Asmt 14 Word Format

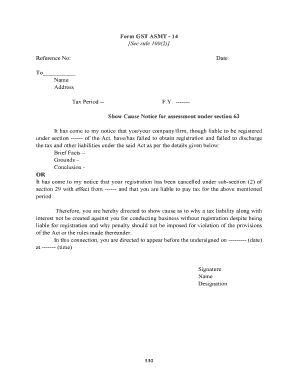

What is the asmt 14 word format

The asmt 14 word format is a specific document template used primarily for tax and compliance purposes under the Goods and Services Tax (GST) framework. This format is designed to facilitate the collection and submission of necessary information related to GST filings. It ensures that all relevant data is presented in a clear and organized manner, making it easier for both taxpayers and regulatory bodies to process the information efficiently.

How to use the asmt 14 word format

Using the asmt 14 word format involves several key steps. First, download the template in Word format from a reliable source. Once downloaded, open the document and fill in the required fields with accurate information. Ensure that all entries comply with the guidelines set forth by the GST regulations. After completing the form, save it securely, and prepare for submission according to the preferred method, whether online or via mail.

Steps to complete the asmt 14 word format

Completing the asmt 14 word format requires careful attention to detail. Follow these steps for accurate completion:

- Download the asmt 14 word format template.

- Open the document and review the instructions provided.

- Fill in your personal or business information as required.

- Provide any additional details related to your GST obligations.

- Review the completed form for accuracy and completeness.

- Save the document in a secure location.

Legal use of the asmt 14 word format

The legal use of the asmt 14 word format is crucial for ensuring compliance with GST regulations. To be considered valid, the completed form must meet specific legal standards, including proper signatures and adherence to submission deadlines. Utilizing a trusted electronic signature solution can enhance the legal standing of the document, ensuring it is recognized by authorities and courts alike.

Who issues the form

The asmt 14 form is typically issued by the tax authority responsible for GST in the United States. This authority oversees the collection of GST and ensures that businesses comply with the necessary regulations. It is important for taxpayers to obtain the latest version of the form from the official source to ensure compliance with current laws and guidelines.

Form submission methods (Online / Mail / In-Person)

Submitting the asmt 14 form can be done through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online: Many tax authorities offer online portals where taxpayers can upload their completed forms securely.

- Mail: Completed forms can be printed and sent via postal service to the designated tax office.

- In-Person: Some taxpayers may choose to submit their forms directly at local tax offices, ensuring immediate receipt and processing.

Quick guide on how to complete asmt 14 word format

Complete Asmt 14 Word Format effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Asmt 14 Word Format on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Asmt 14 Word Format with ease

- Find Asmt 14 Word Format and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and electronically sign Asmt 14 Word Format and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the asmt 14 word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ASMT 14 in GST, and why is it important?

ASMT 14 in GST is a specific form used for the assessment of relevant tax compliance by businesses. It plays a crucial role in ensuring that companies are adhering to GST regulations, making it essential for maintaining operational transparency and avoiding penalties.

-

How can airSlate SignNow assist with ASMT 14 in GST?

airSlate SignNow provides an efficient platform for businesses to digitally sign and send the ASMT 14 in GST forms. Our solution simplifies the workflow, ensuring that your documents are processed swiftly and securely, saving time and reducing errors.

-

What features of airSlate SignNow enhance the ASMT 14 in GST process?

With features like robust document tracking, customizable templates, and secure cloud storage, airSlate SignNow streamlines the completion and submission of ASMT 14 in GST. These tools provide clarity and enhance document management efficiencies.

-

Is there a cost associated with using airSlate SignNow for ASMT 14 in GST?

airSlate SignNow offers competitive pricing structures tailored to fit various business needs, including those focused on managing ASMT 14 in GST. Our cost-effective solution ensures you can complete necessary documentation without overspending.

-

Can I integrate airSlate SignNow with other tools for managing ASMT 14 in GST?

Yes, airSlate SignNow offers seamless integrations with numerous business applications, enhancing your ability to manage ASMT 14 in GST alongside your existing workflows. This feature ensures that all your documents and data synchronize smoothly across platforms.

-

What benefits does using airSlate SignNow provide for ASMT 14 in GST submissions?

By utilizing airSlate SignNow for ASMT 14 in GST submissions, businesses benefit from increased efficiency, reduced processing times, and enhanced security. This allows firms to focus on core activities while ensuring compliance with GST requirements.

-

Is airSlate SignNow secure for handling ASMT 14 in GST-related documents?

Absolutely! airSlate SignNow adheres to strict security protocols, ensuring that all documents related to ASMT 14 in GST are stored securely and accessed only by authorized users. This commitment to security helps protect sensitive financial information.

Get more for Asmt 14 Word Format

- Bar certificate order form pdf

- Excalibur hotel amp casino form

- Business license change form washoe county nevada

- Form slap22 82 83 ampquotapplication for taxidermist licenseampquot nevada

- Subsidy application vermont judiciary vermontjudiciary form

- Form w 2g rev january internal revenue service

- 1099 int irs form

- Post 911 gi bill education benefits bar to duplication of form

Find out other Asmt 14 Word Format

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT