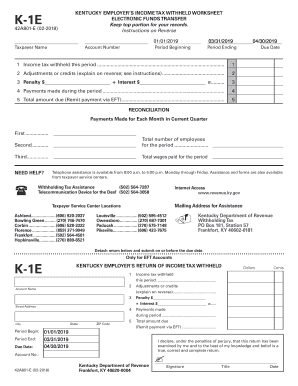

K 1e Form

What is the K-1E?

The K-1E form is a tax document used in the United States to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information to the IRS and the individual partners or shareholders, helping them accurately report their share of income on their personal tax returns. The K-1E is essential for ensuring compliance with tax regulations and for maintaining transparency in financial reporting.

How to Use the K-1E

To effectively use the K-1E form, individuals must first receive it from the entity they are associated with, such as a partnership or S corporation. Once received, the information on the form should be reviewed for accuracy. Taxpayers will need to incorporate the data from the K-1E into their personal tax returns, typically on Form 1040. It is crucial to ensure that all reported income and deductions align with the information provided in the K-1E to avoid discrepancies with the IRS.

Steps to Complete the K-1E

Completing the K-1E involves several steps:

- Gather necessary information about your partnership or S corporation, including their EIN and your ownership percentage.

- Fill out the K-1E with accurate details regarding your share of income, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the K-1E to the IRS along with your personal tax return by the designated deadline.

Legal Use of the K-1E

The K-1E form must be used in accordance with IRS regulations. It is legally binding and serves as an official record of income distribution from partnerships and S corporations. Proper use of the K-1E ensures that taxpayers report their income accurately, thereby avoiding potential legal issues with the IRS. Failure to report the information correctly can lead to penalties or audits.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the K-1E is crucial for compliance. Typically, partnerships and S corporations must provide the K-1E to their partners or shareholders by March 15. Taxpayers should ensure they receive their K-1E in time to file their personal tax returns, which are generally due on April 15. Extensions may be available, but it is important to check specific guidelines to avoid penalties.

Who Issues the Form

The K-1E form is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or shareholders, detailing each individual's share of income, deductions, and credits. It is essential for the issuing entity to ensure that the information is accurate and timely to facilitate proper tax reporting by recipients.

Quick guide on how to complete k 1e

Prepare K 1e effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage K 1e on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign K 1e without hassle

- Obtain K 1e and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign K 1e to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 1e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of k 1e 2019 in document signing?

The k 1e 2019 refers to a specific format or version used in electronic document signing. Understanding k 1e 2019 can help businesses ensure compliance with legal standards for electronic signatures, making processes faster and simpler.

-

How does airSlate SignNow support k 1e 2019 documents?

airSlate SignNow is designed to handle various formats, including k 1e 2019. Our platform allows you to easily upload, send, and eSign these documents, ensuring a smooth workflow and compliance with legal requirements.

-

What pricing plans does airSlate SignNow offer for k 1e 2019 features?

airSlate SignNow offers several pricing tiers tailored to meet the needs of businesses using k 1e 2019. Each plan includes access to essential features for document management and eSigning, ensuring you get great value for your investment.

-

What are the key features of airSlate SignNow that benefit k 1e 2019 users?

Key features of airSlate SignNow for k 1e 2019 users include template creation, bulk sending, and integrations with popular apps. These features streamline the signing process, enhance efficiency, and ensure that your document workflows remain organized.

-

Why should I choose airSlate SignNow for my k 1e 2019 document signing needs?

Choosing airSlate SignNow for k 1e 2019 ensures you have a user-friendly and cost-effective solution. Our platform facilitates secure eSigning, simplifies document management, and provides a robust audit trail, all essential for maintaining compliance.

-

Can airSlate SignNow integrate with other software for handling k 1e 2019?

Yes, airSlate SignNow integrates seamlessly with various software applications that support k 1e 2019. This enhances your existing workflows by allowing you to link your document processes with CRM systems, cloud storage, and other essential tools.

-

Is airSlate SignNow compliant with regulations for k 1e 2019 documents?

Absolutely, airSlate SignNow complies with all relevant electronic signature laws, making it perfect for handling k 1e 2019 documents. Our platform adheres to eIDAS and UETA regulations, ensuring your eSigned documents are legally binding.

Get more for K 1e

- State of connecticut wic programdepartment of public health certificationmedical referral form infants and children participant

- Vat515 form

- Sol licitud certificat damp39esportista secretaria general de lamp39esport esports gencat form

- Asnt level 3 application form

- Fillable online mcle judiciary gov mcle form no 09 a

- Scholastic record 452057276 form

- Stit kp gov pkcontactscience ampamp technology and information technology depratment

- Motor vehicle proposal form revised igi insurance

Find out other K 1e

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template