Irs Form 8736

What is the IRS Form 8736

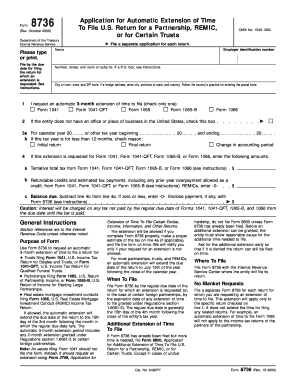

The IRS Form 8736 is a document used by taxpayers to request an extension of time to file certain tax returns. This form is particularly relevant for those who may need additional time to gather necessary documentation or complete their filings accurately. It is essential for ensuring compliance with tax regulations while allowing taxpayers to manage their obligations effectively.

How to Obtain the IRS Form 8736

Obtaining the IRS Form 8736 is straightforward. Taxpayers can access the form directly from the official IRS website. It is available for download in PDF format, allowing users to print and fill it out at their convenience. Additionally, the form can typically be found in tax preparation software, which may streamline the process of completing and submitting it electronically.

Steps to Complete the IRS Form 8736

Completing the IRS Form 8736 involves several key steps:

- Begin by entering your name and taxpayer identification number at the top of the form.

- Provide the tax year for which you are requesting an extension.

- Indicate the type of return you are filing, ensuring accuracy to avoid processing delays.

- Sign and date the form to validate your request.

Once completed, the form can be submitted according to the preferred method outlined by the IRS.

Legal Use of the IRS Form 8736

The IRS Form 8736 is legally recognized as a valid request for an extension of time to file tax returns. To ensure its acceptance, taxpayers must adhere to specific guidelines set forth by the IRS. This includes submitting the form before the original due date of the tax return and ensuring that all information is accurate and complete. Failure to comply with these requirements may result in penalties or denial of the extension request.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the IRS Form 8736. The form must be filed by the due date of the original tax return to avoid penalties. Typically, this means submitting the form by April 15 for individual taxpayers. It is essential to stay informed about any changes to deadlines, as they can vary depending on specific circumstances or legislative updates.

Form Submission Methods

The IRS Form 8736 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved tax software that supports the form.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, which varies based on the taxpayer's location.

- In-Person: Some taxpayers may choose to deliver the form directly to their local IRS office.

Choosing the appropriate submission method can enhance the efficiency of the filing process.

Quick guide on how to complete irs form 8736 1663363

Complete Irs Form 8736 effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 8736 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Irs Form 8736 with ease

- Locate Irs Form 8736 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Irs Form 8736 and ensure clear communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8736 1663363

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8736 and why is it important for my business?

Form 8736 is crucial for businesses as it serves a specific purpose related to IRS filings. Utilizing form 8736 ensures compliance and helps streamline the tax reporting process, making it easier for businesses to maintain accurate records and avoid penalties.

-

How can airSlate SignNow help me with form 8736?

airSlate SignNow simplifies the process of filling out and eSigning form 8736. Our intuitive platform allows you to easily upload, edit, and send the form for signature, ensuring a seamless workflow and reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for form 8736?

airSlate SignNow offers various pricing plans that cater to different business needs, starting at a budget-friendly rate. This enables you to handle form 8736 efficiently while keeping costs manageable, making our platform a cost-effective solution for document management.

-

Can I integrate airSlate SignNow with other software to use form 8736?

Yes, airSlate SignNow provides integrations with many popular software applications, making it easier to manage form 8736 alongside your existing tools. This seamless integration helps to improve productivity and maintains a unified workflow.

-

What features does airSlate SignNow offer for managing form 8736?

airSlate SignNow includes features such as document templates, status tracking, and custom workflows specifically designed for form 8736. These features enhance efficiency by allowing you to manage documents digitally and reduce the hassle of paper-based processes.

-

Is it safe to use airSlate SignNow for filing form 8736?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption technologies to protect your data when filing form 8736. You can confidently send and receive sensitive documents knowing that your information is secure.

-

How does airSlate SignNow enhance my experience with form 8736?

By using airSlate SignNow, you can experience a more streamlined and efficient process for handling form 8736. Our user-friendly interface and electronic signature capabilities save time and help keep your document management organized and hassle-free.

Get more for Irs Form 8736

- Home occupational application henry bcountyb co henry ga form

- Terry l basin clayton county tax commissioner 121 form

- Motor bus ad valorem tax report general instructionsvehicle taxestitle ad valorem tax tavt and annual admotor bus ad valorem form

- Tn tangible personal property form

- Organization phone no form

- Application for service or early retirement benefits form

- Tangible personal property tax form

- 1500010263 kentucky department of revenue form

Find out other Irs Form 8736

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation