Form 2827

What is the Form 2827

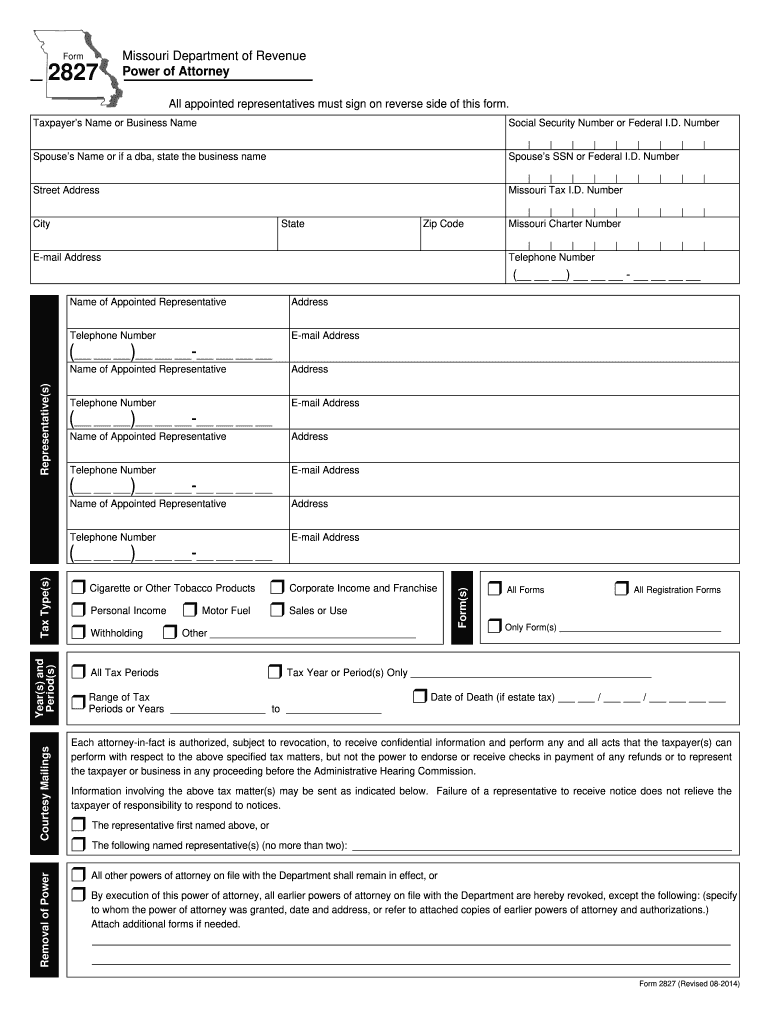

The Form 2827, also known as the Missouri Form 2827, is a document used primarily for reporting specific information to the state of Missouri. This form is typically associated with various legal and administrative processes within the state. It is essential for individuals and businesses to understand the purpose of this form to ensure compliance with state regulations.

How to use the Form 2827

Using the Form 2827 involves several steps to ensure accurate completion and submission. First, gather all necessary information required for the form, including personal details and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, it can be submitted electronically or through traditional mail, depending on the specific requirements outlined by the state.

Steps to complete the Form 2827

Completing the Form 2827 involves a systematic approach:

- Review the instructions provided with the form to understand the requirements.

- Collect all necessary documents and information needed for completion.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Form 2827

The legal use of the Form 2827 is crucial for ensuring that the information provided is valid and recognized by the state. To be legally binding, the form must be completed in accordance with Missouri state laws and regulations. This includes providing accurate information and adhering to any specific guidelines set forth by the state authorities.

Key elements of the Form 2827

Several key elements are essential when filling out the Form 2827:

- Identification Information: This includes the name, address, and contact information of the individual or entity submitting the form.

- Purpose of Submission: Clearly state the reason for submitting the form, as this can affect processing.

- Signature: A signature may be required to validate the form, confirming that the information provided is accurate.

Form Submission Methods

The Form 2827 can typically be submitted through various methods, including:

- Online Submission: Many forms can be submitted electronically through the state’s online portal.

- Mail: The completed form can be sent via postal mail to the designated state office.

- In-Person Submission: Individuals may also have the option to submit the form in person at a local office.

Quick guide on how to complete form 2827

Complete Form 2827 effortlessly on any gadget

Web-based document administration has become favored among corporations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right template and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your files swiftly without holdups. Manage Form 2827 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest method to edit and electronically sign Form 2827 with ease

- Obtain Form 2827 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your files or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text (SMS), or shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2827 and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2827

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2827?

Form 2827 is a document commonly used for electronic signatures in various business processes. It allows users to efficiently collect and manage signed documents, simplifying workflows. With airSlate SignNow, completing and storing Form 2827 is seamless and secure.

-

How can I integrate Form 2827 with other applications?

airSlate SignNow offers robust integrations that allow you to automate your workflows, including Form 2827. You can connect with various applications such as CRM systems and project management tools. This integration enhances productivity and streamlines document management.

-

What are the pricing options for using Form 2827 with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to businesses of different sizes. You can use Form 2827 features at a competitive rate, with options for monthly or annual subscriptions. Visit our pricing page to find the plan that best suits your needs.

-

What are the benefits of using Form 2827 in my business?

Using Form 2827 with airSlate SignNow enhances efficiency in document management and reduces turnaround time. It ensures secure electronic signatures that comply with legal requirements. Additionally, it fosters better collaboration and visibility across teams.

-

Is there a mobile app available for signing Form 2827?

Yes, airSlate SignNow provides a mobile app that allows users to sign Form 2827 on the go. This app is designed for ease of use, ensuring that you can manage your documents anytime, anywhere. Accessibility is a key feature for busy professionals.

-

Can I customize Form 2827 according to my requirements?

Absolutely! With airSlate SignNow, you can customize Form 2827 to fit your specific business needs. From adding fields to changing layouts, our platform allows full personalization, ensuring the document serves its purpose effectively.

-

How secure is the submission of Form 2827 through airSlate SignNow?

Security is paramount when submitting Form 2827. AirSlate SignNow employs advanced encryption and data protection measures to keep your documents safe. You can have peace of mind knowing your sensitive information is well-protected.

Get more for Form 2827

- Afrotc form 29 20080422 air force rotc detachment 755

- Questionnaire template form

- Your 3 letters of authorization a briggs form

- Fillabe cobra notices form

- Wisconsin judicial commission complaint form

- Sample employment application form template carnival restaurant

- Texas mailing address change form

- Share purchase us agreement template form

Find out other Form 2827

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online