Form 3372

What is the Form 3372

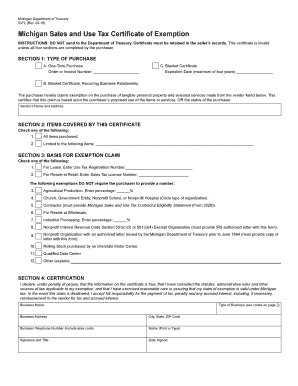

The Form 3372 is a document used primarily for specific tax-related purposes in the United States. It serves as a declaration or application that may be required by various governmental agencies, depending on the context in which it is used. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and other legal requirements.

How to use the Form 3372

Using the Form 3372 involves several steps to ensure that it is filled out correctly and submitted appropriately. First, gather all necessary information and documents required for completion. Next, carefully fill out each section of the form, ensuring accuracy and clarity. After completing the form, review it for any errors before submission. Depending on the requirements, you may need to submit it online, by mail, or in person.

Steps to complete the Form 3372

Completing the Form 3372 involves a systematic approach:

- Gather required information, such as personal identification and financial details.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for any mistakes or omissions.

- Sign and date the form as necessary.

- Submit the form through the specified method, whether online, by mail, or in person.

Legal use of the Form 3372

The legal use of the Form 3372 is governed by specific regulations that dictate how it should be completed and submitted. It is essential to adhere to these regulations to ensure that the form is considered valid and enforceable. This includes understanding the legal implications of the information provided and ensuring that all signatures are executed in compliance with applicable laws.

Key elements of the Form 3372

Key elements of the Form 3372 include:

- Identification information, such as name and address.

- Specific details related to the purpose of the form.

- Signature lines for all required parties.

- Instructions for completion and submission.

Form Submission Methods

The Form 3372 can be submitted through various methods, depending on the requirements set forth by the issuing agency. Common submission methods include:

- Online submission via a secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a local office or agency.

Quick guide on how to complete form 3372

Complete Form 3372 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 3372 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest method to modify and eSign Form 3372 without hassle

- Find Form 3372 and then click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details, then click on the Done button to save your changes.

- Decide how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow simplifies all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3372 and guarantee superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3372

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3372?

Form 3372 is a document used for various administrative purposes. In the context of airSlate SignNow, it can be easily created, shared, and electronically signed, ensuring that all parties involved can access it swiftly and securely. Utilizing airSlate SignNow for form 3372 simplifies the signing process and enhances document management efficiency.

-

How does airSlate SignNow support form 3372?

airSlate SignNow provides a robust platform for handling form 3372 by allowing users to create templates tailored to their needs. Our eSigning features enable you to send the form effortlessly for electronic signatures, ensuring compliance and reducing delays associated with traditional signing methods. With airSlate SignNow, managing your form 3372 is streamlined and efficient.

-

Can I integrate form 3372 with other applications?

Yes, airSlate SignNow offers seamless integrations with numerous applications, facilitating the use of form 3372 in your existing workflows. Whether you use CRM systems, cloud storage services, or project management tools, our integrations ensure that your form 3372 is easily accessible within your preferred applications. This enhances productivity and ensures a smooth experience.

-

What are the pricing options for using airSlate SignNow with form 3372?

airSlate SignNow offers flexible pricing plans to cater to different business needs when using form 3372. You can choose from various subscription options based on the number of users and features required. Each plan provides essential functionalities that enhance your experience with form 3372, ensuring you get value for your investment.

-

Is my data secure when using airSlate SignNow for form 3372?

Absolutely! airSlate SignNow prioritizes the security of your documents, including form 3372. We implement advanced encryption and compliance measures, ensuring that all your data is protected during storage and transmission. With our secure platform, you can confidently send and eSign form 3372 without worrying about data bsignNowes.

-

What are the benefits of using airSlate SignNow for form 3372?

Using airSlate SignNow for form 3372 comes with numerous benefits, including expedited document processing, improved accuracy, and a reduction in paper usage. Our intuitive design makes it easy for users to create, send, and sign documents, thereby enhancing overall workflow efficiency. Additionally, electronic signatures on form 3372 are legally binding, offering peace of mind for all parties involved.

-

How can I get started with form 3372 on airSlate SignNow?

Getting started with form 3372 on airSlate SignNow is simple. You can sign up for a free trial to explore our features and create your first form. Once you're ready, you can easily customize your form 3372, set workflows, and start sending it out for signatures—all within our user-friendly platform.

Get more for Form 3372

- Firearm bill of sale nc form

- Resident registration form

- Correction instrument as to a recorded original bb form

- Unregistered vehicles and missing signatures declaration form

- Synthesis essay rubric form

- Treatments carried out by general practitioners with form

- Form 1041 u s income tax return for estates and trusts

- Form 1099 r

Find out other Form 3372

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF