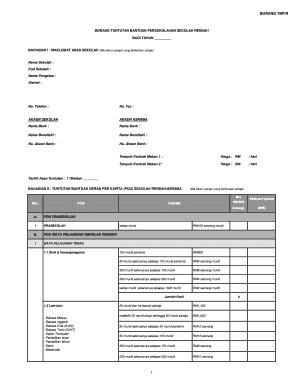

Borang Pelarasan Pcg Form

What is the Borang TBP R 2019?

The Borang TBP R 2019 is a specific form used for tax purposes, primarily related to the reporting of income and other financial details for individuals and businesses. It is essential for ensuring compliance with tax regulations and for accurately calculating tax liabilities. This form is particularly relevant for taxpayers who need to disclose various types of income, deductions, and credits to the Internal Revenue Service (IRS).

Steps to Complete the Borang TBP R 2019

Completing the Borang TBP R 2019 involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements, previous tax returns, and any relevant financial records.

- Fill out the form with accurate personal and financial information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, self-employment income, and any additional earnings.

- Detail any deductions or credits you are eligible for, as these can significantly impact your tax liability.

- Review the completed form for accuracy before submission to avoid potential penalties or delays.

Legal Use of the Borang TBP R 2019

The Borang TBP R 2019 is legally binding when filled out and submitted correctly. It is crucial to adhere to IRS guidelines to ensure that the form is accepted without issues. Failure to comply with the requirements can lead to penalties, including fines or audits. Understanding the legal implications of the information provided on the form is essential for all taxpayers.

Form Submission Methods

The Borang TBP R 2019 can be submitted through various methods, catering to different preferences and situations:

- Online Submission: Many taxpayers opt to file electronically through authorized e-filing services, which can expedite processing times.

- Mail Submission: Alternatively, the form can be printed and mailed to the appropriate IRS address, ensuring it is sent well before the filing deadline.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated IRS offices for immediate processing.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for compliance with tax regulations. The due date for submitting the Borang TBP R 2019 typically aligns with the annual tax filing deadline, which is usually April fifteenth. Taxpayers should also be mindful of any extensions that may apply and ensure that they file their forms on time to avoid penalties.

Required Documents

To complete the Borang TBP R 2019 accurately, several documents are typically required:

- Income statements such as W-2s or 1099s.

- Records of any additional income sources.

- Documentation for deductions and credits, including receipts and statements.

- Previous tax returns for reference.

Eligibility Criteria

Eligibility for using the Borang TBP R 2019 generally depends on various factors, including income level, filing status, and specific tax situations. Taxpayers must assess their circumstances to determine whether this form is applicable to them. Understanding these criteria is essential for ensuring that the correct form is used for tax reporting.

Quick guide on how to complete borang pelarasan pcg

Complete Borang Pelarasan Pcg effortlessly on any device

Digital document management has become favored among organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the suitable template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Borang Pelarasan Pcg on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Borang Pelarasan Pcg with ease

- Find Borang Pelarasan Pcg and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Borang Pelarasan Pcg and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borang pelarasan pcg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is borang tbp r 2019 and how is it used?

Borang tbp r 2019 is an official document form often utilized in various business processes. It simplifies the workflow of obtaining approvals and signatures, making it essential for compliance and formal communications. By using airSlate SignNow, you can easily manage and eSign borang tbp r 2019 to enhance your operational efficiency.

-

How much does it cost to use airSlate SignNow for borang tbp r 2019?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs. Depending on your chosen plan, you can access features for managing borang tbp r 2019 at competitive rates. We provide a 7-day free trial so you can explore our platform risk-free before making a commitment.

-

What features does airSlate SignNow offer for managing borang tbp r 2019?

With airSlate SignNow, you’ll have access to a variety of features for managing borang tbp r 2019, including customizable templates, secure eSignatures, automated workflows, and document tracking. These features not only simplify the signing process but also provide a comprehensive view of your document’s status in real time.

-

Can I integrate borang tbp r 2019 with other applications?

Yes, airSlate SignNow supports integrations with numerous applications such as CRM systems, cloud storage, and productivity tools. This capability allows you to streamline your processes involving borang tbp r 2019, reducing manual tasks and enhancing efficiency by automatically syncing information across platforms.

-

What are the benefits of using airSlate SignNow for borang tbp r 2019?

Using airSlate SignNow for borang tbp r 2019 enhances efficiency by automating document logistics and ensuring faster turnaround times for approvals. Beyond convenience, it also offers enhanced security features to protect sensitive information. Additionally, businesses can save both time and money compared to traditional paper-based processes.

-

Is airSlate SignNow compliant with legal standards for borang tbp r 2019?

Absolutely! airSlate SignNow is designed to comply with all major legal standards, including eSignature laws such as ESIGN and UETA. This compliance ensures that documents like borang tbp r 2019 signed through our platform are legally binding and secure.

-

How do I get started with using airSlate SignNow for borang tbp r 2019?

Getting started with airSlate SignNow for borang tbp r 2019 is easy. Simply sign up for a free trial on our website, explore the platform’s user-friendly interface, and begin uploading your forms. Our tutorials and support team are available to help you navigate any questions you might have.

Get more for Borang Pelarasan Pcg

- Guadalupe county tax assessor form

- Texas conference of seventh day adventists medical consent form

- Grievance consent form grievance consent form

- Msi health card renewal form

- I also authorize the communication of information related to the

- Standard form 1164 dod overprint42002 employer support of

- Back the campaign to stay in petition signature sheet to print and post back to us eastlibdems org form

- Dsar04 form

Find out other Borang Pelarasan Pcg

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement