlate SignNow takes compliance seriously, and our platform ensures that KY inheritance tax forms are completed in accordance with Kentucky state laws. We provide guidance and tips to help you fill out and submit these forms accurately.

-

Can I integrate airSlate SignNow with other software to manage KY inheritance tax forms?

Yes, airSlate SignNow offers integrations with various popular tools and software, making it easy to manage KY inheritance tax forms. This includes integration with document management systems and accounting software, enabling seamless workflows.

-

How secure are my KY inheritance tax forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect your KY inheritance tax forms and personal data from unauthorized access.

Get more for Kentucky Inheritance Tax

Find out other Kentucky Inheritance Tax

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy