Form 8009 a Cp Notice

What is the Form 8009 A Cp Notice

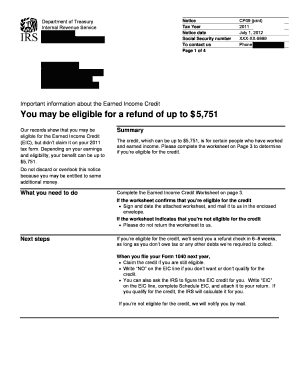

The Form 8009 A Cp Notice is an official document issued by the IRS that provides taxpayers with important information regarding their tax status. This notice typically outlines any discrepancies or issues that may arise in relation to a taxpayer's filings, including adjustments to their tax return or potential liabilities. Understanding this form is crucial for taxpayers to ensure compliance and to address any concerns raised by the IRS promptly.

How to use the Form 8009 A Cp Notice

Using the Form 8009 A Cp Notice involves carefully reviewing the information provided within the document. Taxpayers should verify the details against their records to identify any discrepancies. If the notice indicates an adjustment or an amount owed, it is essential to follow the instructions outlined in the notice. This may involve making a payment, filing an amended return, or providing additional documentation to the IRS.

Steps to complete the Form 8009 A Cp Notice

Completing the Form 8009 A Cp Notice requires several key steps:

- Review the notice thoroughly to understand the information presented.

- Gather any necessary documentation that supports your position or clarifies discrepancies.

- Respond to the notice within the specified timeframe, ensuring all required information is included.

- Keep a copy of your response and any supporting documents for your records.

Key elements of the Form 8009 A Cp Notice

Several key elements are crucial to understanding the Form 8009 A Cp Notice:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Tax Year: The specific tax year that the notice pertains to.

- Explanation of Changes: A detailed account of any adjustments made by the IRS.

- Response Instructions: Clear guidance on how to address the notice.

IRS Guidelines

The IRS provides specific guidelines regarding the Form 8009 A Cp Notice. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the timelines for responding to the notice and the types of documentation that may be required. Adhering to these guidelines helps prevent further complications and ensures that any issues can be resolved efficiently.

Filing Deadlines / Important Dates

Filing deadlines associated with the Form 8009 A Cp Notice are critical for taxpayers to note. The notice will typically specify a deadline by which a response must be submitted. Missing this deadline can result in penalties or additional interest on any amounts owed. Taxpayers should mark these dates on their calendars and ensure timely responses to avoid complications.

Quick guide on how to complete form 8009 a cp notice

Complete Form 8009 A Cp Notice effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and sign your papers swiftly without delays. Manage Form 8009 A Cp Notice on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and sign Form 8009 A Cp Notice without hassle

- Locate Form 8009 A Cp Notice and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that reason.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Form 8009 A Cp Notice and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8009 a cp notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a notice cp09 and why is it important for businesses?

A notice cp09 is a communication that informs businesses about specific tax obligations or actions needed from them. Understanding the notice cp09 is critical for compliance, as it helps prevent potential penalties and ensures that your business’s financial practices are aligned with regulations.

-

How can airSlate SignNow help manage documents related to notice cp09?

AirSlate SignNow provides an intuitive platform for sending and eSigning documents, including those related to a notice cp09. With features like templates and automated reminders, businesses can easily keep track of important compliance documents and ensure they are processed in a timely manner.

-

What are the pricing options for airSlate SignNow and how do they relate to managing a notice cp09?

AirSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. With cost-effective solutions, customers can manage important documents such as a notice cp09 without breaking the bank, allowing for efficient compliance management while keeping expenses controlled.

-

Can airSlate SignNow integrate with other software to handle notice cp09 documents?

Yes, airSlate SignNow integrates seamlessly with various business software such as CRMs and accounting tools. By connecting with your existing systems, you can streamline the way you manage documents associated with a notice cp09, enhancing overall productivity and compliance tracking.

-

What features does airSlate SignNow offer to ensure the secure handling of notice cp09 documents?

AirSlate SignNow is equipped with advanced security features, including encryption and secure cloud storage, to protect sensitive documents like notice cp09. These measures ensure that your business's data remains confidential and secure during the sending and signing processes.

-

How does airSlate SignNow simplify the process of eSigning documents related to notice cp09?

With airSlate SignNow, eSigning documents related to notice cp09 is straightforward and user-friendly. The platform enables multiple signers, allows for easy tracking of signatures, and sends notifications to ensure that all necessary parties are informed, making compliance hassle-free.

-

Is there a mobile app for airSlate SignNow to manage notice cp09 on the go?

Yes, airSlate SignNow offers a mobile app that allows users to manage documents, including those related to notice cp09, from anywhere at any time. The mobile functionality ensures that you can send, sign, and track important documents, even while on the move, enhancing your overall efficiency.

Get more for Form 8009 A Cp Notice

- 0113052489 form

- Jet fuel storage facility transport truck record of receipt envoy air form

- Please fill in all necessary information in the spaces provided

- Eo egbochuku assessment of the quality of guidance form

- Commercial corpocasescourt of appeal of singaporestate form

- Form con111 11 1 download fillable pdf or fill online

- Degarmos materials and processes in manufacturing pdf form

- Debt assignment agreement template form

Find out other Form 8009 A Cp Notice

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy